How To Make Better Real Estate Investment Decisions

This year will mark my tenth year in the real estate industry.

And while that’s nothing compared to CRE professionals who have had 30+ year careers in the space, at this point I’ve seen and been through enough to start to see some patterns.

Whether that’s through preparing materials to get deals past a seasoned investment committee in institutional settings or through my own real estate investments and mistakes and successes I’ve had along the way, there are some common threads I’ve found among deals that have worked out well, and other common threads among deals that…well…haven’t.

And in this article, I want to share five of the biggest lessons I’ve learned around the real estate investment decision-making process, and a few methods I’ve learned to minimize your downside and maximize your upside as you’re looking at your own deals out in the field.

If video is more your thing, you can watch the video version of this article here.

Look For The “Low-Hanging Fruit”

The first point on this list is a pretty cliché term, but this is to look for the “low-hanging fruit”.

In my experience, the easiest deals to pitch to institutional capital (or any investors, for that matter) are the deals that have clear upside potential that will both increase rents and the value of the property, and the upside presented is both easy and inexpensive to execute on.

How This Works In Practice

A commonly used, applicable example of this is adding washers and dryers to a multifamily property that already has laundry hookups in each unit, but the actual washer and dryer appliances aren’t included for the renter.

For the added convenience of having pre-installed washers and dryers, tenants are often willing to pay an additional $30-$50 per month in rent, and the cost to install those washer and dryer units generally isn’t more than about $1,000 per unit for the owner of the property.

And an additional $360 to $600 per year in rent to be generated on a $1,000 investment is a 36% to 60% return on cost, with extremely little risk to the investor.

Especially if this is done at scale on a larger multifamily deal, the total value of these increases can have a significant impact on cash flow and the overall returns generated at the property.

The same thing is true for things like turning unused space into paid storage, increasing the cost of things like parking fees to be more representative of market rates, or other small items that have a very low cost and effort to execute on and very high rental upside in comparison to that cost.

And the more opportunities like this you find where you can drive value with little effort or expense, the more you tend to de-risk your investment and increase your chances of success on the deal.

Use Your Competitive Advantage & Stay In Your Lane

Now next up on this list is another strategic play, and that is to use your competitive advantage and stay in your lane.

The most successful real estate investors are the ones that know the operations of a specific product type inside and out, or know a specific geographic market like the back of their hand, and they stick to their expertise and do those one or two things very, very well.

Very few investors are experts in multiple product types, simply because of the amount of knowledge and experience it takes to be successful on a large scale.

This is why you see most small to medium sized real estate investment firms only focusing on one specific asset class and location, whether that’s west coast multifamily, office buildings in the southeast, or niche product types like data centers or self-storage in the south.

To find good deals, it takes a tremendous amount of effort and focus to create and maintain broker relationships, see enough deal volume to understand patterns and operational norms in a market, and have the systems and infrastructure in place to be able to run with those opportunities.

By branching off into an unknown product type or geographic area, you’re significantly increasing your chances of a major mistake around something you don’t know you don’t know, which can often lead to investors missing pro forma returns or jeopardizing the deal altogether.

In my experience, the most successful investors focus on getting really, really good at just a few things, and then spend their time and energy continuing to improve their knowledge and relationships in the geographic markets or product types they’re experts in.

Market Timing Doesn’t Work

Aside from staying in your lane and finding the low-hanging fruit, the third point on this list is something I think is more relevant than ever today, and that is that someone will always be calling the top of the market.

Back in 2014 when I first started my MBA, I can’t tell you how many speaker panels I went to where someone said, “We’re in the 8th inning of a 9-inning ballgame”.

I’ve heard these same types of comments every single year since then, all the way up through 2020. And then, finally, for a select few product types and markets, those people calling the end of the cycle were right.

In the meantime, however, the people and companies that started sitting out back in the early 2010s ended up missing out on tremendous growth in real estate rents and asset prices during this time, and also missed out on the experience that comes with almost a decade of operating real estate assets and building relationships.

So, yes – at any point, someone might be right that a market crash is coming or we’re headed towards the end of a cycle.

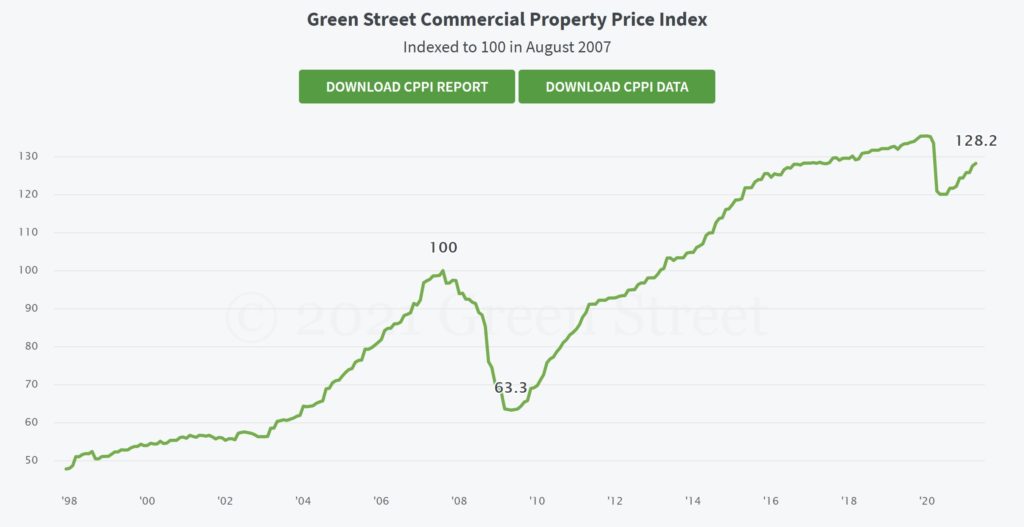

With that said, though, considering we’ve only seen property values fall during about 2 and a half years in total out of the last 25 years in the US, chances are that sitting out of the market actually presents more risk to would-be investors than actually being in the market in the first place.

