How To Know If You’re Overpaying For a Real Estate Deal (3 Checks)

Coming up with a reliable valuation for a real estate deal isn’t easy.

Between the market research that goes into knowing what comparable properties are trading for, what rents are in the market, what expenses should be, the debt terms that you’re likely to get, and an estimate of construction costs to renovate the property, it’s a lot of work to make that sure your assumptions check out on a real estate deal.

But aside from those main key assumptions that most investors are digging into and really doing their research on, there are some other assumptions that real estate investors make that often just aren’t researched as much as they should be.

These mistakes can often leads to unrealistically high valuations, and unfortunately, investors overpaying for the properties they’re acquiring.

So, to save you the headache of making these mistakes yourself, this article will walk through three of the most common underwriting mistakes that can lead investors to overpay for deals, especially in a hot market, and how you can make sure you’re not doing the same thing.

If video is more your thing, you can watch the video version here.

The Real Estate Underwriting Process

If you’re looking at buying a real estate deal, the process is usually going to go something like this:

- Collect all property information from a seller or broker.

- Add that information to your real estate financial model.

- Make assumptions about how that deal is going to perform during your hold period.

- Come up with a valuation based on those assumptions and the return metrics you’re targeting on the deal.

But as the old saying of “garbage in, garbage out” goes, if your assumptions in that model don’t accurately reflect what is actually going to happen on a deal, you might be in for a rude awakening a few years from now when you and your investors are falling short of the cash flow and return projections you set when you first acquired the deal.

So to save you the headache of getting into a situation like this, let’s walk through three of the most common mistakes I see real estate investors making that causes them to overvalue real estate deals. And, more specifically, what to do instead of these things to make sure your assumptions are as accurate as possible and you can feel confident heading into your first or next real estate deal.

Setting Your Exit Cap Rate Too Low

First, and probably most prevalent among newer investors, is setting your exit cap rate assumption too low in your underwriting, creating an overinflated property value assumption when you assume to sell the deal.

With the 10-year US treasury yield recently hitting all-time lows in the summer of 2020, many investors are expecting interest rates to increase over the next few years as the economy begins to recover.

With most real estate transactions being financed anywhere from 50% to 70% by debt, increasing interest rates will inevitably have an effect on the price investors can pay for properties in the future, directly affecting market values of real estate deals in relation to interest rate changes.

How This Plays Out In Practice

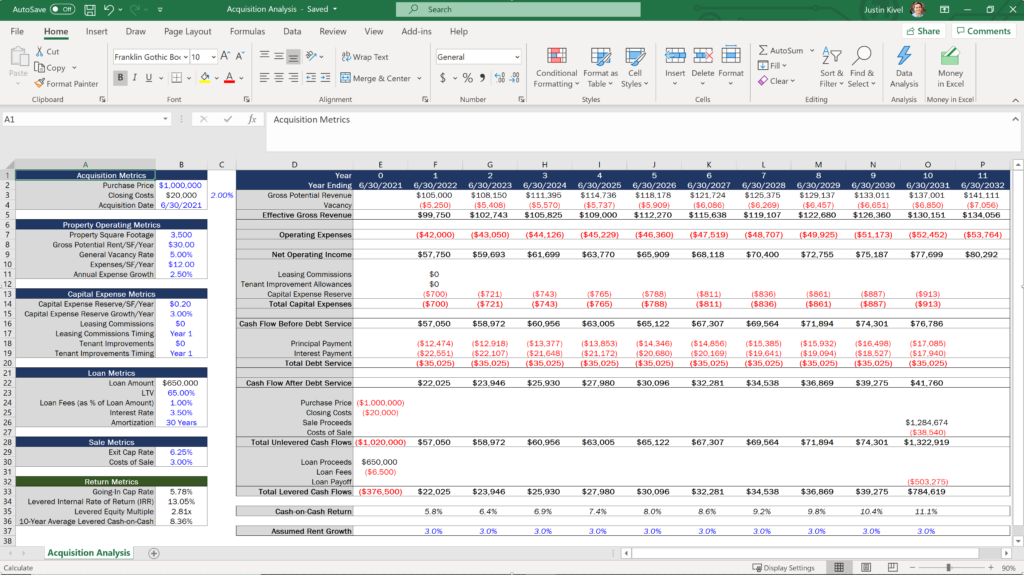

To use rough numbers on a sample acquisition, if we assume an investor pays $1,000,000 to acquire a property today at a 5.8% cap rate, we assume that investor finances that property with debt at a 65% LTV ratio with a 3.5% interest rate, and we assumed the investor sells that property at a 6.25% exit cap rate at the end of 10 years, that investor would earn a 13.05% IRR over that 10-year hold period.

