Commercial Real Estate Loans – What To Know Before Financing a Deal

If you’re coming into commercial real estate from the residential sector or a different industry altogether, the financing of commercial properties and the terms associated with commercial real estate loans might seem pretty complex.

The way these loans are structured, how payments are made, and even the fees and penalties to look out for when financing deals are all pretty unique, but these are also really important things to consider when valuing commercial properties and underwriting deals.

So to make sure you have the foundations covered, this article walks through four things you need to know about commercial real estate loans before getting into the game, and how each of these things can impact a commercial real estate deal.

If video is more your thing, you can watch the video version of this article here:

The Makeup of Interest Rates

The first thing I want to highlight here is directly related to interest rates and how these are determined by commercial real estate lenders, and this is that, on commercial property loans, interest rates are made up of two different components – an index rate and a spread.

The index rate is generally going to be the equivalent term risk-free rate in the market, which represents bond yields with the same maturity date as the loan and an assumed 0% default risk by commercial real estate lenders.

For fixed-rate loans, or loans with an interest rate that doesn’t change throughout the loan term, the index that’s generally used in the US is the equivalent-term US Treasury yield.

This means that, for a loan with a 5-year term, the index rate on that loan would be the 5-year US Treasury yield at the time the rate is locked.

And on top of the index rate, a lender will also add a spread to make up the all-in interest rate on the loan, which is going to be based on the assumed risk the lender is taking on and volatility levels within the debt markets.

When interest rate movement and the risks associated with a given deal are low, commercial real estate loan spreads will also usually be low, and when the interest rate environment is more volatile and the risks associated with a given deal are high, commercial real estate loan spreads will also usually be elevated.

Prepayment Penalties

Interest payments aren’t the only costs to borrowers on commercial real estate loans, and penalties and fees on these loans can also be substantial.

And when commercial real estate loans are paid off early, there are typically fees owed to the lender known as prepayment penalties, which can often have substantial impacts on the economics of a deal.

Unlike mortgages on owner-occupied single-family homes that can typically be paid off early without penalty, if a commercial real estate loan is paid off before the end of the loan term (whether an investor wants to refinance a deal or sell a property outright), it’s usually not going to be cheap to make that happen.

This is especially true in situations where interest rates have dropped since the initial loan proceeds were issued, since commercial real estate lenders need to maintain their yields. And if a borrower pays off a loan in a lower interest rate environment, that lender then needs to go back out into the market with additional capital to deploy, just to earn that same rate of return.

Prepayment penalty calculations can sometimes be as simple as a percentage of the outstanding loan balance at the time the loan is paid off, but these can also sometimes be more nuanced formulas associated with making the lender whole for missed interest payments.

In some cases, prepayment penalties may be based on a yield maintenance calculation, which calculates the present value of the remaining loan payments that the lender would have received if the loan wasn’t paid off before loan maturity.

In other cases, prepayment penalties may be based on defeasance calculations, which requires a borrower to replace the lender’s yield with government-backed bonds that can replicate the cash flows of the remaining monthly payments.

Lockout Periods

It’s also important to note that commercial real estate loans might include a lockout period, or a portion of the loan term in which the loan can’t be prepaid at all.

This means that, even if a borrower was willing to pay a penalty to pay off the loan early (usually to refinance at a lower interest rate or sell at a desirable price point), they may not be able to make that happen, even if prepayment is in the best interest of the investor.

Amortization Period vs. Loan Term

The next thing that often trips people up about commercial real estate loans, especially those that are coming from the residential sector, is that the amortization period of a commercial real estate loan is often significantly different than the term of the loan.

On residential home loans in the US, you’ll generally see 30-year loan terms, where payments are also calculated based on a 30-year payback schedule. As a result, these loans will be paid off in full by the borrower at the end of the term through regular, fixed monthly payments.

However, to mitigate risk on commercial real estate loans, lenders usually won’t offer loan terms of more than about 10 years in length, with 3-year, 5-year, and 7-year terms also being common.

And in order to keep loan payments manageable for investors within that timeframe, commercial real estate loans will often include a 25-year or 30-year amortization period to calculate monthly payments, despite the loan term being significantly shorter.

This creates what’s referred to as a balloon payment at the end of the loan term, which represents a one-time payment from the borrower to pay off the entire outstanding loan balance at the time of loan maturity (or when the loan is prepaid).

Commercial Real Estate Loan Sizing

Directly related to this process of refinancing and the amount of loan proceeds that a lender is going to provide, the last point I want to make in this article is that commercial real estate loan funding is generally based not only on the property’s value, but the income the property is expected to generate.

Commercial real estate lenders often look very closely at a property’s debt service coverage ratio (DSCR), which measures the amount of times over a property’s net operating income (operating revenue minus operating expenses) can cover annual debt service that would be owed on a loan.

Usually, lenders are going to want to see this DSCR figure fall somewhere between about 1.25x and 1.40x, depending on the product type and the risk associated with the deal.

