How To Know If You’re Overpaying For a Real Estate Deal (3 Checks)

Coming up with a reliable valuation for a real estate deal isn’t easy.

Between the market research that goes into knowing what comparable properties are trading for, what rents are in the market, what expenses should be, the debt terms that you’re likely to get, and an estimate of construction costs to renovate the property, it’s a lot of work to make that sure your assumptions check out on a real estate deal.

But aside from those main key assumptions that most investors are digging into and really doing their research on, there are some other assumptions that real estate investors make that often just aren’t researched as much as they should be. And when these things are overlooked, these mistakes can often lead to unrealistically high valuations, and investors overpaying for the properties they’re acquiring.

So, in an attempt to save you the headache of making these mistakes yourself, this article will walk through three of the most common underwriting mistakes that can lead investors to overpay for deals (especially in a hot market), and how you can make sure you’re not doing the same things.

If video is more your thing, you can watch the video version of this article here.

Overly Aggressive Exit Cap Rate Assumptions

First on this list, and probably most prevalent among newer investors, is setting your exit cap rate assumption too low in your underwriting, creating an overinflated property value when you assume to sell the deal.

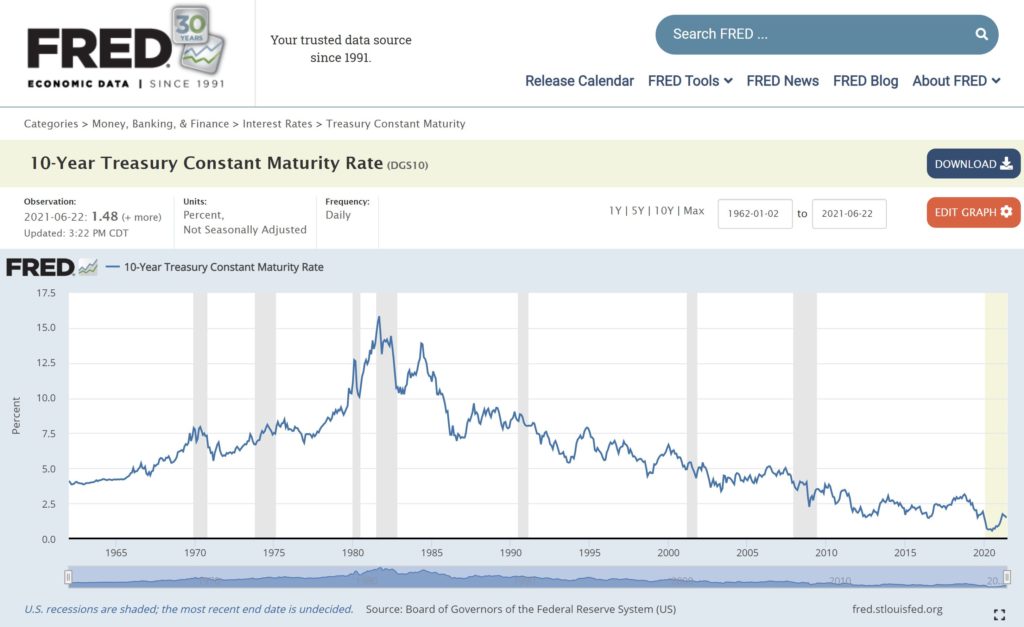

With the 10-year US treasury yield hitting all-time lows in the summer of 2020, many investors are expecting interest rates to increase over the next few years as the economy begins to recover, and we’ve already started to see this trend beginning in recent months.

With most real estate transactions being financed anywhere from 50% to 70% by debt, interest rate increases will inevitably have an effect on the price investors can pay for properties in the future, directly affecting market values of real estate deals in relation to interest rate changes.

How This Works in Practice

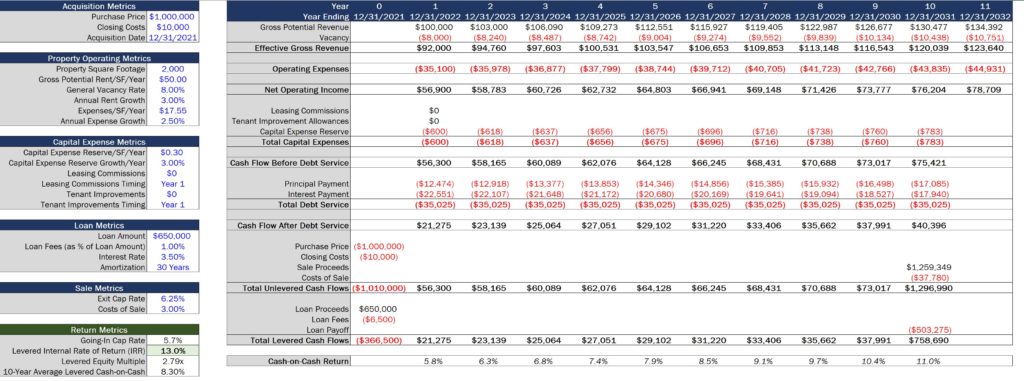

For example, let’s assume that an investor pays $1,000,000 to acquire a property today at a 5.7% cap rate. Let’s also assume that investor finances that property with debt at a 65% LTV ratio with a 3.5% interest rate, and then sells that property at a 6.25% exit cap rate at the end of 10 years. And with those assumptions, that investor would earn a 13.0% IRR over their 10-year hold period.

