How Interest-Only Loans Affect Real Estate Investment Returns

If you’ve been in commercial real estate for a while, or you’ve shopped around for commercial real estate financing options, you’ve probably heard of an interest-only period.

And an interest-only period is exactly what it sounds like – a period of time in which you’ll only pay interest payments, and won’t pay any principal payments on the loan.

Now that sounds good on paper, but what does that actually mean for a commercial real estate deal, and how might interest-only loans affect your returns on a real estate acquisition?

In this article, we’ll walk through what interest-only loans are, how they’re used in commercial real estate, and the pros and cons of an interest-only structure on a real estate deal.

If video is more your thing, you can watch the video version of this article here.

Interest-Only Loans Increase Cash Flow and Cash-on-Cash Returns

The first impact that an interest-only period can have on a real estate deal is that it can increase cash flow on the project, and cash-on-cash returns as a result.

It’s pretty clear that your cash flow will increase if you’re not paying a principal payment on top of the interest payment every month, but let’s take a look at how the numbers might work and the concrete impact this can have on a real estate deal.

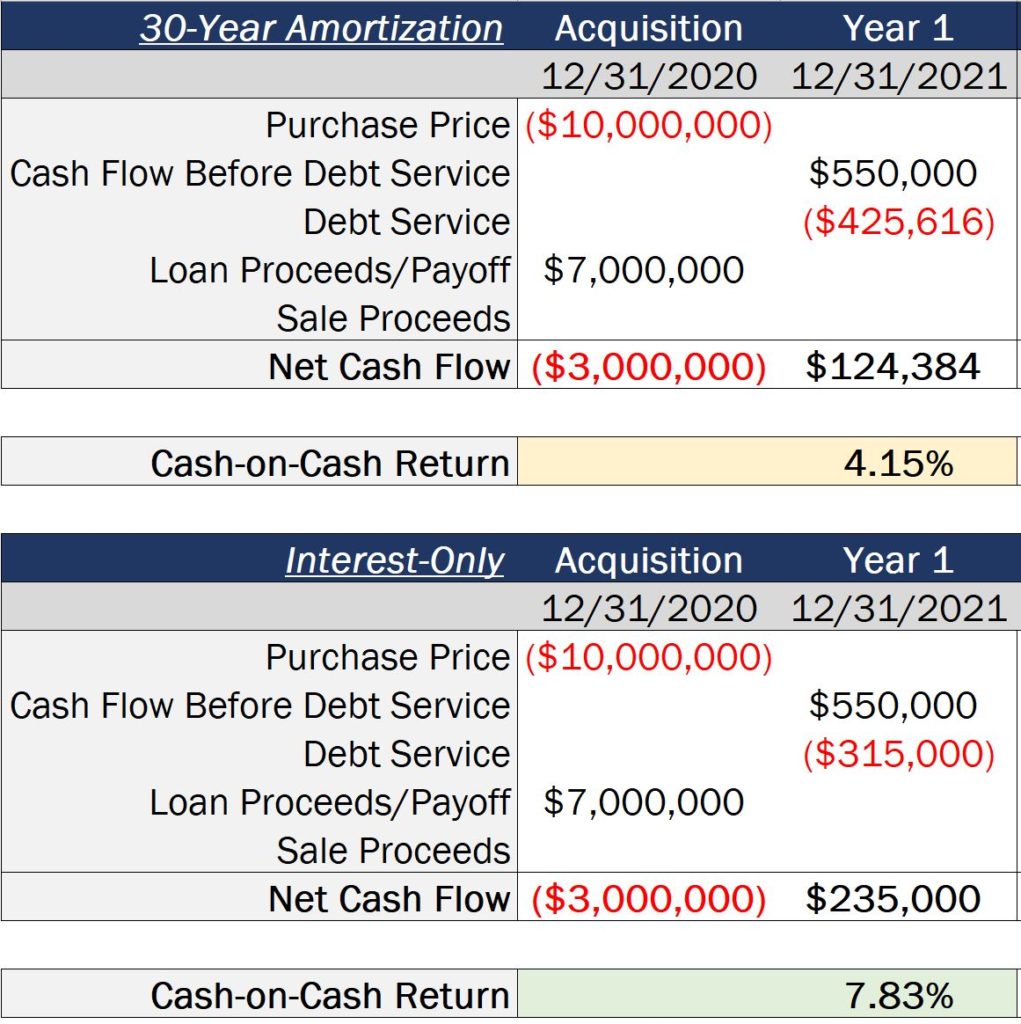

For example, if we calculate the total annual loan payments on a $7 million loan at 4.5% interest amortized over 30 years, we would need to pay $425,616 per year in debt service on the loan.

