Real Estate Equity Partnerships: A Beginner’s Guide

If you’ve ever wondered how commercial real estate investors or investment firms buy buildings that are worth $10 million, $50 million, $100 million or more, the secret is that these investors almost never buy these properties completely by themselves.

The commercial real estate industry is powered by equity partnerships that bring investor capital together to buy individual properties (or portfolios of properties) that often come in at an 8-figure or 9-figure price point, but exactly how these partnerships tend to work can get pretty complex.

So to help simplify this process, this article walks through the mechanics of real estate equity partnership structures, how these tend to function in practice, and the different aspects of these agreements that can have the biggest impacts on a real estate deal.

If video is more your thing, you can watch the video version of this article here:

The General Partner & The Limited Partner

The first thing to note about real estate equity partnerships is that these generally have two main components – a general partner (GP) and a limited partner (LP).

There can be multiple GPs or LPs within a partnership, but regardless of how many parties are on each side, the GP and the LP are each going to be responsible for very different things related to a deal.

The Limited Partner (LP)

On the LP side, a limited partner essentially acts as a silent money partner that generally brings the majority of the equity required to close. And usually, the LP on a transaction will not be an experienced real estate investor or won’t have the time or resources to manage deals on their own, so in exchange for bringing that capital to the table, the LP is usually looking for a hands-off investment.

This is why LPs are generally considered passive investors, since they won’t be the ones responsible for acquiring, managing, or selling a deal, and in the vast majority of cases, they also won’t have a say in how these things are done.

There will often be multiple limited partners on a transaction (especially on deals that are priced in the ~$2-15 million dollar range), with the most common investors in these types of deals being high-income earners and high net worth individuals that want exposure to real estate, but don’t want to buy and manage properties directly.

Alternatively, sometimes there will only be one limited partner on a deal. In these cases, this is usually a major private equity firm, pension fund, family office, or even a single wealthy individual that’s looking to deploy a significant amount of capital all at one time, and usually wants to have more of a say over the terms of the agreement.

The General Partner (GP)

If the limited partner or limited partners are not responsible for acquiring or managing a deal, this means that another party needs to step up and control this process, and this is where the general partner comes into play.

You might hear the GP being referred to as the “sponsor” on a deal, but either of these terms just refers to the individual or company that coordinates all aspects of a transaction. These things include finding a property to buy, raising both debt and equity capital, managing due diligence and closing, managing property operations once the acquisition is complete, and ultimately selling the property on behalf of the partnership.

And in exchange for the work they put in, the GP will usually charge fees associated with these activities, usually in the form of:

- Acquisition Fees (as a percentage of the purchase price)

- Asset Management Fees (as a percentage of operating revenue)

- Construction Management Fees (as a percentage of construction costs)

- Disposition Fees (as a percentage of sale proceeds)

This is why you’ll often see investors and investment firms looking to buy the biggest deals possible, since these fee percentages become much larger whole dollar amounts as the size of a deal increases. This makes the companies that are able to raise the most capital and control the highest value real estate the ones that can usually generate the greatest amount of revenue in the shortest period of time.

Promoted Interest & Real Estate Equity Waterfall Structures

Aside from fee income, some of the biggest cash inflows to a sponsor come from what’s referred to as promoted interest, which allows the GP to earn outsized returns based on the performance of each deal or fund they manage.

Promoted interest is generally determined by what’s referred to as an equity waterfall structure, and this determines the performance metrics the GP will need to hit before promoted interest starts to come into play.

An equity waterfall structure allows the general partner to earn a percentage of the cash flows that is greater than the percentage of the equity that they contributed up-front, only if they exceed certain performance targets.

These performance targets are referred to as preferred returns or hurdle rates, and are often based on metrics like the IRR, the equity multiple, or the cash-on cash-return.

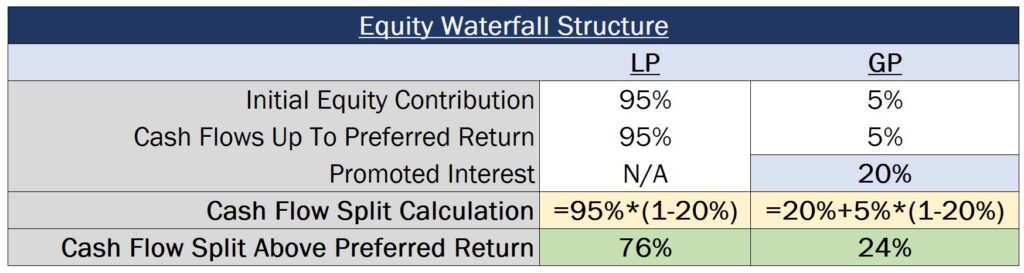

For example, if we had a partnership structure where the GP invested 5% of the equity required to close, the LP invested the remaining 95% of the equity requirement, the preferred return was an 8% IRR, and the promoted interest was 20%, this means that, up to the point when that 8% IRR is hit, cash flows would be split 5% to the GP and 95% to the LP. However, on all dollars above that 8% IRR, the GP would now receive an additional 20% of the cash flows over this amount, on top of their equity interest in the remaining 80% of the cash flows above the preferred return.

In this scenario, this results in the GP taking home 20% of the cash flows above the 8% IRR, plus their original 5% percent of the remaining 80% of the cash flows that aren’t subject to promoted interest, bringing the total GP cash flow percentage over the preferred return to 24% in this case.

This type of structure is often used within real estate partnerships to align incentives between the GP and the LP on a deal, since promoted interest is based on the returns to the LP directly and will only be earned when those returns are hit.

This is also another reason why GPs will often try to do the biggest deals possible (as quickly as possible), since these percentage values become much bigger whole dollar amounts when property values also increase.

Now, every real estate equity partnership structure is going to be a little bit different, and how each partnership will operate is going to come down to the exact legal language within a JV operating agreement, including the rights and responsibilities of each partner, the fees that are going to be generated by the GP, and the waterfall structure that’s going to impact each partner’s cash flows. However, in my experience, this is the general framework of how these partnerships often come together, and what this might look like if you’re putting together a deal yourself or passively investing alongside a GP.

How To Build Real Estate Equity Waterfall Models in Excel

If you want to learn more about real estate equity partnerships and how to build models to calculate these cash flow splits automatically in a variety of different waterfall structures (based on a variety of different hurdle rates), or even incorporate things like catch-up and clawback clauses, make sure to check out our all-in-one membership training platform, Break Into CRE Academy.

A membership to the Academy will give you instant access to over 120 hours of video training on real estate financial modeling and analysis, you’ll get access to hundreds of practice Excel interview exam questions, sample acquisition case studies, and you’ll also get access to the Break Into CRE Analyst Certification Exam. This exam covers topics like real estate pro forma and development modeling, commercial real estate lease modeling, equity waterfall modeling, and many other real estate financial analysis concepts that will help you prove to employers that you have what it takes to tackle the responsibilities of an analyst or associate at a top real estate firm.

As always, thanks so much for reading, and make sure to check out the Break Into CRE YouTube channel for more content that can help you take the next step in your real estate career.