However, in that same scenario with interest rates rising, if that interest rate jumps just 100 basis points to 4.5% and all other assumptions stay the same, the IRR on that same project for that investor would drop to just 11.93%.

And to get back to that 13% IRR value, the investor would have to drop their pricing down to just $960,000, a 4% drop in the price that investor would be able to pay for that same deal with the 3.5% interest rate.

With that 4% price drop, that NOI value on that deal would stay the same, leading to an increase in the going-in cap rate up to 6.02%, an increase of over 20 basis points from the going-in cap rate at a 3.5% interest rate.

And this is a prime example of how interest rate increases can directly lead to rate increases throughout the industry as a whole.

What To Do Instead (Exit Cap Rate Expansion)

Because of this, most institutional investors and private equity groups are underwriting some sort of exit cap expansion (growth) during their projected hold period.

This figure is usually at least 5 basis points per year between their going-in cap rate on a deal and their exit cap rate assumption.

And to make sure you’re not getting too aggressive on your sale assumptions in the case that interest rates don’t continue falling back to historic lows, baking in some sort of cap rate expansion into your own underwriting can help protect against a big miss in your cash flow projections in the case that interest rates continue to rise over the next 3, 5, or 10 years.

Not Accounting For Property Tax Adjustments

Aside from setting your exit cap rate assumptions correctly, the second mistake on this list has to do with not only your sale assumptions, but also your operating assumptions, and that is not adjusting correctly for property tax changes upon purchase or sale of a property (or within your hold period itself).