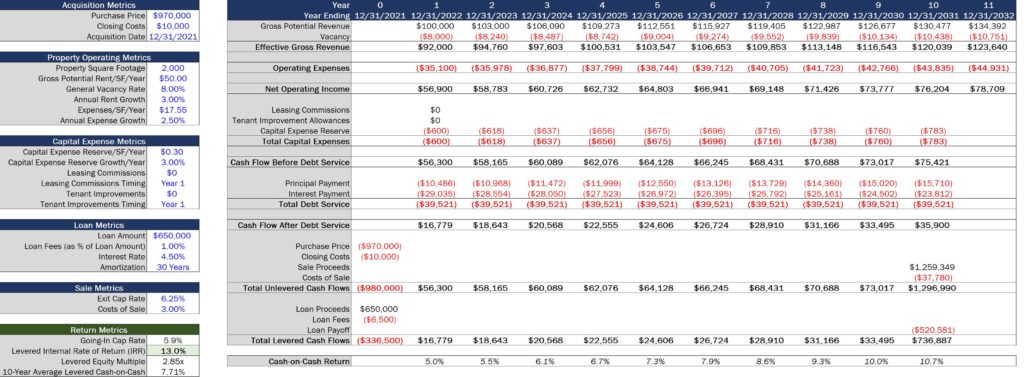

However, in that same scenario with interest rates rising, if that interest rate jumps just 100 basis points to 4.5% and all other assumptions stay the same, the IRR on that same project for that investor would drop to just 11.8%.

And to get back to that 13.0% IRR value, the investor would have to drop their pricing down to just $970,000, a 3% drop in the price that investor would be able to pay for that same deal with the 3.5% interest rate.

And with that 3% price drop, that NOI value on that deal would stay the same, leading to an increase in the going-in cap rate up to 5.9%, an increase of over 20 basis points from the going-in cap rate at the 3.5% interest rate.

Because of the impact of cap rate movement on pricing, most institutional investors and private equity groups are underwriting some sort of exit cap expansion (growth) during their projected hold period, usually of at least 5 basis points per year between their going-in cap rate on a deal and their exit cap rate assumption.

And to make sure you’re not getting too aggressive on your sale assumptions, baking in some sort of cap rate expansion into your underwriting can help protect against a big miss in your cash flow projections in the case that interest rates continue to rise over the next 3, 5, or 10 years.

Incorrectly Adjusting Property Taxes Over Time

Aside from setting your exit cap rate assumptions correctly, the second mistake on this list has to do with not only your sale assumptions, but also your operating assumptions, and that is not adjusting correctly for property tax changes upon purchase or sale of a property (or within your hold period itself).

Here in the US, property tax assessment practices vary substantially from state to state (and often from county to county or city to city).

Some states will reassess property values immediately upon sale, and property tax values will be directly related to the purchase price of the asset.

Other states do not reassess property values immediately upon sale, and your assessed property value for tax purposes will be directly related to the previous year’s value and a specific growth rate applied to that figure.

Some states don’t end up following either of these rules, and actually reassess property values on a predetermined schedule (every X number of years), and then phase in that reassessment over time. And this is the most unpredictable of the three scenarios, causing property taxes to increase irregularly at different intervals throughout your ownership period.

Knowing exactly how this is going to be treated up-front is huge in making sure your cash flow projections are accurate, because this will directly affect both the timing and the amount of the cash flows you expect to generate. In many cases, this will also affect your NOI during operations, and potentially even your sale value in a very, very big way.

How This Works in Practice

This is impactful for properties where landlords assume responsibility for paying all operating expenses out of pocket, but even for properties with tenants on triple-net (NNN) leases, or structures where the tenants reimburse the landlord for all operating expenses associated with the property, this can still be a really big deal.

Most tenants will determine how much they can pay in rent by calculating their all-in occupancy costs, and operating expense reimbursements are included in that mix.

So if all of a sudden a tenant’s property tax reimbursement obligations double over a 2-3 year period, this makes it significantly more difficult for that tenant to operate profitably in that location. And because of this, that tenant is going to become much more likely to vacate or request some sort of a rent reduction once the lease expires.

