Discounted Cash Flow (DCF) Analysis in Real Estate Explained

In commercial real estate, the discounted cash flow analysis is at the core of property valuations, which ultimately shapes investment decisions made by real estate firms.

But because of how real estate deals are typically financed (especially by major private equity firms), the way this is applied in practice isn’t all that straightforward.

So in this article, we’ll break down how a discounted cash flow analysis comes into play when investors value commercial properties, why commercial real estate firms tend to prefer analyzing a different metric when evaluating opportunities, and how you can talk through this concept clearly and concisely within a real estate interview.

If video is more your thing, you can watch the video version of this article here:

Defining “Discounted Cash Flow”

So to step back and start by defining what a discounted cash flow analysis actually is, this involves taking the cash flows that are projected to be generated by a commercial property, and then discounting those cash flows using a predetermined discount rate and the amount of time that has elapsed since the initial capital investment.

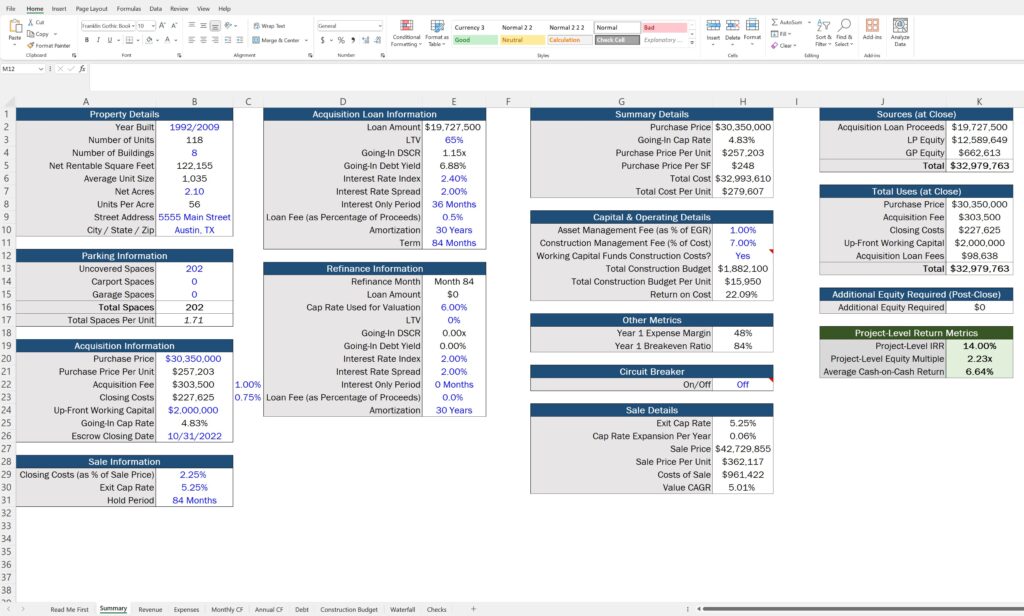

In the vast majority of cases, commercial real estate investors and investment firms will come up with valuations for properties using an Excel-based financial model, often a multi-tab template that looks something like this:

This model will be used to make projections about future property performance and what the cash flows generated by the property are going to be, using assumptions around things like rent growth, vacancy, leasing, operating expenses, and the terms of the debt that will be used to finance the deal.

These cash flows are then going to result in distributions to investors, that are putting their money to work in real estate with the goal to earn a targeted rate of return, and this is where the discount rate starts to come into play.

The Discount Rate

The discount rate represents the time-weighted, annualized return on capital invested that investors would require to make an investment worthwhile.

Now, we have a video that covers the process of choosing a discount rate in much more detail (link here), but in general, higher levels of risk will usually result in higher required rates of return (and ultimately a higher discount rate), and lower levels of risk will usually result in lower required returns (and ultimately a lower discount rate), all else being equal.

And where these discount rates come into play within the discounted cash flow analysis is that these are applied to the projected future cash flows of a property, to determine if an investor is ultimately going to hit their required returns based on the timing and the amounts of projected distributions.

An Example

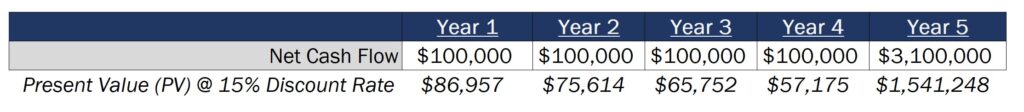

To use an example to illustrate this, let’s take a look at a deal where investors would require a 15% annualized, time-weighted return on a real estate investment that’s planned to be held for 5 years. Let’s also say that the property is projected to generate $100,000 per year in operating cash flow and an additional $3,000,000 of net sale proceeds at the end of that 5 year period.

