Three Things Commercial Real Estate Employers Are Looking For Right Now

In the first few months of 2021, I’ve seen a significant uptick in the number of hiring managers reaching out and looking for training and testing materials for incoming hires. And this includes some pretty big name shops looking to make substantial additions to their analyst teams.

These conversations I get to have with hiring managers provide some incredibly helpful, real-time feedback regarding what commercial real estate investment, brokerage, and lending firms are looking, and the skill sets or characteristics that these companies value most when hiring analysts and associates on their team.

What I’ve found through these conversations is that many of these employers are looking for very similar things in analyst candidates.

In fact, from most hiring managers, I’m hearing the same themes over and over again.

So, because different people will tell you a million different things that you “should” be doing to make yourself an attractive candidate for the job you’re after, this article will break down three of the most common themes I hear when talking to commercial real estate firms, what those firms are looking for (specifically), and what you can do to land your dream job at your target company.

If video is more your thing, you can watch the video version of this article here.

Real Estate Firms Want To Hire People Who Have Done The Job Before

The first thing I hear over and over again from commercial real estate employers is that they’re looking for someone who has done the job before.

Most people panic when they hear this, but someone who has “done the job before” is a phrase used very loosely at the analyst and associate level.

With that, this doesn’t necessarily mean that real estate firms are looking for analyst candidates with multiple years of experience in a full-time analyst role already, but what this does mean is that they’re looking for people who have had real, in-the-trenches exposure to the industry (in addition to any coursework or certifications that person has).

What If I’m In College?

For people just graduating college or a Master’s degree program, internship experience is huge here. So, if you’re watching this in your college years, my advice is to do everything you can to make sure you have some sort of on-the-job experience on your resume before applying to full-time jobs.

Full-time summer internships are ideal here, but if you don’t have another summer in school or that’s not an option for you, even part-time internships where you’re working 10-20 hours/week or unpaid shadowing opportunities with companies your school is connected with can both work here.

At the end of the day, the goal is to be able to demonstrate to an employer that you’ve actually been able to apply what you’ve learned in school into a real-life, real estate context.

What If I’m Switching Careers?

If you’ve been out of college for a while and you’re looking to move to a different part of the industry or make a career switch altogether, the biggest thing you can do here to demonstrate your ability to do the job is to highlight your on-the-job experiences that most directly relate to the positions you’re applying for.

This means that if you’re an accountant that has worked for a real estate firm trying to move into an acquisitions or asset management role, make sure to talk through how you supported the acquisitions process or how you worked directly with the asset management team to track property performance over time.

If you’ve worked in lending as an underwriter and want to move to the principal side of the business, this means talking through how you analyzed new deals and how you worked with borrowers to get transactions done.

The key here is to present yourself as being familiar with the industry and the on-the-job tasks you’d be performing.

This takes the pressure off the employer, and lets them know that you understand both how the industry functions and how your academic coursework or adjacent industry experience fits into that context.

Real Estate Firms Want To Hire People With a Strong Understanding of Real Estate Financial Modeling Fundamentals

Aside from looking for candidates with experience, real estate employers are looking for candidates that have a solid foundation in the technical fundamentals of the commercial real estate industry.

Specifically, real estate firms are looking for candidates with a strong knowledge of Microsoft Excel and real estate finance concepts. And ideally, that person has the ability to work in, customize, and build real estate financial models from scratch using that knowledge.

In almost all real estate analyst positions, Excel is going to be a huge part of the day-to-day responsibilities of the role. And with that, companies are looking for someone who can work efficiently in the company’s proprietary Excel models, and someone who doesn’t need hand-holding on the basic functions, formulas, and shortcuts that make Excel such a powerful tool.

This is always one of the first comments a hiring manager will make, whether the company is a brokerage, private equity firm, or lender. Every single employer I’ve spoken with over the past three years has shared that they’re looking for someone who understands the fundamentals, often citing their desire to focus their own training on the company-specific skill sets to get that person up to speed.

The Real Estate Financial Modeling Excel Exam

To make sure that employees are coming in with the skills necessary to do the job and have the basics covered, more and more firms are administering Excel assessments as part of the interview process.

Companies know that it’s one thing to say that you have the basics covered, but it’s another thing to show mastery of the fundamentals and your readiness to add value in a role from day one.