And on the back-end, this is just as important (if not more important), because an increase in property tax values is going to directly affect your NOI, which will directly affect your sale value.

A next buyer is going to value the property they’re acquiring based on the income it can generate, and if your property is going to be reassessed upon sale and that buyer’s property taxes are going to increase as a result, this is going to reduce the next buyer’s NOI, and reduce the price they’re willing to pay for the property.

If this reduction isn’t reflected in your assumptions, this likely means you’re going to be overvaluing the property based on an overinflated sale assumption, which is not good news for hitting the projected returns you’ve promised yourself (or your investors).

All of this is to say that one of the most important things you can do is verify how property taxes are going to change once you acquire the property, but also during your ownership period and when you sell the property to the next buyer, as well.

Overly Aggressive Rent Growth Assumptions Early On In The Analysis

Finally, the last point on this list is to make sure you’re not overly aggressive on your rent growth assumptions early on in your analysis.

Remember that the rent values in each year grow from the previous year’s values, meaning that misses early on are more impactful than misses later on in your hold period.

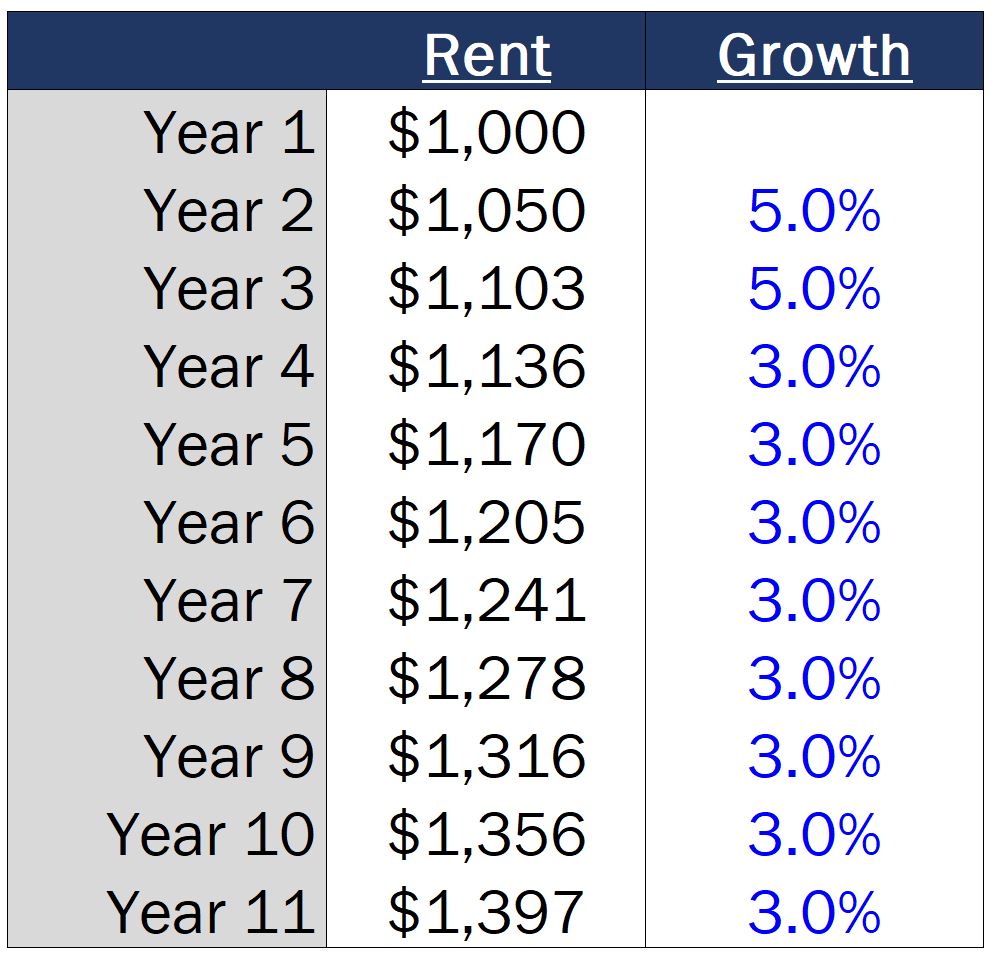

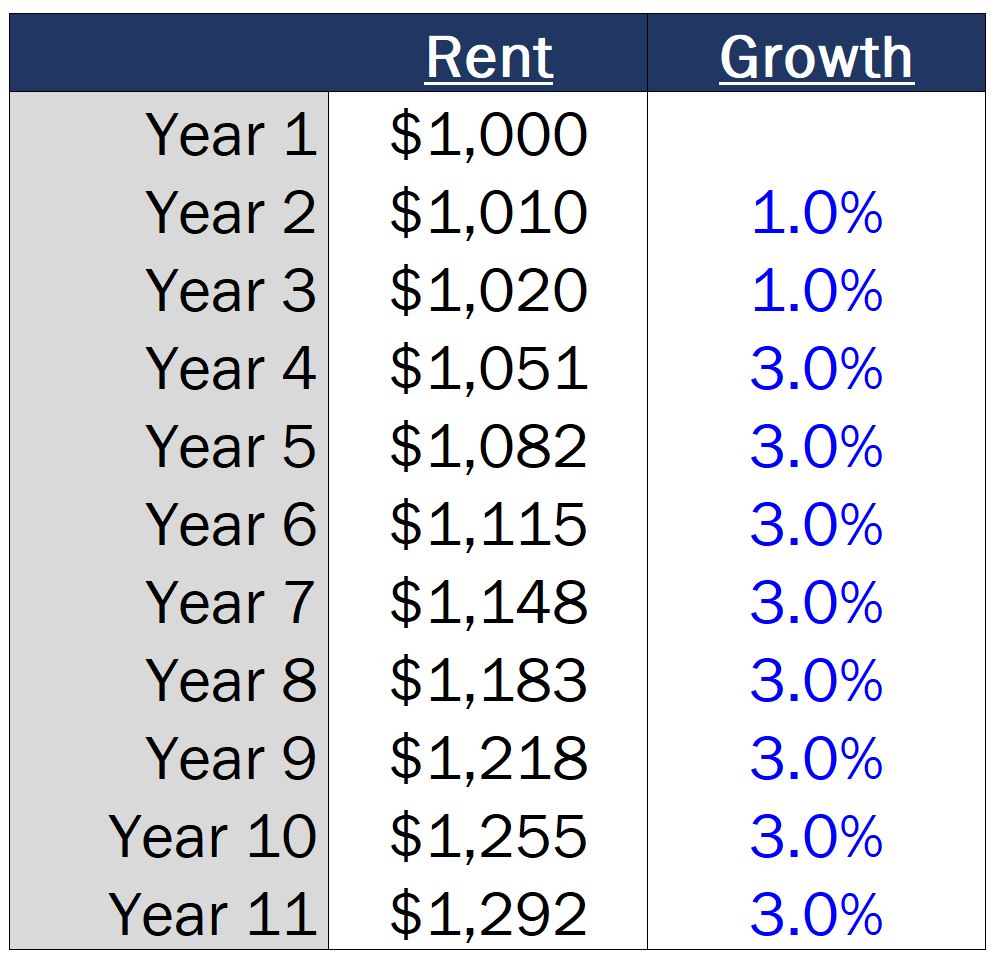

For example, take a unit that rents for $1,000 per month in year 1 of our analysis period.

If we assume that $1,000 market rental rate grows by 5% in years 2 and 3 of our analysis, and then we let that rent grow at 3% per year every year thereafter, the rent in year 11 (or the rent our sale value is going to be based on) is $1,397.

However, if we run into trouble in the first few years of our hold period, this is going to produce a very different story once we get to the sale year within our analysis.

