Private Equity Real Estate Mental Math Questions (& Answers)

As real estate continues to become more and more institutionalized, the expectations of incoming analysts at private equity real estate firms have risen higher and higher over the last few years.

At this point, a solid understanding of real estate finance is absolutely critical to landing a position in the commercial real estate industry.

And while most private equity real estate firms will administer some sort of Excel exam during the interview process where you’ll have to sit down and build a model in Excel based on a sample case study and assumptions, some firms will also want to test how you can apply your knowledge of CRE finance on the fly, and how you think on your feet in conversation.

These questions generally test your knowledge of the main key real estate finance calculations, but the way these questions are asked can sometimes get pretty tricky.

So, to help with this if you find yourself asked a tough question on the fly (without access to Excel), in this article, we’ll walk through three of the most common topics covered in private equity real estate interviews (outside of a timed Excel exam), sample questions you might be asked on each of these topics, and the (answers and logic) behind each.

If video is more your thing, you can watch the video version of this article here.

IRR-Related Interview Questions

The first topic that’s often tested in private equity real estate interviews is your understanding of the internal rate of return, or IRR.

At a private equity real estate shop, this is going to be one of the most important metrics you use on a day-today-day basis (if not the most important), so a solid understanding of both what the IRR is and also how it works in practice is critical for any real estate analyst stepping into new a role.

In simple terms, you can think of the IRR as the annualized, time-weighted return on equity invested.

And the time-weighted portion of this definition is important, because the IRR takes into account the time value of money, meaning that $100 received today is worth more than that same $100 received 5 years from now for the purposes of this calculation.

With that, most questions around this concept will test your understanding of how that time value of money plays into this calculation, and how the timing of your cash flows is going to affect returns.

Sample IRR Timing-Based Question

A common question you might receive around the IRR might look something like this:

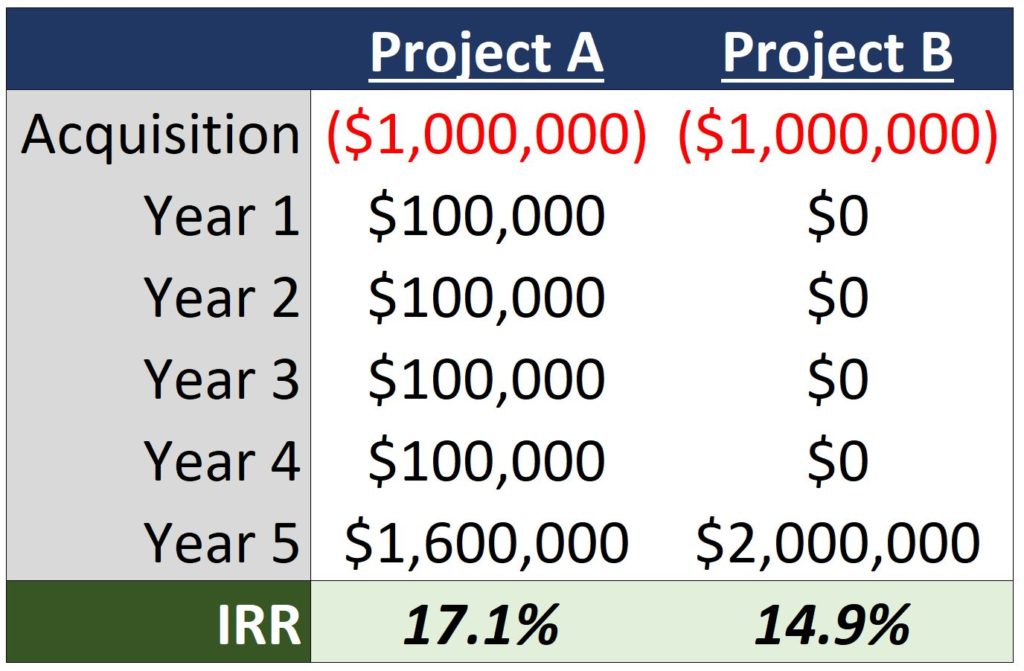

“You invest $1,000,000 in two different projects. Project A produces $100,000 in operating cash flow every year for 5 years, and you sell the property at the end of year 5 for $1,500,000. Project B, on the other hand, produces $0 in operating cash flow every year for 5 years, but you sell at the end of year 5 for $2,000,000. At the end of 5 years, which project has the higher IRR?”

The answer to this question lies in exactly what we just talked about with the timing of the cash flows, which results in Project A winning out in this scenario, even with the sale value being 33% higher in Project B.

