Real Estate Equity Waterfalls Explained

Ah, real estate equity waterfalls.

These are powerful tools for a real estate investor looking to raise capital from investors in a syndication or fund, but this is also one of the most daunting and complicated topics in all of commercial real estate finance.

And when I was first starting out in the real estate industry, every time I would read something online about equity waterfalls or ask someone to try and explain the concept to me, I would end up feeling way more confused than when I first started.

Not good.

So, if you’re in the same boat as I was and haven’t been able to wrap your head around what a real estate equity waterfall structure is and how it works, in this article, we’ll break down real estate equity waterfalls the way that I wish someone would have explained these to me when I was first getting started in the real estate private equity industry.

If video is more your thing, you can watch the video version of the article here:

To understand the concept of a real estate equity waterfall, the most important part of this is understanding what an equity waterfall is, and why it’s used in private equity real estate syndication and fund structures.

What Is a Real Estate Equity Waterfall?

First, let’s break down what an equity waterfall structure actually is (applied to real estate private equity, specifically), and let’s use an example to do it.

Let’s assume you’re 25 years old and want to invest in apartment buildings. You have $50,000 to invest, and you start your hunt to find your first deal.

After several months of searching, you (finally) stumble upon the perfect deal. At the asking price, after you’ve run the numbers in your pro forma model, you believe you can hit an 18% IRR on the project over a 5-year period, and the deal is a slam dunk.

However, there’s one problem.

That deal is $3 million, which means that even with 65% of the purchase price likely being covered by a commercial real estate lender, you’ll still have to come up with about $1 million of equity to close on the deal.

Oof.

Fortunately, you have conviction, you believe in this deal, and want to get it done. But since you don’t have $1 million hanging around, you need to find someone else who can partner up with you to provide that equity to close on the deal.

A Sample Real Estate Partnership Structure

You call up your Uncle Mark, who started some social media company that starts with an F (but you can’t remember the name). Either way, you know he’s flush with cash and always looking for new investment opportunities.

Uncle Mark answers his phone, and you jump in and say, “Uncle Mark, I’ve got a real estate deal for you. How would you like an 18% return on your money?”

Uncle Mark says, “Sounds great, kid. But I don’t know anything about real estate investing and I’ve got my hands tied with this business I’m running.”

“No problem,” you say. “I’ll do all the work!”

Uncle Mark thinks about this for a second and says, “Interesting…how much money do you need?”

You say, “I need to $1 million of equity to close on the deal.”

Uncle Mark says, “Ok, I’ll give you $950,000. I want you to have some skin in the game.”

The General Partner and The Limited Partner

Before we move on, let’s just recap what happened, because this part is important.

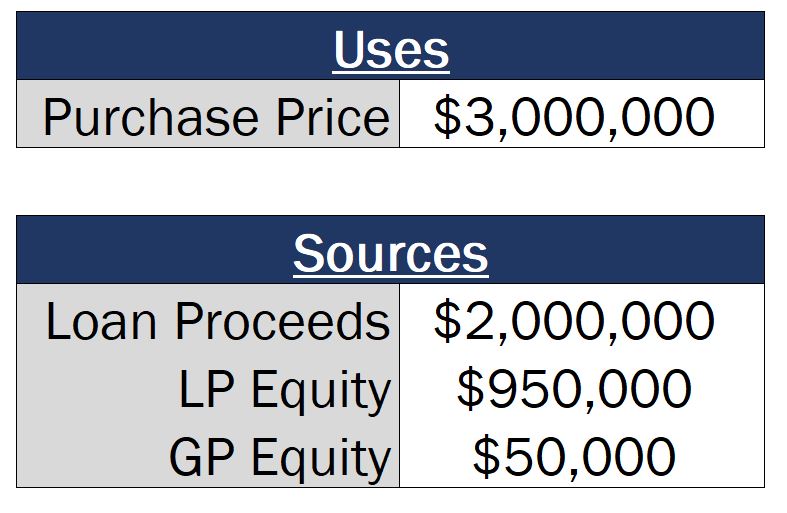

We have a purchase price of $3 million, assumed debt of $2 million, and an equity requirement of $1 million.

Uncle Mark is going to put up $950,000, or 95% of the equity requirement, and you’re going to put up $50,000, or 5% of the equity requirement. And this type of scenario is an extremely common structure in real estate syndications.

Usually, the General Partner, or the operating partner that’s doing all the work on the deal (you in this case), will be responsible for putting up 1%-10% of the equity investment. And the Limited Partner, or capital partner that will not be responsible for doing the work and likely won’t have much decision making power (Uncle Mark), will put up the rest.

