3 Things That Can Break a Real Estate Deal

Real estate investment analysis involves a lot of attention to detail, since what might seem like really little things can have really big impacts on your cash flows and returns.

And after underwriting thousands of acquisition opportunities throughout my own career, I’ve noticed a few things that I definitely did not pay enough attention to when I was just starting out, but are really important to consider (and can materially impact a deal).

So to make sure that you’re accounting for these things, especially if you’re just starting out in the industry, this article covers three things that need to be incorporated within any real estate investment analysis, and the impacts these things could have on your cash flows and returns.

If video is more your thing, you can watch the video version of this article here:

Get Clear on Property Taxes

The first thing that’s extremely important (regardless of the product type you’re analyzing) is to get clear on property taxes, specifically how and when the property will be reassessed.

Within the US, property tax reassessment practices can vary a lot from state-to-state, and the timing and the amount of a reassessment of property value can have a huge impact on your cash flows and returns.

Some states will reassess property values immediately upon sale at 100% of the sale price, which can make the property tax bill significantly different for the buyer than it was for the seller after a property trades hands.

Other states reassess property values on a predetermined schedule, for example, every three years or every five years, and this timing isn’t going to be contingent on the timing of a sale.

States can also have unique standards for how much assessed property values can increase year-over-year, with some states keeping assessed values flat for multiple years between reassessment periods, some providing a cap on the maximum annual percentage increase of assessed values, and some conducting assessments each and every year based on current market data and recent property sales.

This is why, if you own a commercial property in one state, you might see huge annual property tax increases when market values increase, while if you own a commercial property another state, you might see only a 2% or 3% assessed value increase on an annual basis (regardless of how much market values have risen).

Property taxes can also often be one of the biggest (if not the biggest) operating expense line item for a commercial real estate investor, so it’s really important to get this right. This is especially true if you’re underwriting a deal where your tenants won’t be responsible for any sort of expense reimbursements that would include property taxes on a monthly or annual basis.

Even if you’re underwriting a deal where all leases include a NNN reimbursement structure (meaning that the tenants will be responsible for reimbursing their pro rata share of all property operating expenses), assessed values are still extremely important to understand as an investor. This is because your tenants are going to be the ones absorbing these increases, which is usually either going to make them much less likely to renew their lease upon expiration, or much more likely to ask for a rent reduction to keep their occupancy costs manageable.

Some tenants will also have protection clauses within their leases, which can cap their total property tax exposure and shift the responsibility of property tax increases back to the landlord.

Get Clear on Transfer Taxes

In addition to property taxes, there’s another tax-related consideration that investors need to make outside of just their income tax burden, and this is the transfer tax on a transaction, as well as who is responsible for paying this when a property changes hands.

Transfer taxes are imposed by state or local governments when properties are sold, and these are usually calculated based on a percentage of the sale price as a one-time tax.

Similar to property taxes, what these percentages are and market norms around whether the buyer or the seller is responsible for paying these can vary a lot from state to state, county to county, and even city to city. And even though this might seem small, in many cases, this can have a significant impact not only on the equity that needs to be raised up-front when a property is initially acquired, but also at exit when an investor is ready to sell.

Some states don’t have any transfer taxes at all, while others have transfer taxes that usually fall somewhere between about 0.10% and 1.00% of the sale price of a property, and many states and counties also leave it up to the buyer and seller as far as who is responsible for paying this amount.

While transfer taxes are sometimes an afterthought for newer analysts and investors, the impacts of these taxes can be material, and this is definitely something to consider when underwriting deals.

Get Clear on Concessions

This last point I want to mention in this article isn’t related to taxes at all, but rather the rent a property is generating, and this is to get clear on any concessions being offered by a seller.

When a property is being prepped for sale, that property owner will often start offering up-front rent concessions, usually in the form of free rent over a 1-6 month period.

In most cases, this will be in exchange for tenants signing leases at much higher rental rates than they would have otherwise agreed to without these in place, and this is especially relevant for multifamily properties.

Since residential leases are typically very short-term in nature, just a 1-2 month free rent period on newly signed leases can sometimes result in an entire rent roll being altered, with rents that might appear to be 5-15% higher than the actual rents in the market.

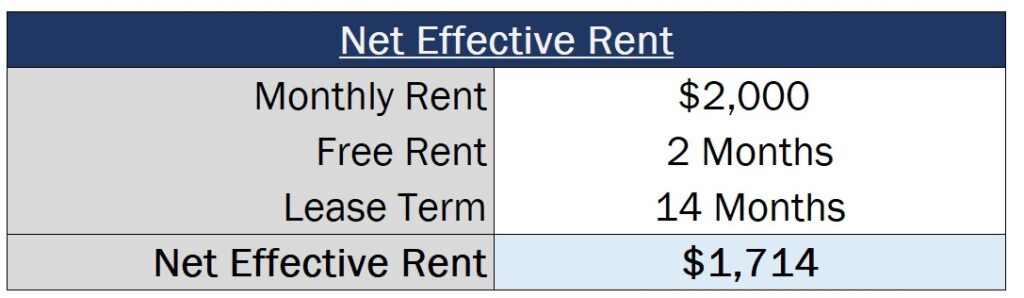

To understand what true market rents are and what these rents might look like if concessions weren’t offered at a property, investors will often calculate the net effective rents on a deal, which factor in both the amount of these concessions and the duration of each lease to calculate a true monthly rental rate over the entire lease term.

For example, this might look like a 14-month lease on a multifamily deal signed at $2,000/month, but the tenant actually received their first 2 months of rent for free during the term. This means that, if we calculate the true average monthly rate over the entire 14-month period, this comes out to just $1,714/month (rather than the $2,000/month that shows up on the rent roll).

In these cases, an investor likely wouldn’t be able to generate these kinds of rents without these concessions in place, so if you’re not factoring these in within your investment analysis, you might be significantly overstating your cash flows (and ultimately, your valuation).

How To Learn More About Real Estate Investment Analysis

When underwriting deals, it’s very easy to focus only on the big ticket items, or just assume that the seller’s operations are going to continue exactly as they’ve been. However, in my experience, this is very rarely the case, and these are three things that you need to be aware of that can have huge effects on a real estate deal.

And if you want to learn more about the real estate investment analysis process, or if you want to build the skills you’ll need to land an analyst or associate role at a top real estate investment or development firm, make sure to check out our all-in-one membership training platform, Break Into CRE Academy.

A membership to the Academy will give you instant access to over 120 hours of video training on real estate financial modeling and analysis, you’ll get access to hundreds of practice Excel interview exam questions, sample acquisition case studies, and you’ll also get access to the Break Into CRE Analyst Certification Exam. This exam covers topics like real estate pro forma and development modeling, commercial real estate lease modeling, equity waterfall modeling, and many other real estate financial analysis concepts that will help you prove to employers that you have what it takes to tackle the responsibilities of an analyst or associate at a top real estate firm.

As always, thanks so much for reading, and make sure to check out the Break Into CRE YouTube channel for more content that can help you take the next step in your real estate career.