For each project in this example, the total profit on the deal is $1,000,000.

However, with all else being equal, the IRR of a project is going to be higher when cash flows are received earlier in the hold period. And this makes Project A the clear winner, with distributions starting a full 5 years before any cash flow is received in Project B.

The takeaway here is that, if you’re asked to compare the IRR between two projects with identical or very similar total profit numbers, the project where cash flows are received earlier in the hold period is likely going to be the project with the highest IRR.

A Positive IRR Requires a Return of Capital

Another common IRR-based question to prepare for is similar to the first, but this question actually tests your understanding of the return of capital concept, and how that concept applies to the IRR calculation.

And to test your understanding of this, another question that might be thrown your way on the IRR is the following:

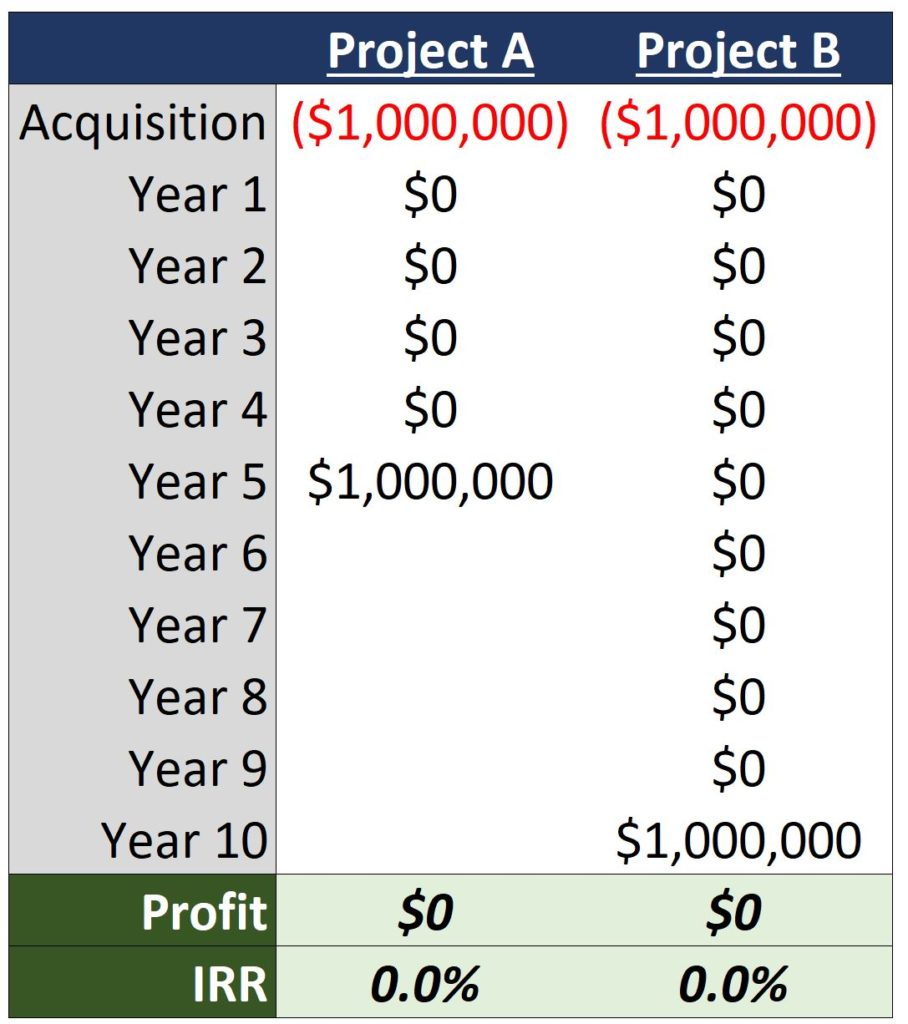

“You make two real estate investments – Project A, where you purchase the property for $1,000,000 today and sell the property for $1,000,000 5 years from now, and Project B, where you purchase the property for $1,000,000 today and sell the property for $1,000,000 10 years from now. Which deal has the higher IRR?”

This is actually somewhat of a trick question, and the answer here is neither, because investments in both Project A and Project B just represent a return of capital, not a return on capital, resulting in a 0% IRR in both cases.

To explain this in a little bit more detail, let’s head back to the definition used earlier on in this article, that the IRR represents the time-weighted, annualized return on equity invested.

And this means that in order for the IRR to be a positive value, the investment needs to provide some sort of profit on the deal.

