A Guide To Real Estate Equity Waterfalls

Real estate private equity can be a very lucrative industry to work in or start a company in, and a huge reason for that is the existence of promoted interest.

Promoted interest allows an individual investor or investment firm raising capital to earn an outsized percentage of the profits of a deal over and above their original equity interest, and this amount is determined by what’s referred to as an equity waterfall structure.

And while the details of equity waterfall structures can get pretty complex, the vast majority of these really come down to a few main principles, and this article will break down what a typical equity waterfall structure actually looks like in commercial real estate, how these structures tend to function in practice, and the calculations behind these that end up driving the cash flow splits between investors on a deal.

If video is more your thing, you can watch the video version of this article here:

Real Estate Partnership Structures

Real estate equity partnership structures will usually be made up of two main players – a general partner (GP) that manages the investment, and one or more limited partners (LPs) that are passive equity partners without involvement in property operations.

And within a partnership, an equity waterfall structure provides a framework for how cash flows will be split between each partner in a variety of different scenarios, and also includes performance hurdles that are going to govern these calculations.

The Preferred Return

The first performance hurdle that’s going to be included within a waterfall structure is the preferred rate of return (the “pref” for short), which represents the rate of return the limited partner requires before the general partner can earn promoted interest on a deal.

A preferred return can be based on a variety of different metrics, including the cash-on-cash return, the equity multiple, or even just simple interest, but in most cases (especially when the LP is a major institution), this is going to be based on a target IRR.

The IRR, or internal rate of return, measures the annualized, time-weighted return on equity invested, incorporating all cash flows on an individual deal or throughout the life of a fund. And usually, when this is used, the preferred return ends up being somewhere between about 6% and 9% depending on deal risk and negotiating leverage that each partner has.

In most JV partnership structures, cash flows up to the preferred return are going to be split pari passu, or in proportion to each investor’s original equity contribution. This means that if the limited partner contributes 90% of the equity and the general partner contributes 10% percent of the equity, all cash flows up to the preferred return would also be split 90% to the LP and 10% to the GP.

Promoted Interest

Once that preferred return is hit, this is the point where the cash flow split is going to start to change, due to what’s referred to in real estate as promoted interest.

Promoted interest (the “promote” for short) is a percentage of the cash flows above the preferred return that’s allocated directly to the general partner on a deal, and in most cases, the remaining cash flow outside of the promote will also be split pari passu based on each partner’s original equity investment.

For example, on a deal that calls for the GP to earn 20% promoted interest over an 8% IRR, using those same 90% LP and 10% GP up-front equity contributions, this would mean that for all cash flows above that 8% IRR, the GP’s cash flow allocation would be calculated by taking that 20% promoted interest and adding another 10% of the remaining 80% of the cash flows, for a total of 28% of these distributions above the preferred return going to the GP (as shown below):

20% Promoted Interest + 10% Equity Interest * (1 – 20% Promoted Interest) = 28% Cash Flow To GP

An easy way to think about this is that the promoted interest represents the percentage of the cash flows that would have otherwise been allocated to the LP in the preferred return tier, or in this case, 20% of what would have been their 90% of cash flow distributions:

90% Equity Interest * (1 – 20% Promoted Interest) = 72% Cash Flow To LP

In many cases, there will also be multiple return hurdles, each with their own unique promoted interest amounts. When this is the case, there may be a 20% promote above an 8% IRR, but then there may also be something like a 35% promote above a 14% IRR, and again, this is intended to incentivize the GP to maximize returns for all investors in the deal.

The GP Catch-Up

For the vast majority of individual real estate deals, the structure we just talked about is going to be applied. However, in some cases (especially within discretionary fund structures), cash flows above the preferred return are split based on what’s referred to as a “catch-up” structure.

A catch-up essentially involves a pre-determined, often 50/50 cash flow split on all cash flows above the preferred return, to “catch up” a general partner until they hit another predetermined maximum cash flow allocation.