And to run a DCF analysis on this deal given this information, what we need to do is take each of these cash flows in each year of the projected hold period and discount these values at that 15% rate, based on the amount of time that’s elapsed since the start of the analysis.

And the way we can calculate this is to take the cash flow generated in each year of our hold period and divide this by one plus the discount rate, and then take this to the power of the number of years that have elapsed since the initial acquisition:

Annual Cash Flow / (1 + Discount Rate)^Number of Years Since Acquisition

In this case, in year one, we’d need to take that $100,000 in net cash flow and divide this (1+15%), and then take this to the power of one, resulting in just under $87,000 for our discounted cash flow value in this year.

And to calculate this in year 2, we now need to factor in that 2 years have elapsed since the initial acquisition, multiplying that same $100,000 value by (1+15%)^2, which gets us just a little over $75,000 for our discounted cash flow value in this period.

As you can see, this $100,000 amount continues to be discounted even further in years 3 and 4 as that exponent in the denominator continues to increase, ultimately leading to our $3,100,000 sum of operating cash flow and net sale proceeds in year 5 only accounting for a little over $1,500,000 within our DCF analysis.

Now once we have these discounted cash flow amounts, all we need to do to finish out our DCF analysis is find the sum of these values, or $1,826,746 in this case.

And what this tells us is that, based on these cash flows, assuming that each of these occurs at the end of each year for a full 5-year hold period and our investor requires a time-weighted, annualized return of fifteen percent on the deal, that investor could contribute up to $1,826,746 into the transaction and still hit their return target (assuming our projections are correct).

Why The Internal Rate of Return (IRR) is Preferred

However, since this $1,826,746 figure represents only the up-front equity investment the investor could make in the deal, this doesn’t tell us the actual purchase price we could pay for the property after factoring in debt.

So instead of using a discount rate and backsolving to an equity investment directly, many commercial real estate investors will use a target IRR in their models to come up with valuations instead, since this incorporates all cash flows and loan proceeds into this figure.

The IRR, or internal rate of return, represents the discount rate at which the net present value of a set of cash flows is equal to zero, essentially getting us to that same $1,826,746 up-front investment producing a 15% IRR.

However, because an initial equity investment in a real estate deal is usually going to be based on a mixture of a purchase price, closing costs, and loan proceeds, using a target IRR allows an investor to see their projected returns in a model much more easily, and can ultimately guide their offers in a more direct way.

This is why, if you open up the models used by some of the biggest investment and development firms in the industry, the IRR is almost always going to be the focal point and you won’t necessarily even see a net present value (NPV) calculation within the entire template. The IRR allows an investor to analyze the same time-weighted, annualized returns that the standard DCF analysis allows, but in a much more dynamic way, and makes it significantly easier to see the impacts of different purchase prices on a property’s projected returns.

Putting It All Together

To sum this all up, a discounted cash flow analysis takes a discount rate, or an investor’s targeted, annualized, time-weighted return on capital invested, and applies that to each projected cash flow on a deal based on the amount of time that has elapsed since the initial investment was made.

And from there, the sum of these cash flows represents the initial equity contribution that could be made by investors that would ultimately result in achieving those returns.

So if you’re asked a question during an interview that sounds something along the lines of, “Walk me through a DCF,” this is how you can describe this concept in a way that goes a layer deeper than just talking through general formulas, and how this is applied in a real estate context.

And if you’re in the process of preparing for interviews and want to make sure you’re ready for an Excel modeling exam that might be given to you during the process, or you just want to see how all of these things come together within a full real estate pro forma model, as always, make sure to check out our all-in-one membership training platform, Break Into CRE Academy.

A membership to the academy will give you instant access to over 120 hours of video training on real estate financial modeling and analysis. You’ll get access to hundreds of practice Excel interview exam questions, sample acquisition case studies, and you’ll also get access to the Break Into CRE Analyst Certification Exam, which covers topics like real estate pro forma and development modeling, commercial real estate lease modeling, equity waterfall modeling, and many other real estate financial analysis concepts, that will help you prove to employers, that you have what it takes, to tackle the responsibilities of an analyst or associate, at a top real estate firm.

To learn more about the Academy, you can see all the details here.

Thanks for reading!