Commercial Real Estate Buzzwords You Should Know

Commercial real estate investors can sometimes sound like they have their own language, and if you’re just breaking into the industry (or trying to), it can be intimidating to feel like an outsider looking in.

When I first broke into the industry, there was a lot of terminology that wasn’t included in my university textbooks and wasn’t explained clearly online, so I was left in the dark to essentially learn these concepts out of context.

So in this article, to make this process easier for you than it was for me, let’s walk through ten of the most common buzzwords that are used in the commercial real estate industry, and what each of these mean.

If video is more your thing, you can watch the video version of this article here.

Trade

The first buzzword on this list is the word trade, which usually shows up in the context of a sentence like “The deal traded at $________________” or, “The deal didn’t trade.”

And this doesn’t mean that two investors traded one property for another, but rather that a property traded hands (or ownership). So, in reality, a property “trading” just means that a property owner traded their property for money.

Essentially, trade is just a synonym for “sell”, with, “The property traded at $10,000,000” really just meaning, “The property sold at $10,000,000”.

Simple and easy.

Re-Trade

A “Re-Trade” in commercial real estate refers to a scenario in which a property has been put under contract, all terms have been agreed to, and then, usually before any refundable deposit money becomes non-refundable (or “goes hard”), the buyer decides to renegotiate the purchase price.

This can sometimes happen due to a buyer finding various capital items that need to be addressed during due diligence, uncovering something that has been misrepresented by a seller in preliminary due diligence, or anything else that comes up during the first several weeks of the due diligence period that would materially impact the economics of the deal.

A re-trade tends to be a four-letter word in commercial real estate, and doing this too much can damage a commercial real estate investor’s reputation with both sellers and brokers. With that said, if you hear this phrase used out in the field, this is what is being referred to.

Basis Points

A “basis point” in commercial real estate refers to one hundredth of one percent, or 0.01%.

You may hear basis points being referred to when talking about changes in interest rates or cap rates (“Cap rates jumped by 25 basis points year-over-year”), or any other percentage metric that experiences changes under about 2.0%.

In written form, you’ll often see this term abbreviated to “bps”. And as a result of that, in conversation, you also might hear these basis points referred to as “bips” for short.

Workforce Housing

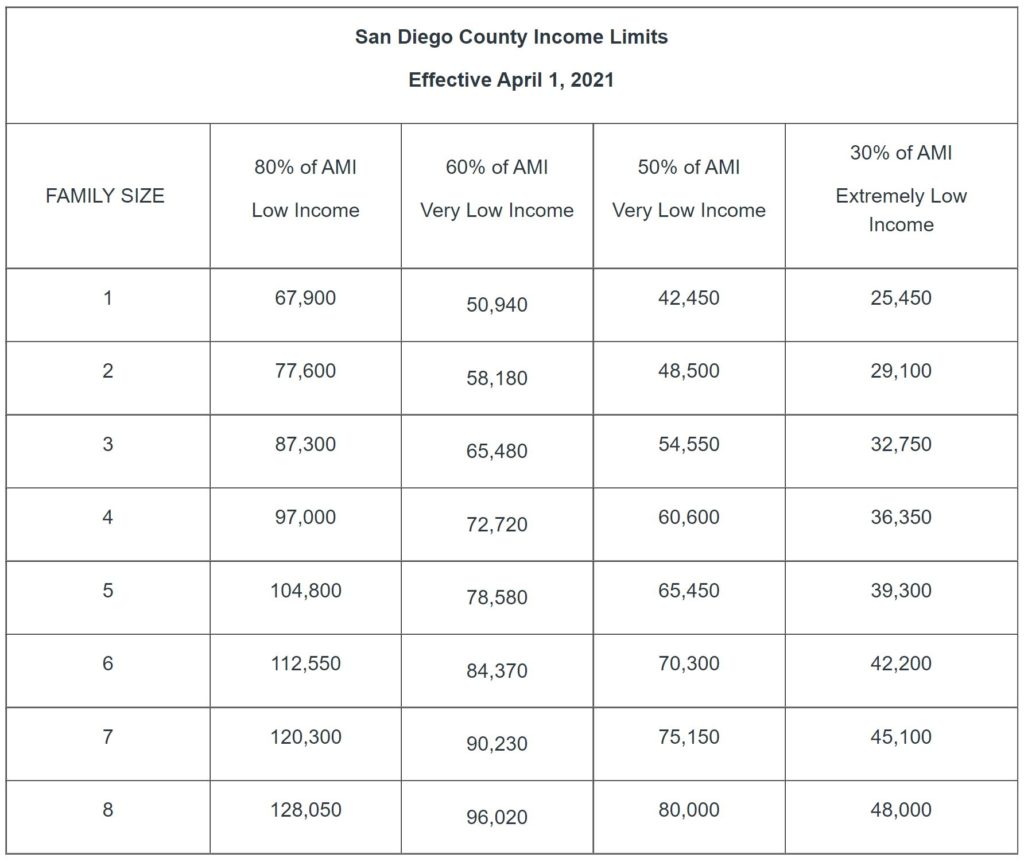

Workforce housing has been an extremely popular part of real estate over the past several years, and this term generally refers to apartments which house a demographic of people with incomes between 60% and 80% of what is known as the “Area Median Income”, or AMI.