The Danger of Inaction

Especially if you have entrepreneurial goals, the last thing you want to do is wait out a crash only to have that crash never come and that dream never materialize.

I’ve known way too many people who are unhappy in corporate environments (many of which were really good at what they do), waiting to strike out on their own when “the downturn” happens.

But by the time the opportunity actually struck, they either had golden handcuffs on, or they had life circumstances that prevented them from doing what they wanted to do in the first place.

All you can do is use the data you have about current and projected supply and demand fundamentals and make the best educated decisions you can today.

And listening to everyone’s predictions of a doom and gloom scenario every year will only make you paralyzed and prevent you from taking any action at all towards your goals and what you’re looking to achieve.

Look For Deals With Downside Protection

The fourth point on this list is another strategy point, and that is to do what you can to find deals with downside protection.

As we learned in 2020, things won’t always go as planned. However, if you have a worst case scenario you can live with (and potentially even profit from), that tends to tip the scales in your favor.

This could mean that you’re a debt investor with significant operational capabilities, so that if you have to foreclose on a property, you’re confident you can turn that property around and sell it at a profit.

This could also mean buying a commercial property with upcoming lease expirations knowing those leases are well below current market rates, meaning that even if those tenants don’t plan to renew at current fair market rents, that gives you the opportunity to go out and find new tenants at a significantly higher rents.

This could even mean buying a multifamily property with a tenant base using government-sponsored housing vouchers, giving you rent collection assurance even if unemployment figures spike and a large portion of your property loses their job unexpectedly.

When making decisions on whether to move ahead with a deal or not, think about your downside scenario and whether or not that’s capped, or if you can see your downside as potentially being an upside scenario after some re-leasing or turnaround efforts are made.

Skate Where The Puck Is Going, Not Where It Is

Finally, to add one more cheesy quote to the list, the fifth part of this framework to make better real estate investment decisions is to skate where the puck is going, not where it is.

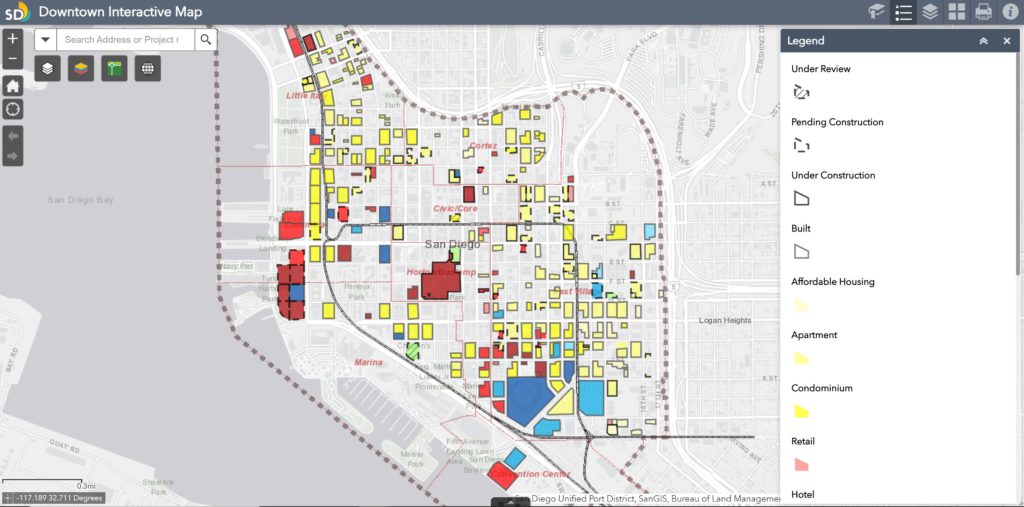

The vast majority of investment memos I’ve put together throughout my career have included an entire dedicated section on how the market or submarket is changing, and the new developments that are planned or under construction in the area that will benefit (or hurt) the deal we’re looking to build or acquire.

Knowing that a major company is going to lease space right across the street from an office property you’re analyzing, or that hundreds of multifamily units are being built on the same block as the retail deal you’re taking a look at, or that hundreds of multifamily units are being built next to an existing apartment project you’re looking to acquire can all help you spot opportunities that will pay off in the future, or help you avoid significant risks that could hurt your property value going forward.

This also means understanding where future transit lines are going, knowing the major tenants with interest in a specific building or submarket, and even any major political or regulatory changes that may have a direct impact on real estate in the market.

The most successful real estate investors evaluate a submarket based on what it is today, but also what it will be five to ten years in the future, which can help you frame your own decision making process when looking at new deals.

The Bottom Line

If I’ve learned anything during my time in the industry, it’s that making decisions that leverage your strengths, have a favorable risk/reward ratio, have some mechanism of downside protection, and factor in future development and redevelopment projects tend to give investors the greatest chance of maximizing their upside and minimizing their losses in the real estate game.

And if you want to learn more about the real estate investment analysis process, make sure to check out Break Into CRE Academy, which will give you instant access to a library of pre-built acquisition and development models to practice analyzing live deals, our entire library of courses on commercial real estate investment analysis and valuation, and training on how to build your own acquisition and development models from scratch in Excel.

I hope you find this helpful in your own real estate investment journey. Good luck!