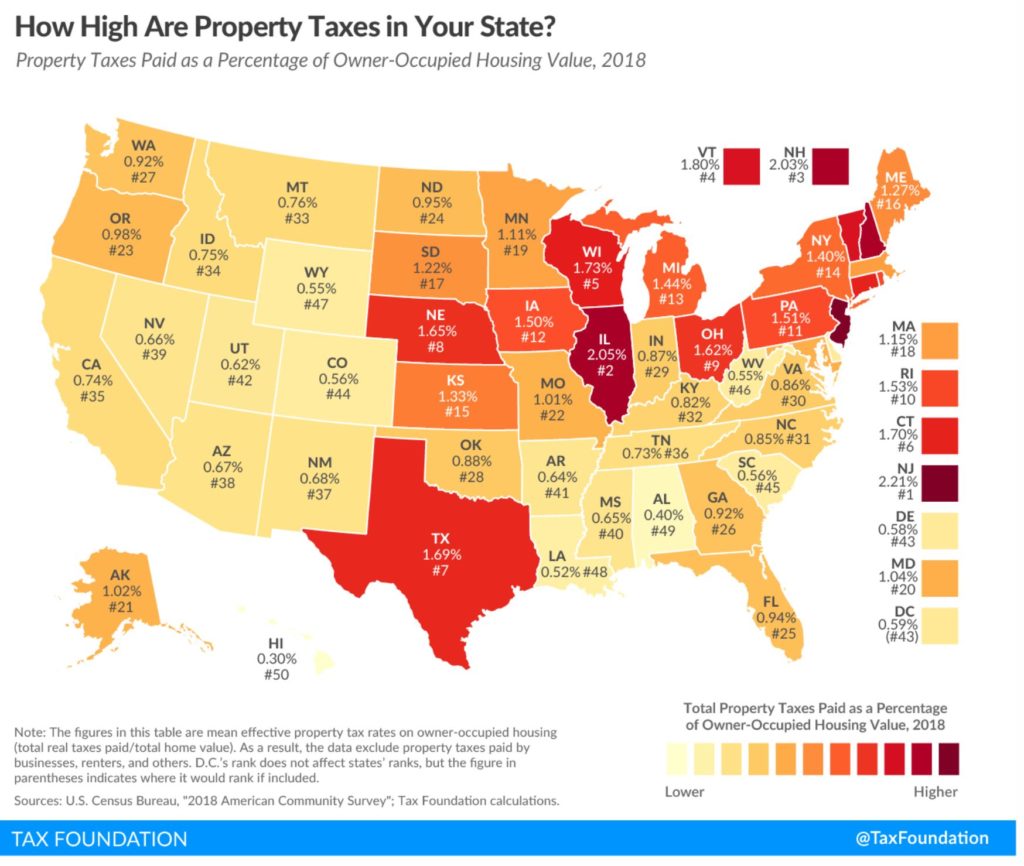

Here in the US, property tax assessment practices vary a ridiculous amount from state to state, and even from county to county or city to city in some cases.

Some states will reassess property values immediately upon sale, and your property tax value will be directly related to your purchase price.

Other states don’t reassess property values immediately upon sale, and your assessed property value for tax purposes will just be directly related to the previous year’s value (and a growth rate applied to that figure).

Some states don’t end up following either of these rules and actually reassess property values on a predetermined schedule (every X number of years) and phase in that reassessment over time, which causes your property taxes to increase irregularly at different intervals throughout your ownership period.

Knowing exactly how this is going to be treated up-front is huge in making sure your cash flow projections are accurate, because this will directly affect both the timing and the amount of the cash flows you expect to generate.

And in many cases, this will affect your NOI during operations and potentially your sale value in a very big way.

Property Taxes Matter To Tenants, Too

This is, without a doubt, impactful for properties where landlords assume responsibility for paying all operating expenses out of pocket. But even for properties with tenants on NNN leases, or structures where the tenants reimburse the landlord for all operating expenses associated with the property (including property taxes), this can still be a really big deal.

Most tenants will determine how much they can pay in rent by calculating their all-in occupancy costs, and operating expense reimbursements are included in that mix.

So if all of a sudden a tenant’s property tax reimbursement obligations double over a 2-3 year period, this makes it significantly more difficult for that tenant to operate profitably in that location. And with that, this also makes it much more likely that that tenant is going to vacate (or request some sort of a rent reduction) once the in-place lease expires.

Property Taxes Directly Affect Real Estate Valuations

On the back-end, this is just as important (if not more important), because an increase in property tax values is going to directly affect your NOI, which is also going to affect your sale value.

A next buyer is going to value the property they’re acquiring based on the income it can generate, and if your property is going to be reassessed upon sale and that buyer’s property taxes are going to increase, this is going to reduce that buyer’s NOI value and reduce the price they’re willing to pay for the property as a result.

If this reduction isn’t reflected in your assumptions, this likely means you’re going to be overvaluing the property based on an overinflated sale assumption, which is not good news for hitting the projected returns you’ve promised yourself, or your investors.

All of this is to say that one of the most important things you can do is verify how property taxes are going to change once you acquire the property, during your ownership period, and when you sell the property for the next buyer, as well.

Overly Aggressive Rent Growth Assumptions

Finally, the last point on this list to make sure you’re not overvaluing a property is to make sure you’re not overly aggressive on your rent growth assumptions early on in your analysis.

Remember that rent values in each year grow from the previous year’s values, meaning that misses early on are more impactful than misses later on in your hold period.