In both scenarios here, where $1,000,000 is invested up-front and $1,000,000 is received several years in the future, the total profit is $0. And this means that there is no profit in either scenario, and the IRR is going to be 0% regardless of the timing of that $1,000,000 distribution.

The bottom line on the IRR concept is to look for a return of capital first, and once that occurs and there is actual profit on the deal, then move into considering the timing of the cash flows.

Cap Rate-Related Interview Questions

One of the most fundamental calculations in all of commercial real estate is next on this list, and that is the capitalization rate, or cap rate.

The cap rate is a much simpler calculation than the IRR, and just measures the net operating income (NOI) on the deal divided by the value of the property.

For example, if the annual NOI on a property is $50,000 and we buy that property for $1,000,000, we can divide that $50,000 NOI value by our $1,000,000 purchase price to calculate our cap rate at 5.0%.

However, for interview purposes, companies are going to want to know not only that you know the formula here, but also that you can apply that formula, and spot cause and effect relationships between changes in cap rates and valuations of commercial real estate deals.

Sample Cap Rate Valuation-Based Question

As far as questions that might be thrown your way on this topic, you might be asked in an interview something along the lines of the following:

“If cap rates rise from 5.0% to 6.0% in a market, by what percentage will the NOI of a property in that market have to increase for property values to stay the same?”

It might seem like you need to bust out Excel or a financial calculator to solve a problem like this, but the solution here is actually pretty simple. For values to stay the same, the percentage changes in both cap rates and NOI values also need to be the same for both metrics, in either direction.

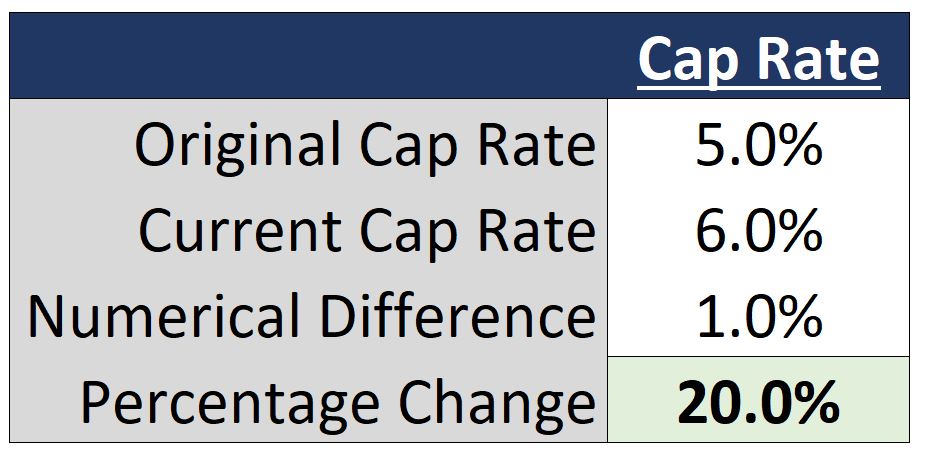

To use this case as an example, if cap rates rise from 5.0% to 6.0%, it might seem like cap rates have only risen by 1.0%.

However, when we look at that 1.0% change as a percentage of the original 5.0% cap rate value, cap rates have actually risen by 20.0%, not 1.0%.

This means that the NOI of properties in that market would also have to increase by exactly 20%, just to keep values where they were at the 5.0% cap rate figure.

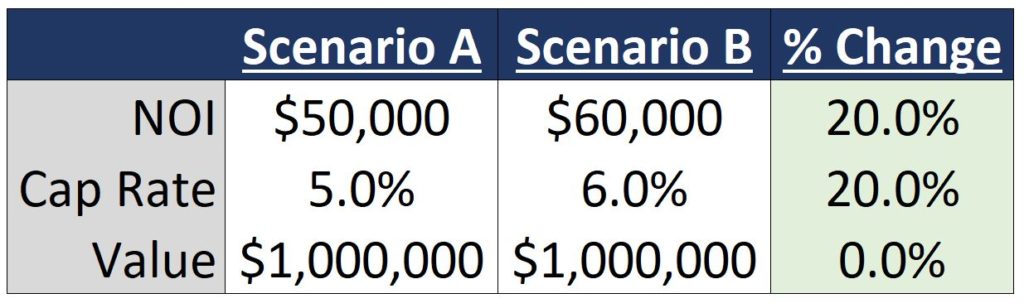

To put this concept into practice using concrete numbers, we can use that same sample property mentioned above with $50,000 in annual NOI. If cap rates in the market are 5.0%, we know that our value is $1,000,000 in this scenario, since $50,000 / 5.0%, = $1,000,000.

