A Real Estate Analyst’s Guide To The IRR

The internal rate of return is one of the most widely used metrics in all of commercial real estate, but this also tends to be one of the least easily understood.

The textbook definition of the IRR is, “The discount rate at which the net present value of a set of cash flows is equal to zero,” which (for the vast majority of people not coming from a finance background), doesn’t really mean much.

However, if you’re looking to land a job as a real estate analyst or associate, trying to raise capital from equity partners to fund deals, or even considering investing passively in a crowdfunding or syndication opportunity, being able to both understand and interpret this metric is extremely important.

So to give you some context around why this metric matters so much in this industry, this article talks through what an IRR represents, and the applications of this metric within a real estate investment analysis.

If video is more your thing, you can watch the video version of this article here:

The IRR is a Time Value of Money Metric

To simplify the internal rate of return, you can think of the IRR as the annualized, time-weighted return on capital invested.

And with that, the first thing you need to know about this metric when using this to analyze a deal is that, because the IRR is a time value of money calculation, this number is going to be heavily dependent on when each distribution occurs.

The concept of the time value of money says that a dollar received today is worth more than a dollar received tomorrow, and this is directly applicable to the internal rate of return. In this context, this means that cash flows distributed earlier in the hold period increase the IRR more than those same cash flows would if they were distributed later.

The main implication of this is that deals with an early refinance or sale are often going to produce higher IRR values than similar, longer-term hold options, even if these deal aren’t as profitable overall. This can be a big shortcoming of this metric if relied on too heavily on its own, and this is also why looking at this metric alongside the equity multiple or total profit is a necessary step when running an investment analysis.

IRRs Drive Real Estate Valuations

Another important thing to note about the IRR is that this metric is a core part of property valuations in the commercial real estate market as a whole, especially among institutions and major private equity firms.

Most large investment firms that control a significant portion of the overall capital flows in commercial real estate won’t raise money on a deal-by-deal basis, but rather in discretionary funds, which are generally advertised with a target IRR.

For example, if a private equity firm goes out and raises $10 billion for a value-add fund with a 15% IRR target for investors, individual deals that go into that fund also need to be able to hit that 15% IRR, meaning that valuations for the company’s acquisitions are going to be heavily determined by their ability to get to that number.

This is a huge reason why cap rates tend to follow interest rates, since, even though NOI values don’t immediately change when interest rates change, IRR values at the same valuations can change significantly with rising or falling rates. This means that investors who raised capital with a specific return expectation up front will often immediately adjust their valuations when interest rates fluctuate.

To put this into context with another tangible example, let’s assume we’re working for a major private equity firm that recently raised a value-add fund, with a 15% IRR target and a 10-year fund life.

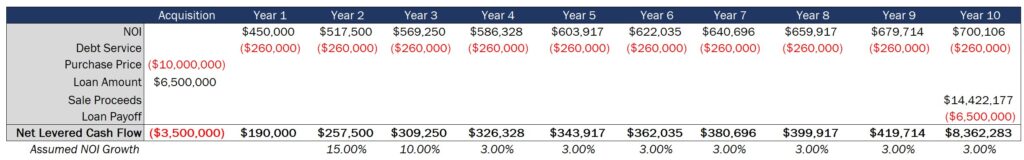

Let’s also assume that we’re analyzing a deal to go into that fund with a going-in NOI of $450,000, an assumed exit cap rate of 5%, assumed NOI growth of 15% in year 2, 10% in year 3, and 3% in each year after that, and a full-term interest-only loan at 65% of the purchase price with a 4.0% interest rate. In this scenario, to hit our target returns, we would reasonably be able to pay $10,000,000 for this deal.

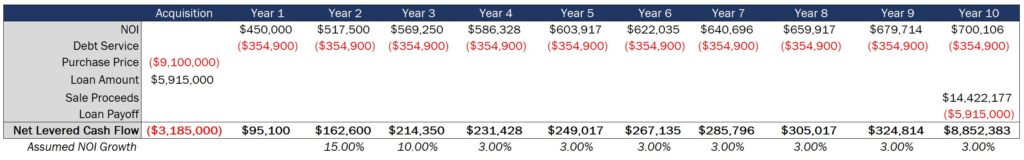

However, if interest rates jumped from 4% to 6%, that IRR would drop to just 12.4% at that same $10,000,000 valuation. And just to get back to that 15% IRR value, we would need to decrease our valuation by $900,000.

This can ultimately create a cascading effect in the market, affecting valuations upward or downward on a very large scale very quickly, which puts the IRR metric at the core of property pricing throughout a significant portion of the real estate market.

The IRR & Equity Waterfall Structures

While this metric is commonly used for valuation purposes, the IRR is also very commonly used to determine cash flow splits between partners in joint venture, equity waterfall structures.

Cash flow distributions on real estate deals tend to be irregular, with part of each investor’s returns coming from operations and another part coming from sale proceeds. Because of this, the IRR is a great way for investors to both understand and compare the overall returns of a real estate deal to other investment vehicles they might be considering, like stocks, general private equity, or venture capital investments.

This is also important to know whether you’re a sponsor, passive investor, or even just an employee of a company, since the amount of promoted interest earned in these types of structures is often going to be heavily dependent on the business plan of each deal.

If you’re working for a private equity firm and trying to maximize your promote, you may lean more heavily towards short-term hold periods and a quick return of capital to investors. However, if you’re a limited partner investing passively in deals, you may be looking for longer-term hold periods to avoid unnecessary transaction costs and to make sure the sponsor performs well over time before paying out promoted interest.

Many sophisticated equity sources that will come in as the sole limited partner on a deal will even go so far as to push for multiple preferred return hurdles, based on both an IRR and an equity multiple target.

While the IRR metric might look impressive on paper, it’s important to understand the time period over which that IRR is generated, how the partnership is structured, the motivations of the sponsor, and whether the total profit expected on a deal makes the investment worthwhile.

How To Learn More About Real Estate Investment Analysis

If you want to learn more about IRRs, equity multiples, cash-on-cash returns, and other real estate finance metrics used in the investment analysis process, make sure to check out our all-in-one membership training platform, Break Into CRE Academy.

A membership to the Academy will give you instant access to over 120 hours of video training on real estate financial modeling and analysis, you’ll get access to hundreds of practice Excel interview exam questions, sample acquisition case studies, and you’ll also get access to the Break Into CRE Analyst Certification Exam. This exam covers topics like real estate pro forma and development modeling, commercial real estate lease modeling, equity waterfall modeling, and many other real estate financial analysis concepts that will help you prove to employers that you have what it takes to tackle the responsibilities of an analyst or associate at a top real estate firm.

As always, thanks so much for reading, and make sure to check out the Break Into CRE YouTube channel for more content that can help you take the next step in your real estate career.