How This Plays Out In Practice

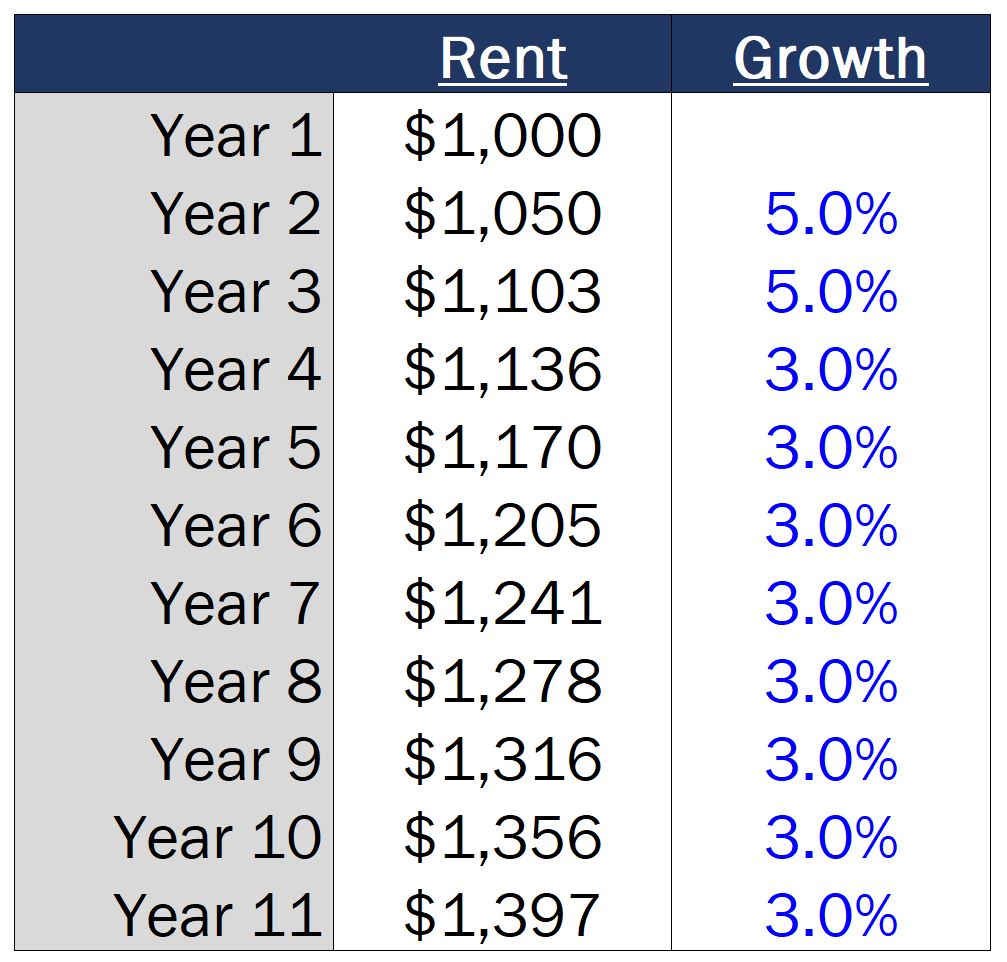

To use an example, let’s take a unit that rents for $1,000 per month in year 1 of our analysis period.

Then let’s assume that $1,000 market rental rate grows by 5% in years 2 and 3 of our analysis, but then we let that rent grow at just 3% per year every year thereafter.

If we take a look at our rent with those assumptions in year 11, or the rent our sale value is going to be based on, this will be $1,397.