However, if cap rates all of a sudden rise to 6.0% in the market, that $50,000 NOI would now only result in an $833,333 valuation. And to get that value back up to $1,000,000, the NOI on the deal would need to jump by 20%, or up from $50,000 to $60,000, since $60,000 / 6% = $1,000,000.

The question here is really looking to make sure that you know that NOI values and cap rates need to move in proportion to one another for values to stay constant, and if you can think of these changes as percentage increases or decreases within each variable, this will make the mental math of solving these types of problems significantly easier.

Equity Multiple-Related Interview Questions

Outside of the IRR and the cap rate calculations, another commonly tested subject in private equity real estate interviews is the equity multiple, which represents how many times over an investor earns their equity investment back over the entire life of the deal.

Unlike the IRR, the equity multiple does not factor in the time value of money. And this means that, for the purposes of this calculation, all cash flows are treated equally, regardless of the time at which they occur.

To calculate this metric, we need to take the sum of all positive cash flows generated by the property throughout the entire hold period, and then we need to divide this by the sum of all equity investments in the property throughout the entire hold period, as well.

For example, if you invest $1,000,000 in a property and earn $2,000,000 in total distributions over a 5-year hold period, that equity multiple would be 2.0x, since you’ve doubled your equity investment in the property over that 5-year timeframe.

Sample Equity Multiple Hold Duration-Related Question

To test your understanding of this metric, a question you might be asked could sound something along the lines of the following:

