Masters in Real Estate or MBA – Right For You Right Now?

With the commercial real estate industry becoming more and more institutionalized every year, I’m starting to see more and more people considering a Master’s in Real Estate or an MBA to kickstart their efforts to break into the business.

Although this is a highly personalized choice, this is also a major decision, and I wanted to share my thoughts on when grad school makes sense for someone breaking into the commercial real estate industry, and when it doesn’t.

If a Master’s in Real Estate or an MBA is something you’re considering, and you’re going through the application process or deciding whether or not to take an acceptance offer to head back to the classroom, this article is for you.

If video is more your thing, you can watch the video version of this article here.

When a Master’s in Real Estate or MBA Makes Sense

Choosing whether or not to take the plunge into grad school is a huge decision on many different fronts, and there are a lot of differing opinions out there on whether or not it makes sense to go back to school to further your career.

And while I know this is an extremely personal choice with a bunch of moving parts, in my experience, people in at least one of any of the four situations below are the people I’ve seen a Master’s in Real Estate or MBA be the most “worth it” for, from both a time and money perspective.

Here’s the list.

You’re Transitioning Into Real Estate For The First Time and Looking To Relocate

A Master’s in Real Estate or MBA tends to be extremely helpful if you’re trying to land your first job in the commercial real estate industry, and also looking to make a major geographical move from where you currently live and work.

For people looking to find their entry point into a commercial real estate investment or brokerage firm and also looking to change cities, this can often present a pretty big challenge when trying to do both things at once.

For example, if you’re working in tech in San Francisco right now and want to land an analyst role at a private equity real estate shop in New York, finding a company that’s going to take on the risk of an out-of-state hire, combined with someone completely new to the real estate space, tends to be a pretty uphill battle.

Coming from out of the area, it’s much more difficult to network with local professionals in the real estate space as well, and employers just generally prefer in-area hires over people who may come with the additional cost or uncertainty around moving to a new city.

In these types of scenarios, finding a college or university that’s local to the city you want to end up in, establishing your network in that city during your time at the school, and potentially building experience with local well-known firms through internships or part-time roles, can be all huge in making a successful transition across the country (or the world).

You’re Making a Significant, Late-Stage Career Transition Into Commercial Real Estate

Aside from trying to make a major move between industries and geographic locations at the same time, the second scenario where grad school tends to really help out is when making a significant, later-stage career transition into commercial real estate from another industry.

People with adjacent industry experience in high finance or general private equity can usually go without this, but once you start to have 8-10 years of experience or more in a significantly different industry than real estate or finance, it can become a lot harder to make a career pivot without some additional help from an established institution.

Fortunately, going back to school to make a career change is a very common practice in general MBA programs, and many people will go to business school to switch industries after deciding they don’t want to spend their long-term career doing what they were doing in their 20s.

One of the main benefits of going this route is the ability to land internships and gain on-the-job experience in a commercial real estate role.

Internships allow you to get your foot in the door (in a very low-risk way for employers), making your next internship or full-time role much easier to land with the brand name experience under your belt.

Also, once candidates start to get about 8-10 years out of school, employer beliefs about employee salary expectations may also be misaligned, with many hiring managers automatically assuming that outside applicants with managerial titles in different industries are looking for a big paycheck in an entry-level role (even if that isn’t the case).

By going the graduate school route, this can clearly show that you’ve accepted taking a slight step back to learn a new industry, and also might help you land a higher paying entry-level role in the CRE industry because of the MBA or Master’s in Real Estate on your resume.

A Master’s in Real Estate or MBA Won’t Set You Back Financially

If you’re in the city you want to be in long-term and you’re only a few years into a non-real estate career, when does a Master’s in Real Estate or MBA make sense?

If this is the case for you, a Master’s in Real Estate or MBA can be helpful in landing your next role and increasing your overall compensation, but I would only recommend this if going to graduate school won’t set you back financially.

Examples of this could be scenarios in which:

- You have all or part of your tuition funded by your current employer

- You’re going to school in the evenings and continuing to work a full-time job

- You have a significant fellowship or scholarship which covers all (or a large majority of) tuition costs for a full-time Master’s in Real Estate or MBA program

With that said, if you’re considering full-time programs (even with a scholarship or fellowship that helps you foot the bill), the opportunity cost of lost wages and experience you’d get on the job often make this path a really tough sell.

Unless you’re looking at a top ten two-year MBA program or top five one-year Master’s in Real Estate program that can expose you to a significant network of accomplished industry professionals that can help you later on in your career, this often doesn’t make sense from a purely financial perspective.

Additionally, once you get in the real estate industry and establish yourself with a few years of experience under your belt, you’re going to want to have that capital available to start investing in deals that will inevitably be presented to you, and you may even need this as start-up capital for going out on your own and starting your own firm.

