Commercial Real Estate Loan Payments Explained

Commercial real estate loan payments have a lot of moving pieces that can all have an impact on the economics of a deal.

And while changes in interest rates tend to make all the headlines, this is only one piece of the puzzle when it comes to calculating loan payments and their impacts on property cash flows and returns to investors.

In this blog post, we break down the math behind commercial real estate loan payments, explore the terms that factor into these payments, and examine the effects of these terms and payment amounts on both a borrower and a lender in a real estate deal.

If video is more your thing, you can watch the video version of the article here:

Breaking Down Commercial Real Estate Loan Payments

When talking about loan payments, the first thing we need to do is break this down into two separate components, which are the interest portion and the principal portion of each payment. The principal portion goes toward paying down the loan balance over time through regular monthly payments, while the interest portion goes toward compensating the lender for taking on the risk of lending on the property. And because of these two components, calculating the monthly payment on a loan isn’t just as simple as multiplying the interest rate by the starting loan balance, and this ends up being a pretty complex calculation when you break down the math.

To calculate the total monthly loan payment on a fixed rate commercial real estate loan, we need to take:

Loan Amount * (Monthly Interest Rate * (1 + Monthly Interest Rate)^Amortization Period in Months / (1 + Monthly Interest Rate)^Amortization Period in Months – 1)

Fortunately, there’s a much easier way to calculate this by using Excel’s built-in PMT function, which just requires an interest rate, an amortization period, and a loan amount, and for real estate financial modeling purposes, this is generally all you need:

=PMT(rate, nper, pv, [fv], [type])

Understanding The Loan Constant

Once we understand what a payment is made up of, we need to understand how these payments are going to impact our deal, and this is where one of the most important commercial real estate loan terms comes into play, and this is the loan constant. The loan constant measures the annual payments on a loan divided by the loan amount, and since this includes both principal and interest portions of these payments, this can be really helpful to understand how the loan itself is going to affect the performance of a real estate investment.

Where this tends to be most helpful is when trying to maximize an investor’s cash-on-cash return, or the total annual distributions divided by the equity invested, and specifically taking a look at how this loan constant compares to the going-in cap rate.

Positive Leverage, Negative Leverage, & Amortization Periods

When the cap rate is higher than the loan constant, this tells us that a deal has positive leverage, meaning that the cash-on-cash return will be higher with debt than without it. But when the cap rate is lower than the loan constant, this tells us that a deal has negative leverage, meaning that the cash-on-cash return will be lower with debt.

And one of the things that’s going to impact that loan constant most is the loan’s amortization period, which represents the time frame over which the loan is assumed to be paid back in full via regular monthly payments (and factors directly into the calculations we talked through earlier).

With a shorter amortization period, that loan constant is going to be higher due to a compressed payback window that’s going to increase monthly payments, and with a longer amortization period, that loan constant will be lower, with lower monthly payments being spread out over time.

And where commercial real estate loans tend to differ from single-family home loans in the US is that the amortization period on a commercial loan is often significantly longer than the term of that same loan, and since the term dictates when the entire outstanding balance needs to be paid off in full, this is where things can start to get a little tricky.

In most cases, commercial real estate lenders will only be willing to issue loan proceeds for a period of about 3-10 years, which makes sure they only have their capital out in the market for a limited period of time. But with a loan term of this length, if the lender were to match the amortization period to that term, this could create a huge strain on a borrower when making monthly payments.

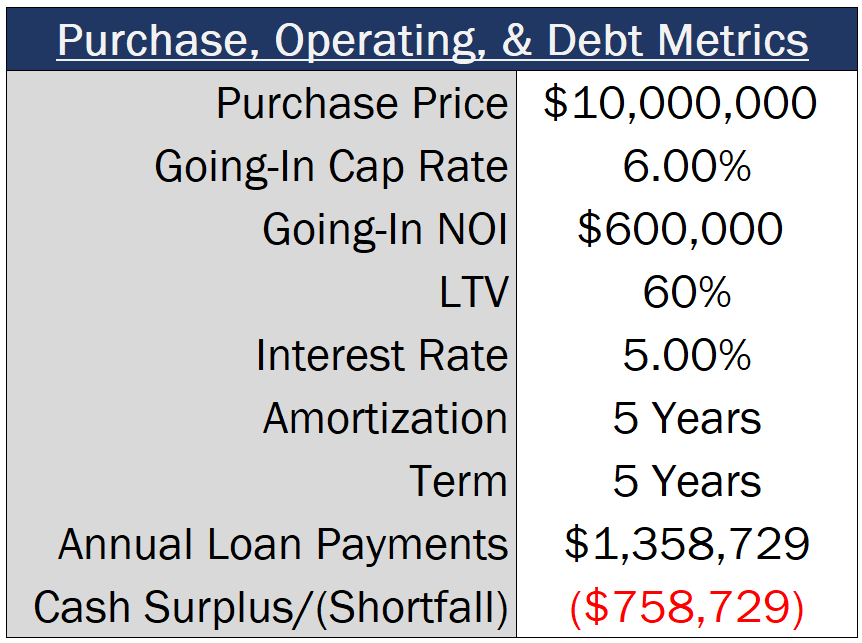

To put this into perspective, if a property is acquired for $10,000,000 at a 6% cap rate, this results in $600,000 of NOI that debt service can be paid from in the first year of ownership. But if that deal is financed at a conservative 60% LTV ratio with a 5% interest rate, 5-year term, and matching 5-year amortization period, this would result in over $1.35 million dollars of loan payments each and every year, and a $750,000+ shortfall that needs to be paid by investors.