If growth ends up being just 1% in years 2 and 3 instead of that 5% figure that we initially projected, and then we let that rent grow at that same 3% every year thereafter, in year 11 of our hold period, the rent ends up being just $1,292, or a 7.5% decrease from the originally projected values at the end of the hold period.

This might not sound like much of a difference in total, but if this NOI value is what your sale price is being based on, a 7.5% drop in sale value is a big deal, and can have a serious impact on your returns in a very negative way.

And this ends up being most impactful for multifamily investors with short-term, 12-month leases that see quick and immediate changes in revenue as market rent values fluctuate, but even for office, retail, and industrial investors with long-term leases at their properties, the market rates at the time of renewal years from now are going to be impacted by how market rents change today.

With that, staying conservative on your rent growth assumptions early on in your hold period (for all product types) is extremely important in not overvaluing a commercial real estate deal.

Where To Go From Here

If your exit cap rate assumption is too low, you haven’t accounted for a property tax reassessment coming, or your market rent growth assumptions early in the hold period are too aggressive, there’s a very good chance you could be overvaluing the properties that you’re analyzing, and paying too much for the deals you’re acquiring.

And if you want more training on the underwriting of commercial real estate deals and the things to look out for when analyzing property acquisitions, make sure to check out Break Into CRE Academy.

A membership to the Academy will give you instant access to a full library of video courses on real estate financial modeling and analysis, pre-built real estate financial models and Excel training files to practice your skills, and additional, one-on-one, email-based career coaching to get your questions answered every step of the way.

Thanks so much for reading – I hope you found this helpful. Good luck on your next deal!