However, if we assumed the loan payments in this scenario were interest-only, this would result in annual debt service of just $315,000 per year, producing an additional $110,616 in cash flow in each year of the interest-only (I/O) period.

And the difference in cash flow is substantial, but where this gets even more impactful is when taking a look at the changes in the cash-on-cash return in that same scenario.

For example, if we assume that $7 million loan is on a $10 million acquisition, that means we’ll need to invest $3 million of equity into the deal at closing (not including closing costs to keep the math simple).

And with that, assuming a $3 million equity investment, $110,616 of additional annual cash flow in the I/O scenario represents a 3.7% increase in cash-on-cash returns each year, which is a massive spike and boost to investor returns.

Interest-Only Loans Can Reduce Total Profits

Even with the higher cash flow and cash-on-cash yield, a downside of interest-only loan periods on real estate deals is that, all else being equal, these periods can decrease your total whole-dollar profits on the deal.

Because the loan balance isn’t being paid down each month, this means that total interest costs are higher during an interest-only period, since interest payments are calculated based on the outstanding loan balance on a rolling basis.

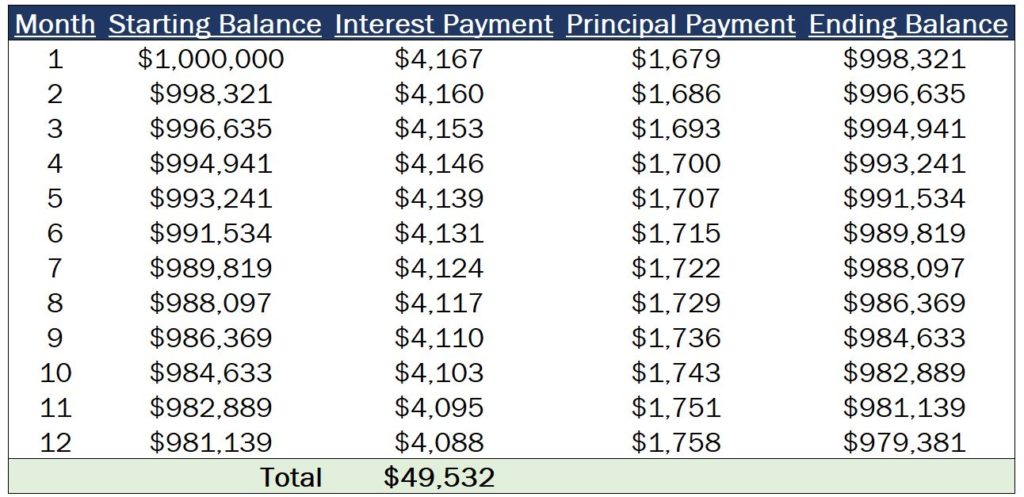

For example, on a $1,000,000 loan at 5.0% interest amortizing over 25 years, the total interest payments in the first year of the loan would be $49,532.

However, in the interest-only scenario, the total interest payments would be $50,000.

And this $468 difference might not seem like much in one year, but when the numbers start getting bigger and this is extrapolated over a longer period of time, this is where things start to get interesting.