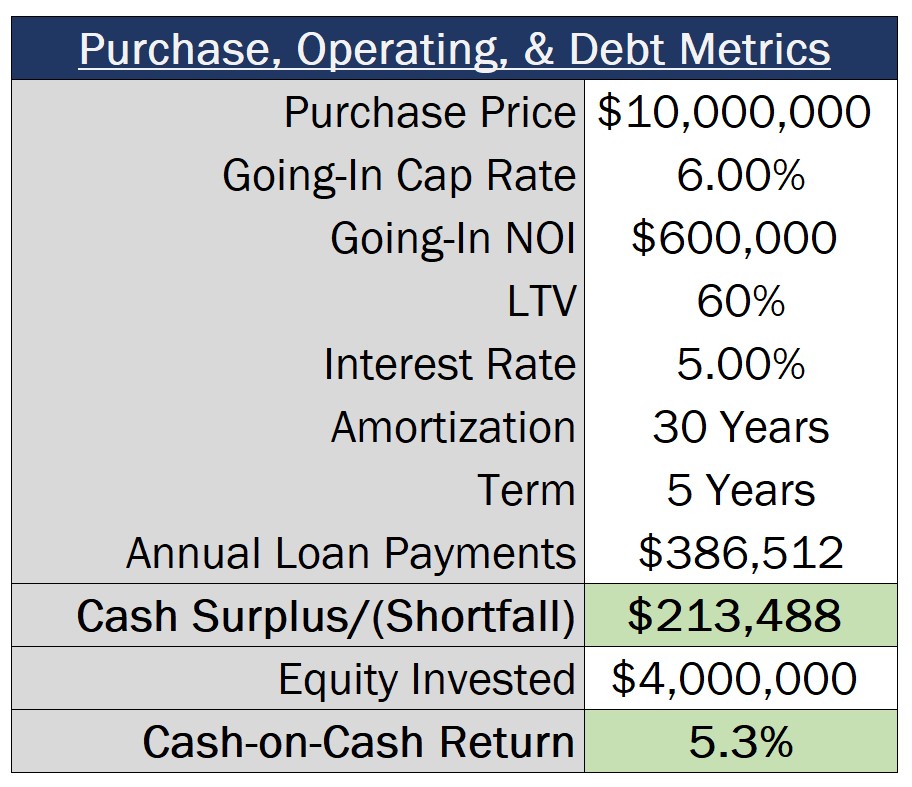

However, if that amortization period is stretched out to 30 years instead, this now results in just over $386,000 of annual loan payments, producing over $213,000 of positive cash flow on the deal and a cash-on-cash return of 5.3%.