This means that, if interest rates or NOI values fluctuate, the loan proceeds a lender will be willing to issue are also going to fluctuate based on those changes.

An Example

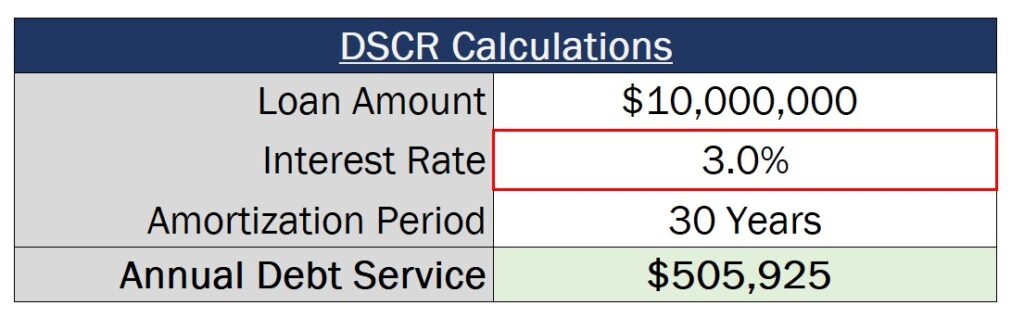

To run through an example of what this might look like, if an investor took out an acquisition loan of $10,000,000 financed at 3.0% interest, assuming an amortization period of 30 years, the annual debt service on this loan would be $505,925.

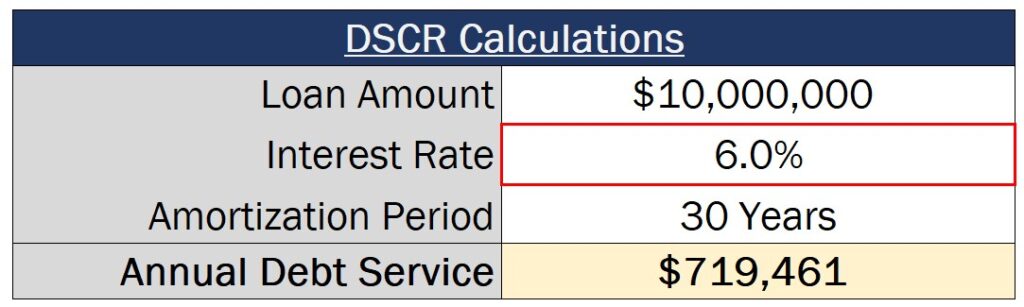

But if that original acquisition loan was set to mature in 3 years and interest rates jump to 6.0% at the time of loan maturity, keeping all other variables constant, that same $10,000,000 loan would now require annual debt service payments of $719,461.

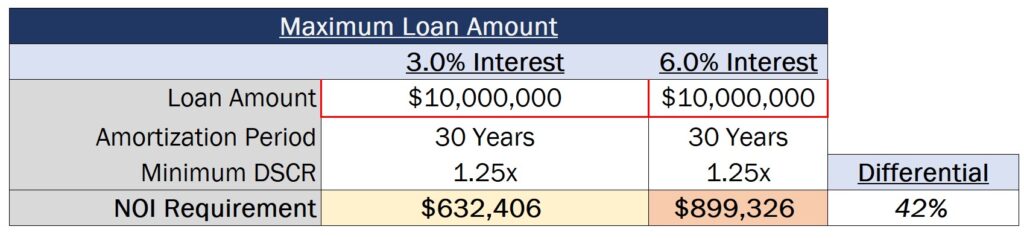

This means that, if DSCR requirements from the lender stay the same on this deal, this would require the property to have seen a net operating income increase of over 42% during this 3-year period just to get back to that same $10,000,000 loan value, and this isn’t even factoring in any loan origination fees that would likely be associated with a refinance of the deal.

How To Model Commercial Real Estate Loans in Excel

Every commercial real estate loan product is different, but these are four things that investors need to pay close attention to when financing deals, and some of the most important components of commercial real estate loans that can have huge implications for investors.

And if you want to learn more about commercial real estate financing and how to model commercial real estate loans when analyzing potential investments, make sure to check out our all-in-one membership training platform, Break Into CRE Academy.

A membership to the Academy will give you instant access to over 120 hours of video training on real estate financial modeling and analysis, you’ll get access to hundreds of practice Excel interview exam questions, sample acquisition case studies, and you’ll also get access to the Break Into CRE Analyst Certification Exam. This exam covers topics like real estate pro forma and development modeling, commercial real estate lease modeling, equity waterfall modeling, and many other real estate financial analysis concepts that will help you prove to employers that you have what it takes to tackle the responsibilities of an analyst or associate at a top real estate firm.

As always, thanks so much for reading, and make sure to check out the Break Into CRE YouTube channel for more content that can help you take the next step in your real estate career.