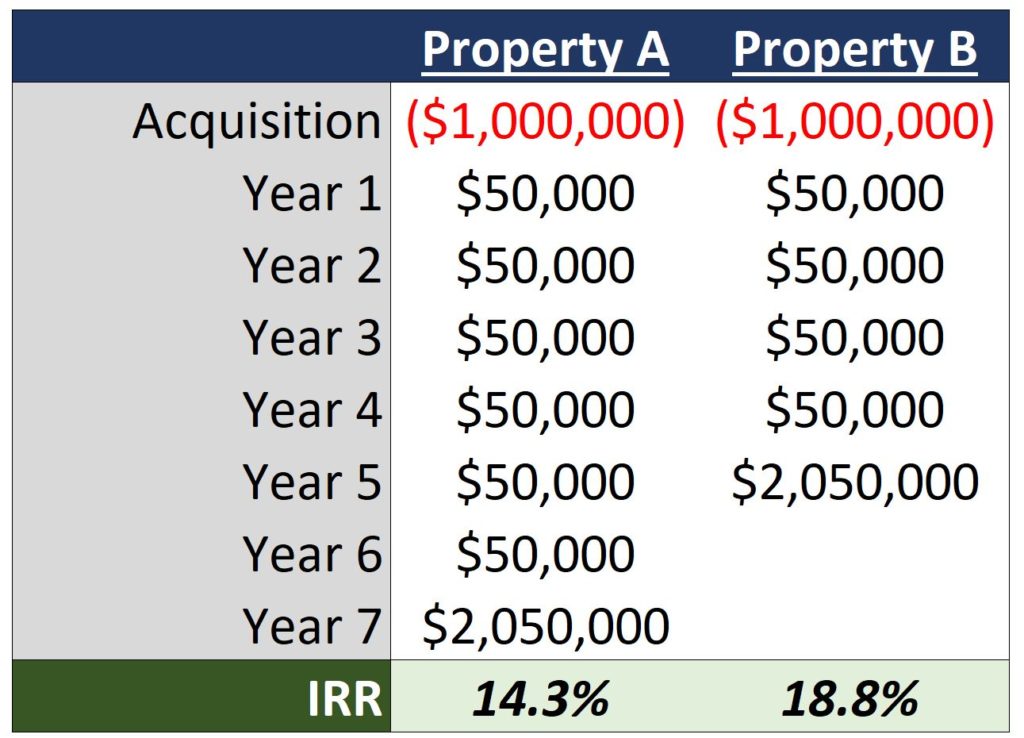

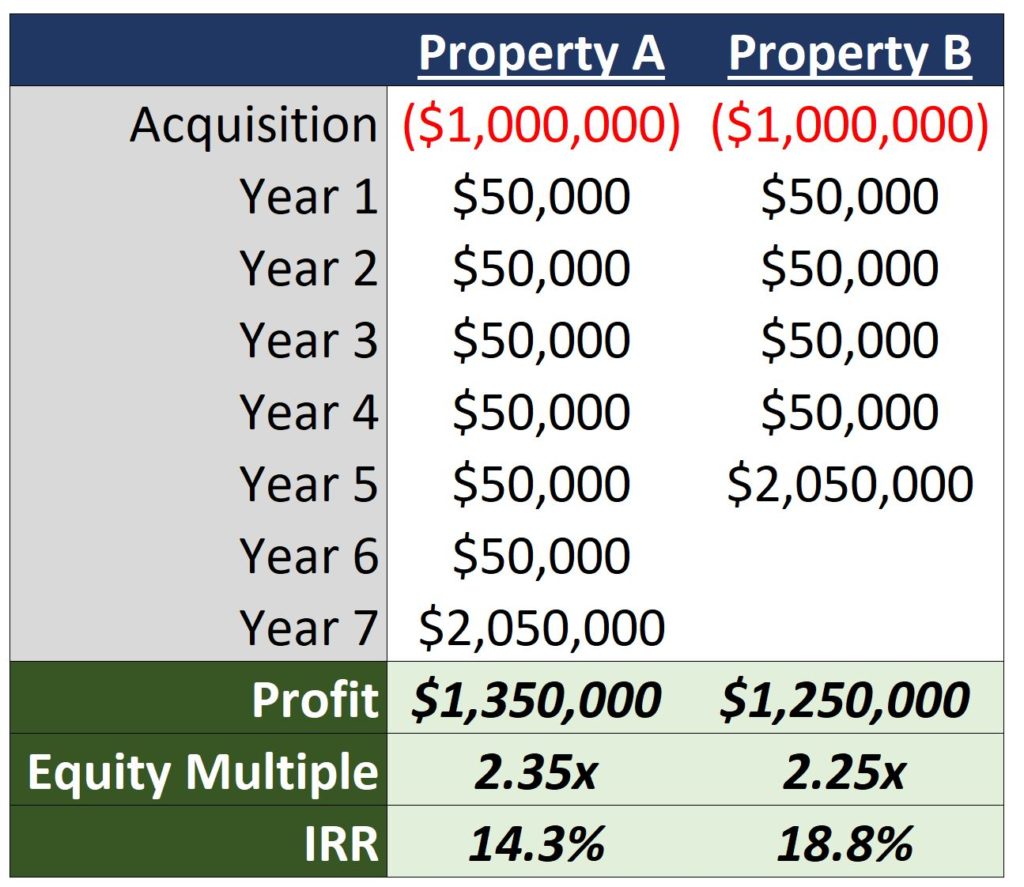

“You purchase two properties for $1,000,000 each today, you receive $50,000 in annual cash flow for each year you hold each deal, and you sell each property for $2,000,000. You hold Property A for 7 years and hold Property B for 5 years. Which deal has the higher equity multiple?”

With all else being equal, since the equity multiple is measuring the sum of all positive cash flows throughout the entire life of the deal, the answer here is Property A. And this is true even with the sale proceeds in this scenario not being received until a full 2 years after the scenario in Property B.

For the purposes of the IRR calculation, timing matters, and Property B would generate an 18.8% IRR, while Property A would generate just a 14.3% IRR (simply due to the timing of the sale).

However, the equity multiple is going to be highest for the deal that generates the most total cash flow in proportion to equity invested. And since Property A will have two more years of generating $50,000 in cash flow than Property B, Property A ends up winning out on this metric with an extra $100,000 in profit, at 2.35x, versus the 2.25x equity multiple for Property B.

The bottom line here is that the equity multiple will be highest for the deal that generates the most profit in relation to equity invested, regardless of when those cash flows are received.

How To Prepare For Interview Day

Most private equity real estate interviews will leave the majority of the technical questions for the Excel exam directly, but in case you end up in a scenario where you have to think on your feet during the interview itself, these are three concepts that are commonly tested outside of a timed Excel exam, and some sample questions and answers that might be thrown your way on each topic.

And if you’re going through the application or interview process right now and want to make sure you’re ready for interview day or an Excel modeling exam at a top private equity real estate firm, make sure to check out Break Into CRE Academy.

An Academy membership will give you instant access to practice interview exams and case studies, in-depth modeling training on in-demand skills like pro forma modeling, development modeling, and equity waterfall modeling in Excel, and additional one-on-one email-based career coaching to help you navigate the job search process based on your own unique situation and goals.

Thanks so much for reading – good luck on the big day!