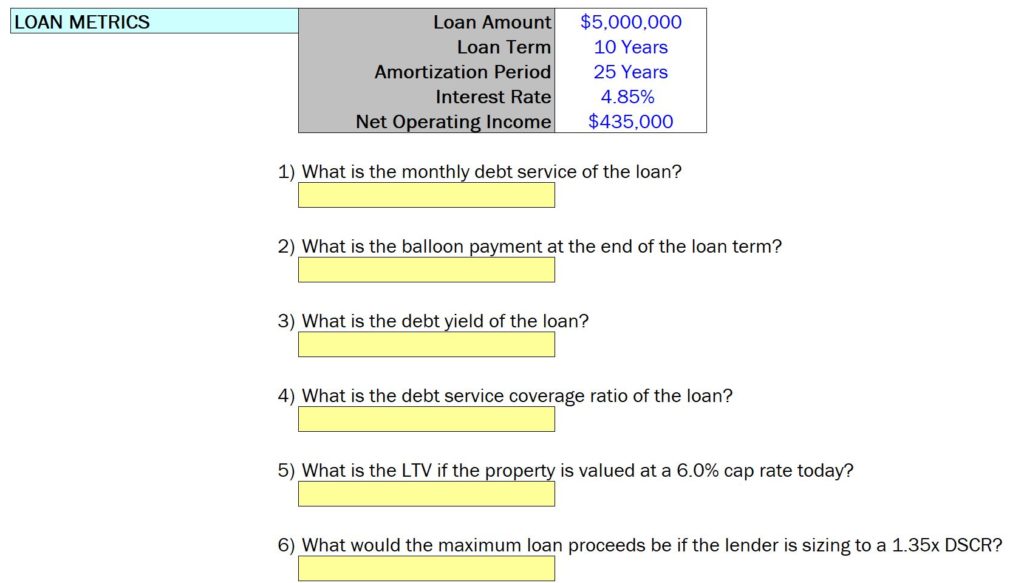

These assessments are usually some form of a case study where you’re given a deal scenario with a set of assumptions, and then asked to build a model and calculate certain risk and return metrics on the deal based on those assumptions.

The exact format and structure of these varies from company to company, but at the end of the day, these tests are primarily meant to be ways for a hiring manager to assess your understanding of the fundamentals applied to an unfamiliar scenario (often under time pressure).

Regardless of the technical format, these exams will generally test your knowledge of Excel, your understanding of basic real estate finance terms like the cap rate, IRR, equity multiple, and cash-on-cash return, and your ability to analyze complex and sometimes large data sets to help the company make better decisions on their deals.

To stand out here, my biggest piece of advice is to practice your Excel financial modeling skill set as much as possible, ideally in a real estate context.

The Break Into CRE Academy coursework was literally built for this, and will walk you through building the technical skill sets employers are looking for and how to prepare for interview exams, so that program is an excellent option if you’re looking to beef up your technical skill sets before interview day.

But even if you don’t decide to use Break Into CRE training materials, the more you can master Excel, the foundations of real estate finance, and ideally real estate financial modeling specifically, the better off you’re going to be.

Real Estate Firms Want To Hire People They Can Trust To Represent Their Company

Finally, outside of your professional experience and technical skill sets, employers are looking for a well-rounded, easy to get along with candidate that they can trust to represent their company.

Regardless of how technical a position might seem, employers aren’t looking to hire robots (yet), and real estate firms are looking for someone who will be easy to work with, enjoyable to be around, and someone that they can confidently put in front of clients and partners.

In almost all brokerage and private equity analyst and associate positions, these roles are going to require communication with people outside of your immediate company.

And whether that’s helping a buyer conduct due diligence as an analyst at a brokerage firm, explaining underwriting assumptions to potential investors as an analyst at a private equity firm, or even just when out at industry events connecting with other professionals at other companies, everyone is becoming hyper-aware that the employees you hire reflect your company and brand.

How To Show You Can Be Trusted

The more you can come across as someone who is responsible, trustworthy, and even driven towards a goal outside of just work or academics, the more you’re likely to stand out in today’s environment.

This doesn’t mean to go ahead and take up 25% of your resume with extracurricular activities, and you definitely want to be selective about the things that you do share. But with that said, a bullet point or two on the organizations you’re involved with, the volunteer opportunities you’ve taken on, or even collegiate athletic experience you’ve had can all be really helpful here.

Employers want to know that you can commit to something and that you’re willing to dedicate time to a goal, even when it’s inconvenient or might not result in an immediate paycheck.

How To Position Yourself For Success

At the end of the day, it really comes down to proving that you can be an addition to the team.

And the more you can show that you have the experience necessary to get up to speed quickly, you have the fundamentals of Excel and real estate financial modeling down, and that you can represent the company’s brand in a way they would want to be represented and make the office a better, more interesting place to work, the more competitive you’re going to be for the roles you’re targeting.

And if you’re about to tackle the job search process and need to tighten up your technical skill sets to prepare for interview exams, or you’re in need of some more individually-tailored career advice to present yourself as a more attractive candidate on paper, make sure to check out Break Into CRE Academy.

A membership to the Academy will give you instant access to our entire library of Break Into CRE coursework, including walkthroughs of solutions to sample interview Excel exams, training on how to tighten up your resume and LinkedIn profile, and one-on-one email based career coaching to help guide you throughout the job search process.

Good luck on your applications!