At this point, you’re able to control a $3 million asset for $50,000. Pretty cool.

But, it gets better. Now let’s get back to the conversation.

The Preferred Return

You say back to Uncle Mark, “Sounds good, that works for me! Just one more thing. If you invested this money somewhere else, what do you think your returns would be?”

Uncle Mark thinks for a second and says, “About 8% per year, I think.”

You say, “Great. So how about this. After everything is said and done and we’ve sold the deal, for every dollar distributed up to an 8% IRR, we split that cash in the proportion we invested in – 95% to you, and 5% to me. Sound good?”

Uncle Mark says, “Yeah, sure, that makes sense.”

The Promoted Interest

And then you say, “But, since I’m doing all the work, to motivate me even more to make the deal more profitable, I have another idea. If the investment hits over an 8% IRR, for every dollar of profit above that 8% IRR, I’m going to take 30% of what would otherwise be your profit. Sound good?”

Uncle Mark says, “You’re a smart kid. Sounds good to me.”

Now let’s talk about what happened here, and this is really where the waterfall part of the equation comes into play.

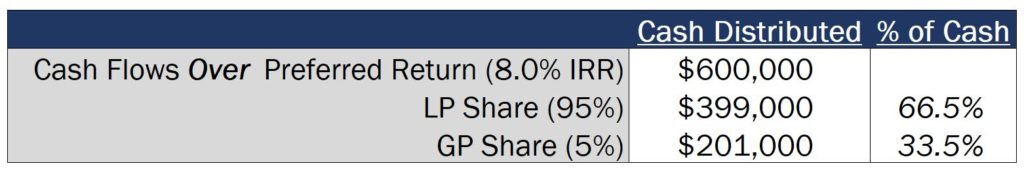

What you’re asking Uncle Mark here is to take 30% of his 95% share of the profits over the 8% IRR. So just because the project hit an 18% IRR does not mean that you automatically take 30% of the total profits on the deal. What it means is that for every dollar of profit after Uncle Mark gets his 8% IRR, you’ll take 30% of his 95%, or 28.5% of the total profits. And this is in addition to the 5% of the profits you’ll receive based on the equity you initially invested, for a total of 33.5% of the profits over the 8% IRR.

The Math Behind a Real Estate Equity Waterfall Structure

Let’s say we fast forward five years and when it’s all said and done, you ended up hitting a 16% IRR rather than an 18% IRR. And at the end of the day, you have $400,000 of profit up to the 8% IRR, and $600,000 of profit over the 8% IRR.

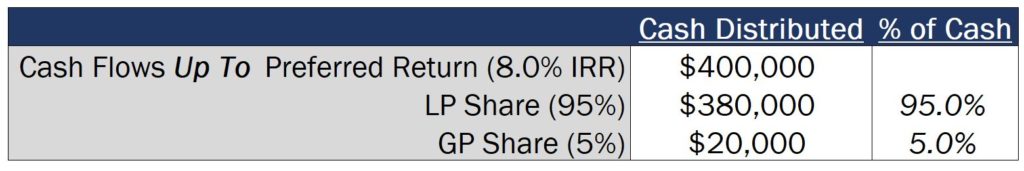

This means that the $400,000 up to the preferred return of 8%, 95% ($380,000) would go to Uncle Mark, and you would get the remaining 5% ($20,000).

But, for the $600,000 of profit, only 66.5% ($399,000) would go to Uncle Mark, and the remaining 33.5% ($201,000) would go to you.

Now, even with that, Uncle Mark gets a 14% IRR on his investment. Pretty solid considering his other options would have only been around 8% per year.

But you, as the syndicator, earn a 40% IRR on your equity investment. You’re compensated with outsized profit sharing once you hit your returns you’ve promised investors.

And these are just example figures. But when put into practice, real estate equity waterfalls can be extremely powerful tools to generate sweat equity for real estate investors that raise capital from partners and manage deals, and to generate significantly higher returns than they would have otherwise if they had done the deal on their own.

Now, onto the technical part of this, which can get pretty tricky.

When I was first starting to learn about waterfalls, even if I understood the basic concept, I had no idea how to model this stuff in Excel. And unfortunately, I couldn’t find a resource that taught me how to actually build one of these in a way that actually made sense to me.

So, I decided to build a course that teaches this process step by step, in a way that I would have wanted the concept to be taught to me when I was first starting out.

And if you want to learn more, check out The Real Estate Equity Waterfall Modeling Master Class on our Courses page for a step-by-step walkthrough on how to build a real estate equity waterfall structure in Excel just like the one we talked through in this article.

Good luck with the modeling of your own real estate equity waterfalls. I hope this helps make this concept more clear!