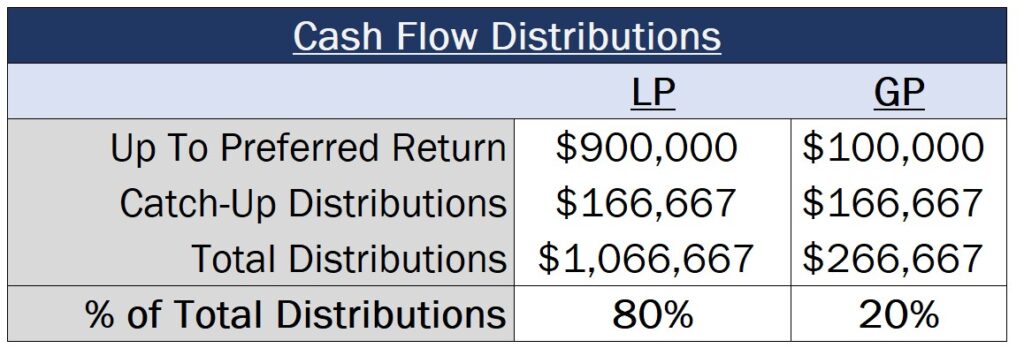

For example, in a 50/50 catch-up structure with a maximum of 20% percent of the cash flows going to the GP, if the partnership had distributed $1,000,000 up to the preferred return (with $900,000 of that going to the LP and $100,000 of that going to the GP), this would call for all cash flows above the preferred return to be distributed evenly until that 20% GP allocation is hit.

And the way the math works on this is that $333,333 would be distributed within the catch-up tier, with half of this going to the LP and half going to the GP, which would ultimately get that GP to a total distribution amount of $266,667 (representing exactly 20% of the total $1,333,333 in distributions made within the partnership).

And from there, once that 20% allocation is hit, all cash flows above this amount would now be subject to that 80/20 LP/GP split, which essentially maxes out the GP’s share of the cash flows at this 20% figure.

The Clawback

The vast majority of equity waterfall structures in real estate will fall under one of the two frameworks mentioned above, but when using either of these, there may also be an additional clause in the operating agreement (that’s often included within fund structures, specifically), and this is referred to as a clawback.

In some cases, promoted interest may be distributed before an entire fund is liquidated or even before an individual deal is sold, most commonly due to either a cash-on-cash-based preferred return that allows a GP to earn promoted interest during ordinary operations, or due to a fund structure that allows the GP to earn promoted interest based on the individual performance of each deal in the fund.

And the clawback makes sure that, in cases where performance actually trends downward after promoted interest is earned and subsequent distributions to (or even required contributions from the LP) cause the investor to dip back below their preferred return target, the LP can take back that promoted interest based on the final performance of the partnership.

This type of structure most often shows up in what are referred to as “American-style” waterfalls used by large real estate funds, where promoted interest is earned on a deal-by-deal basis during the fund life. In these cases, the clawback makes sure that, if the performance of the entire fund doesn’t hit the preferred return by the time of liquidation and the GP has earned promoted interest due to the performance of individual deals in the fund, the GP will have to return some or all of their promoted interest until the LP hits their preferred return overall.

At the end of the day, there are an unlimited number of ways a partnership can be structured, and every deal is going to be unique based on the specific language used within each JV operating agreement. However, in my experience, these tend to be the most common frameworks that often show up in almost all real estate equity waterfall structures, and how I wish someone explained these to me when I was first starting out in the business.

How To Learn To Build Real Estate Equity Waterfall Models

If you want to learn more about commonly used equity waterfall structures and how to model these in Excel, whether you need to calculate cash flows between partners on your own deals or you’re preparing for an Excel modeling exam that might be given to you during the real estate interview process, make sure to check out our all-in-one membership training platform, Break Into CRE Academy.

A membership to the Academy will give you instant access to over 120 hours of video training on real estate financial modeling and analysis, you’ll get access to hundreds of practice Excel interview exam questions, sample acquisition case studies, and you’ll also get access to the Break Into CRE Analyst Certification Exam. This covers topics like real estate pro forma and development modeling, commercial real estate lease modeling, equity waterfall modeling, and many other real estate financial analysis concepts that will help you prove to employers that you have what it takes to tackle the responsibilities of an analyst or associate at a top real estate firm.

Thanks for reading!