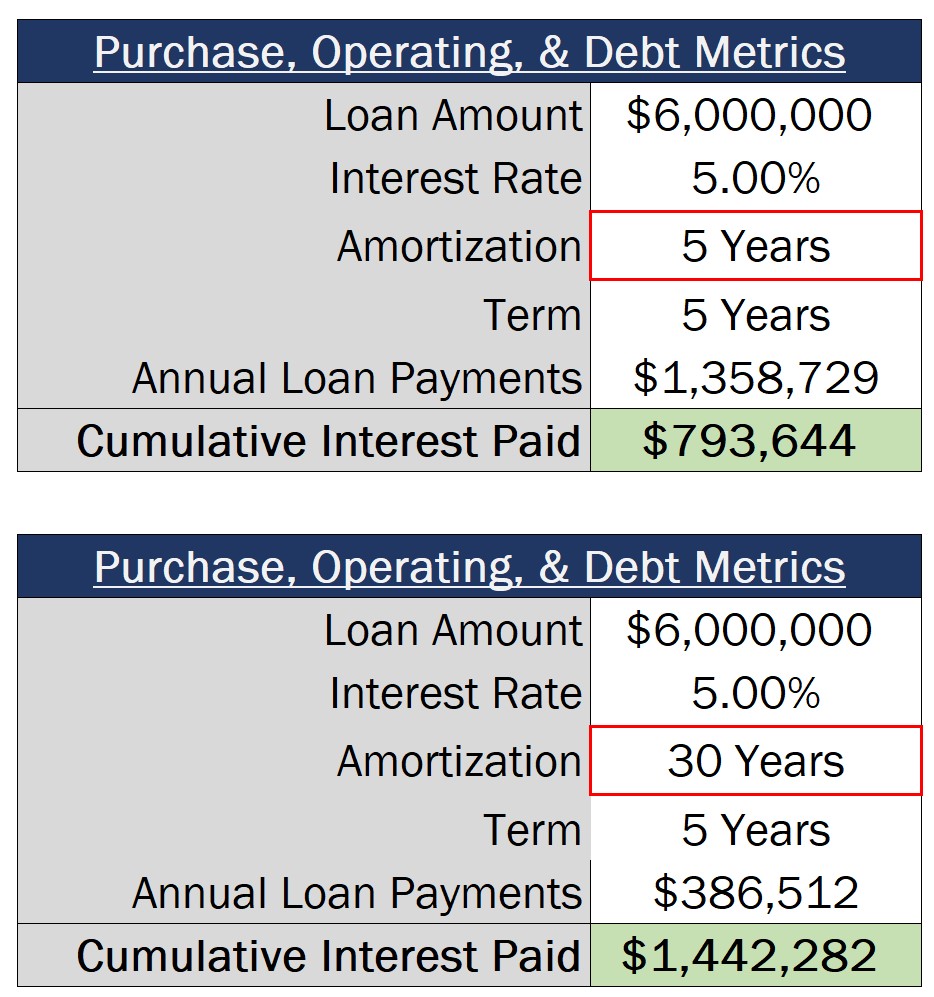

And by stretching out the amortization period beyond the loan term, this doesn’t just benefit the borrower through lower monthly payments, but this also benefits the lender through additional interest earned. Since the interest portion of each monthly loan payment is going to be based on the outstanding principal balance in each month, as the loan balance is paid down more quickly in our 5 year amortization scenario, this produces total interest payments throughout the 5 year term of a little over $793,000. But with the amortization period stretched out to 30 years in length, this generates over $1.4 million dollars of interest for the lender throughout the term.

Balloon Payments

For the borrower, those lower monthly payments mean that this loan will not be paid off in full by the end of the loan term in the 30 year amortization scenario, and this is where what are referred to as balloon payments start to come into play.

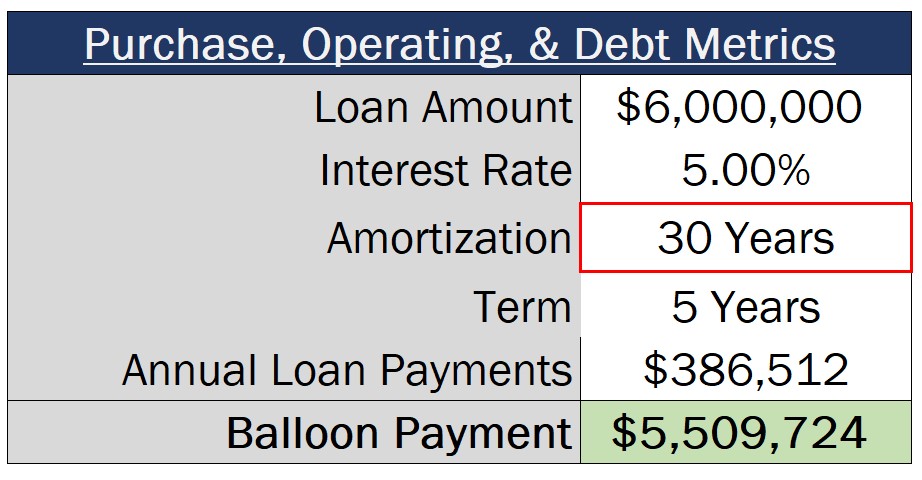

A balloon payment represents the total outstanding loan balance that the borrower will need to pay in full to the lender, all in one lump sum, at the end of the loan term. Longer amortization periods result in higher balloon payments, and shorter amortization periods result in lower balloon payments.

In this case, in the 5 year amortization scenario, because that amortization period matches the loan term, this means that the borrower will pay off that loan using just fixed monthly payments at the end of 5 years. But in the 30 year amortization scenario, this borrower would owe a significant balloon payment at the end of that term, with an outstanding balance of over $5.5 million dollars that would ultimately need to be paid from refinance proceeds, sale proceeds, or even investor equity.

Conclusion

To sum all of this up, on commercial real estate loans:

- Monthly payments are generally made up of both an interest and a principal portion

- The size of these payments will depend on the amortization period on the loan

- Longer amortization periods will result in lower monthly payments, more interest owed, and a higher balloon payment at the end of the term

Now, obviously, loan terms can vary a lot from deal to deal, and if you want to learn more about these concepts or more advanced loan concepts like floating interest rates, interest-only periods, or construction loan draws, and how to model these things in Excel, as always, make sure to check out our all-in-one membership training platform, Break Into CRE Academy.

A membership to the Academy will give you instant access to over 120 hours of video training on real estate financial modeling and analysis, you’ll get access to hundreds of practice Excel interview exam questions, sample acquisition case studies, and you’ll also get access to the Break Into CRE Analyst Certification Exam, which covers topics like real estate pro forma and development modeling, commercial real estate lease modeling, equity waterfall modeling, and many other real estate financial analysis concepts that will help you prove to employers that you have what it takes to tackle the responsibilities of an analyst or associate at a top real estate firm.

Thanks for reading!