You’re Not Getting a Master’s in Real Estate or MBA To Build Technical Skill Sets

If you’ve gotten through all the points above and still think a Master’s in Real Estate or MBA might be for you, the last thing I’d recommend is to make sure you’re not going to grad school for the specific purpose of building the technical skills you’ll need to be a competent analyst or associate at a real estate private equity, brokerage, or lending firm.

Most graduate programs, especially general MBA programs, do a really poor job at providing actual, hands-on training.

And unfortunately, it’s highly likely that you’ll be taking many of your courses from professors who have never actually worked in the commercial real estate industry.

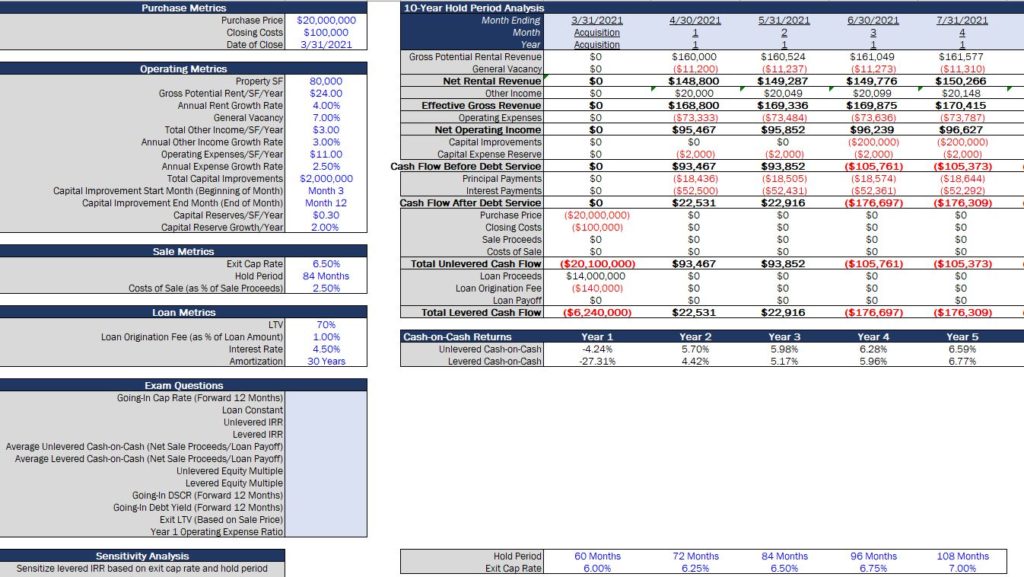

Theory and textbook explanations are definitely helpful and necessary to know, but at the end of the day, what’s going to get you into top commercial real estate firm at the analyst or associate level is going to be your hard skill set in Excel and/or ARGUS, and your understanding of real estate financial modeling and analysis.

Going back to school to learn these skills is an extremely expensive and inefficient way to do this, and you likely won’t come out of a graduate degree program with the technical knowledge you’ll need to pass a real estate financial modeling Excel interview exam or be productive on the job in an analyst or associate position.

Master’s in Real Estate and MBA programs do an excellent job of helping you build a network in your target city, and can help you get your foot in the door for internship and full-time job opportunities with commercial real estate firms. However, if learning the hard skill sets is your main goal, taking specific, targeted coursework like the modeling courses inside Break Into CRE Academy is going to be a much more direct, cost-efficient, and time-efficient option for doing that.

Is a Master’s in Real Estate or MBA Right For You?

To break down the list again, if you’re making a major location change and transitioning out of another industry, you’re more than 8-10 years out of undergrad and also looking to make a career transition, you’re able to go to school part-time or have a significant scholarship or fellowship to offset tuition costs, and you’re going to graduate school to build a network and internship experience (rather than to build a technical skill set), grad school could be a great fit for you, and could help reduce some friction that you might currently be running into when applying for commercial real estate roles.

However, if you’re still relatively early on in your career, you’re not looking to make a major location change, and graduate school will set you back multiple six-figures through tuition and opportunity costs, you’re likely better off bypassing the traditional graduate school route and focusing directly on building your technical skill sets, networking, and tightening up your resume to show hiring managers that real estate is a clear “next step” for you in your career.

And if you’re looking for more help with building the skill sets you’ll need to break into commercial real estate for the first time (or land a new job within the industry), make sure to check out our premium training platform, Break Into CRE Academy.

A membership to the Academy includes private, members-only, email-based career coaching, so you can ask questions and get feedback on your own unique situation, and you’ll also get instant access to our complete library of video courses on real estate financial modeling and analysis, so you can build the technical skill sets you’ll need to ace Excel modeling interviews and land jobs at top real estate private equity, brokerage, and lending firms.

I hope this was helpful if you’re deciding whether or not graduate school is right for you – good luck with the decision!