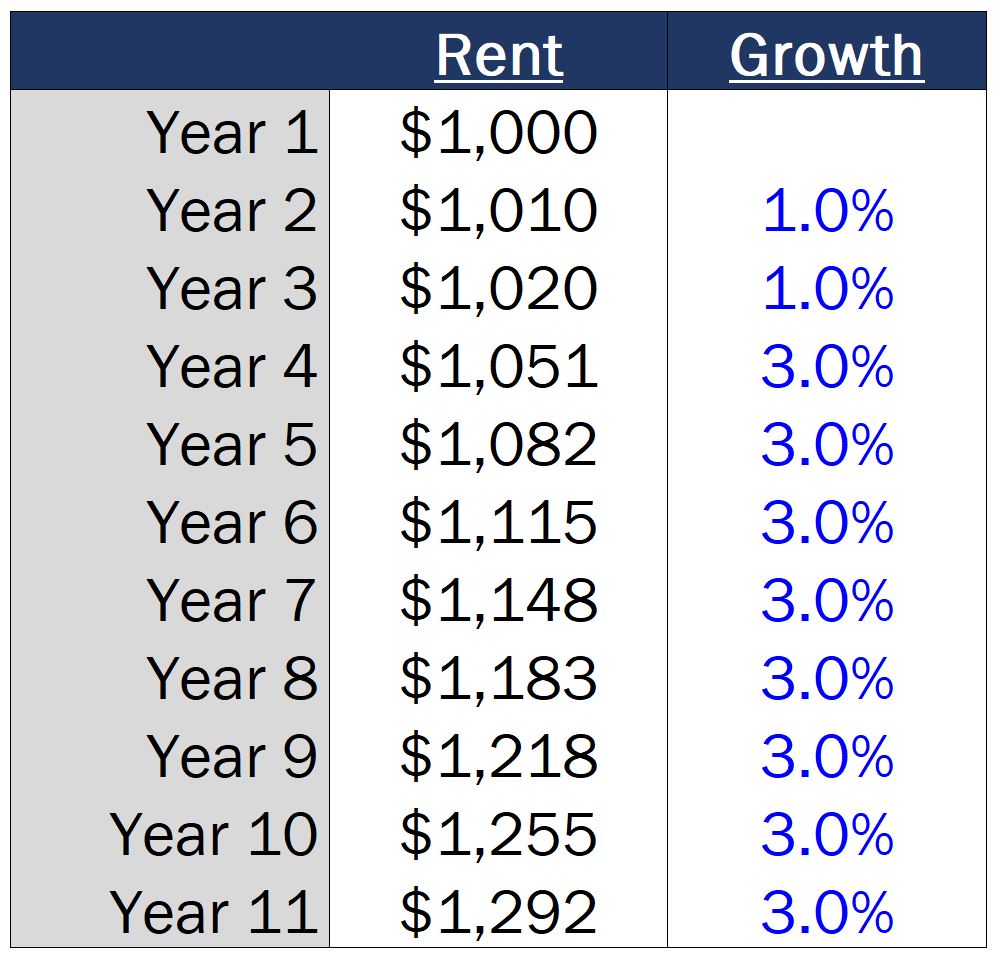

However, if we run into trouble in the first few years of our hold period, this is going to produce a very different story once we get to year 11 of our analysis.

Let’s assume rent growth ends up being just 1% in years 2 and 3 instead of that 5% that we initially projected, and then we let that rent grow at that same 3% every year thereafter.

In year 11 of our hold period, our rent ends up being just $1,292, or a 7.5% decrease at the end of the hold period.

That might not sound like much of a difference in total, but if this NOI value is what your sale price is being based on, a 7.5% drop in sale value is a huge deal, and can have a serious impact on your returns in a very negative way.

Does This Matter For Commercial Properties With Long-Term Leases?

It’s true that these early-term market rent growth dips are going to be most impactful for multifamily investors with short-term, 12-month leases that see quick and immediate changes in revenue as market rent values fluctuate.

But even for office, retail, and industrial investors with long-term leases at their properties, market rents at the time of renewal (even many years from now) are going to be based on market rents today, so even though you might not see a huge dip in revenue in years 1 and 2 if rent growth slows down, you’ll still take that hit when you go to re-lease the space in year 5.

The bottom line here is that staying conservative on your rent growth assumptions early on in your hold period for all product types is extremely important in not overvaluing a commercial real estate deal, and shouldn’t be taken lightly.

The Bottom Line

To recap, if your exit cap rate assumption is too low, you haven’t accounted for a property tax reassessment coming, or your market rent growth assumptions early in the hold period are too aggressive, there’s a very good chance you could be overvaluing the properties that you’re analyzing and paying too much for the deals you’re acquiring.

And if you want more training on the underwriting/analysis of commercial real estate deals and the things to look out for when you’re analyzing properties, make sure to check out Break Into CRE Academy.

An Academy membership will give you instant access to a full library of video courses on real estate financial modeling and analysis, pre-built real estate financial models and Excel training files to practice your skills, and additional one-on-one email-based career coaching to get your questions answered every step of the way.

Thanks for reading – good luck with your underwriting!