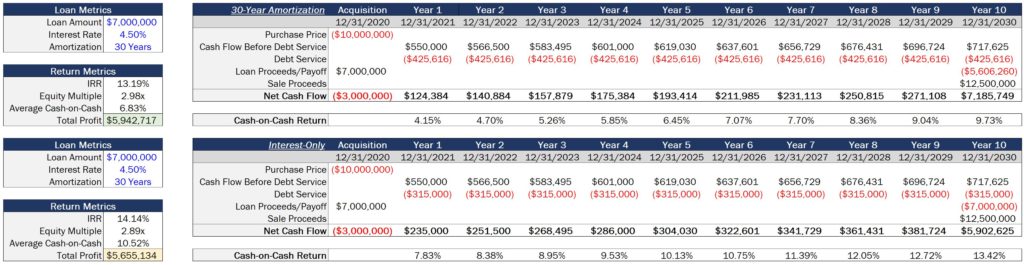

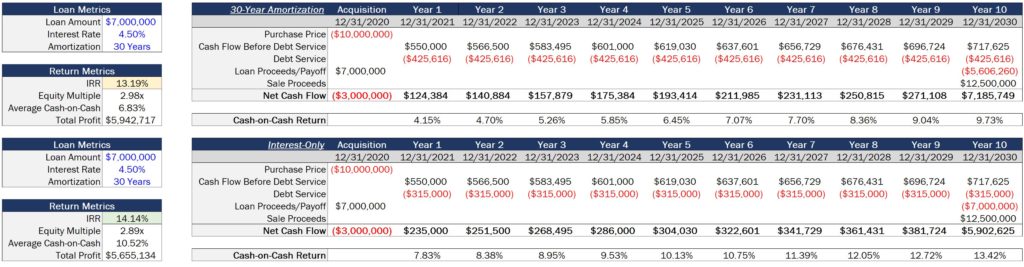

And if we use the same example of that $10 million acquisition with a $7 million loan at 4.5% interest, and compare the whole dollar profit figures between the interest-only scenario and the amortizing scenario over a 10-year period, we get a difference in profit of $287,583, which is no small chunk of change.

Interest-Only Loans Can Increase IRR

Finally, the third thing that an interest-only period on a loan can do for a real estate deal is increase your internal rate of return, or IRR.

Even though the total profit on the deal will decrease, an interest-only period essentially front-loads additional cash flows earlier on in the hold period.

And with that, since the IRR is a time-value of money function, cash flows received earlier on in the hold period are worth more than those same cash flows received later on in the hold period for the purposes of the calculation.

If we take a look at the same example as above, we can see a difference in the IRR of both projects coming out to 0.95%, this time with the full-term interest-only loan coming out on top.

Since many equity waterfall structures that dictate how the General Partner (GP) is compensated are dependent on the IRR metric, specifically, the factors that increase this value tend to win out, and interest-only loans are highly sought-after instruments in the industry as a result.

When Is an Interest-Only Loan Right For Me?

With all of that said, how do you know if an interest-only loan (or short-term interest-only period) is right for you on your own deal?

When an Interest-Only Period Makes Sense

First, if you and/or your investors are looking primarily to maximize cash flow and cash-on-cash returns, adding an interest-only period within the loan can be a great tool to make that happen.

Interest-only periods can also provide a significant boost in cash flow during times when operating cash flow would otherwise be tight, including periods of heavy renovation or re-leasing efforts in an attempt to improve the property and stabilize the deal.

If you plan to spend a significant amount of capital in the first few years of ownership, or you foresee a significant drop in occupancy as a result of an expiring lease or units being taken off-line, an interest-only period can often be a huge help in preserving (and growing) investor distributions, even during these times.

Additionally, as mentioned above, if you’re a GP raising equity from third-party investors and being compensated based on exceeding a certain IRR target, maximizing the interest-only period on the loan will generally be in your best interest, allowing you to shift those cash flows to earlier on in the hold period and boost your IRR by 50 to 100 basis points or more in some cases.

When You Might Want To Think Twice About an Interest-Only Loan

On the other hand, if you’re an individual investor holding a property primarily for long-term wealth accumulation and/or capital preservation, and you’re not overly concerned with cash flow on a month-to-month basis or time weighted return targets, you’ll likely be better off from a whole-dollar profit perspective without the I/O period.

As with all real estate investment decisions, the actions you take here will be based on your own personal goals and objectives, but the interest-only period can be a helpful tool in your back pocket if you’re looking to juice your cash-on-cash or IRR values.

How To Model an Interest-Only Loan in Excel

If you want to learn more about how to implement interest-only periods and other loan terms into a real estate financial model, make sure to check out our premium training platform, Break Into CRE Academy

The Academy includes in-depth course videos on real estate financial modeling and analysis for multifamily, retail, office, and industrial properties, you’ll get instant access to pre-built acquisition and development models so you can practice what you learn in the coursework to analyze returns on new acquisition and development opportunities, and you’ll even have access to private, one-on-one, email-based career coaching support to get your questions answered on your own unique situation, if you’re navigating the job search process and need some extra help along the way.

I hope you find this helpful if you’re considering an interest-only loan on your next real estate deal. Good luck!