Most workforce housing doesn’t technically fall under the category of “affordable” housing, generally isn’t considered a LIHTC (Low-Income Housing Tax Credit) property, and often doesn’t even include any tenants using Section 8 vouchers. Instead, these types of properties tend to serve a blue-collar demographic in secondary and tertiary markets, with property quality usually falling in the B+ to B- range.

Spec Space

“Spec” space is short for “speculative” space and refers to a property, or suite within a property, where a lease is not signed at the time construction begins.

Spec space is most commonly built out for office, retail, and industrial ground-up development projects. However, spec space is also commonly built out in an existing asset when a vacant suite needs to be renovated to be competitive in the leasing market, even without a tenant in tow (or a tenant with a signed lease ready to occupy the suite when completed).

Warm Vanilla Shell

This sounds delicious, but I promise, it’s not.

“Warm vanilla shell” condition refers to a commercial real estate property or individual suite which has a minimally finished interior. Generally, this includes ceilings, walls, flooring, lighting, plumbing, and HVAC. And that’s about it.

This is usually just enough to entice a tenant to lease a space, and from there, the tenant can customize the build-out of the suite to their liking, depending on what their needs are as a user.

The goal here is usually to get the suite to a place where it looks customizable, as somewhat of an easy “plug-and-play” solution for a tenant to put the finishing touches on their space.

Coming On-Line

When development is occurring and additional square footage of commercial property is going to be delivered to the market, this square footage is said to be “coming on-line”.

The square footage of property coming on-line is a direct forward indicator of supply in the market, which can give a real estate investor excellent insight into where rents might be headed in a market, as well.

So, if you’re a multifamily investor looking to acquire a property and you learn that 1,000 multifamily units are coming on-line in the submarket in the next 18 months, this is a very clear indicator that supply is rising quickly, and something to pay very close attention to as a potential investor in the deal.

Absorption

This one isn’t as much a buzzword as it is a technical term, but in the spirit of the three points mentioned above, absorption measures the total square footage that has been leased up in a given market.

Positive net absorption means that more space was leased than was vacated (or came on-line) in the market during a given time period, and negative net absorption means that less space was leased than was vacated (or came on-line) in the market during a given time period.

Net absorption can tell an investor a significant amount about the supply and demand fundamentals in a market for a specific product type, and this information tends to be used quite a bit by commercial real estate investors and developers to decide where they want to buy existing property, and where they want to build.

Experiential Retail

With Amazon and other e-commerce players devastating many retailers over the last several years, experiential retail refers to retail stores or shopping center with an interactive component, that generally cannot be replaced by e-commerce.

Things like movie theaters, rock climbing gyms, restaurants, and bars would all fall under this category, but many larger shopping centers without these types of tenants have also gone out of their way to add an interactive component to their customers’ shopping experience.

This can include things like putting greens or cornhole boards, on-site playgrounds, or relaxation or meditation rooms to create a more fun, accommodating, or peaceful experience for the shopper.

The goal is to create a sense of community that isn’t available when shopping online, and retail property owners have gotten creative with exactly how they make that happen.

Activation

“Activation” in commercial real estate refers to taking previously unused space in a building and turning it into usable, or potentially leasable, space at a property.

For example, you might hear an office investor say that they plan to “Activate the ground floor” of a high-rise office building upon acquisition, which generally means that they plan to take a portion of previously unused space (usually used for storage) for either a new tenant to rent and occupy, or as additional common area space that can be used by all existing tenants.

This could also refer to actions taken to drive additional traffic to the building or center in general, such as an outdoor retail pop-up or community green space.

How Do These Fit Into The Bigger Picture?

If you’re just getting started in the industry, I hope this was helpful in decoding some of what your bosses are co-workers might be saying on a day-to-day basis.

And if you’re just starting the process of trying to break into the commercial real estate industry and looking to land your first role, make sure to check out Break Into CRE Academy.

A membership to the Academy will give you instant access to all Break Into CRE courses on real estate financial modeling and analysis, practice case studies and interview exams to help you land a role at a top real estate investment, brokerage, or lending firm, and private, one-on-one, email-based career coaching to get your questions answered as you navigate the commercial real estate job search process.

I hope this helps – good luck!