A 7-Step Framework For Underwriting Commercial Real Estate

In a real estate context, the term “underwriting” refers to making projections about the performance of a real estate acquisition or development opportunity, and then using that information to assess the risk associated with the investment and value the deal.

And while we have a lot of content on the Break Into CRE YouTube channel that goes into the weeds of some of the individual aspects of real estate underwriting, in this article, I want to take a step back and cover the entire process of analyzing a deal (from start to finish) at a much higher level.

This article breaks down commercial real estate underwriting using a simple, 7-step framework, and the resources you’ll need to lean on at each step of the process.

If video is more your thing, you can watch the video version of this article here:

The Real Estate Pro Forma

First and foremost, as a general prerequisite to the underwriting process, you’re going to need a model that can calculate projected cash flows based on a set of assumptions.

For the purposes of this article, we’re going to be looking at a pro forma we build within one of our Break Into CRE courses, but as long as you have a model that can translate your assumptions into projected cash flows over time, you’re ready to get started analyzing your deal.

Adding Property Information

To start building out your model, step number one is a simple data input exercise, and this involves adding basic descriptive details about the property that you’re analyzing.

This includes adding things to your model like the year the property was built, the address of the property, the total acreage of the site, the leasable square footage that can be rented by tenants, and any other core information that you’re going to want to track.

This part of the process is primarily intended to make sure that you understand the physical characteristics of the property itself, and that you’re not just blindly crunching numbers without any context around the deal.

Adding In-Place Lease Information

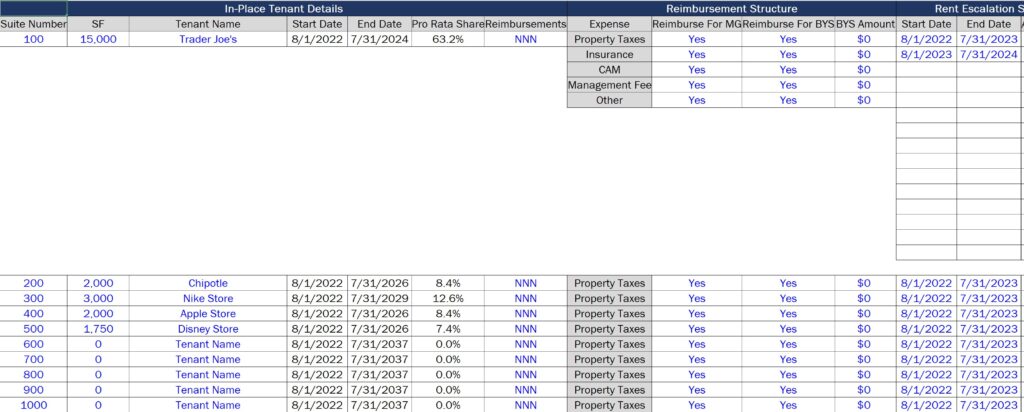

Once you have your property details in the pro forma, the next step in this process is to add leasing information into your model. At this stage, you’ll need to add both the in-place lease information on the deal, and also re-leasing assumptions when those leases expire.

For in-place lease information, this includes adding things like the square footage of each suite, the start date and end date of each lease, the rent escalation schedule for each individual tenant, and any expense reimbursement structures that currently exist on the deal.

All of this information is going to be clearly spelled out within a current rent roll and directly within the leases themselves, so this isn’t necessarily hard to find, but this can be time-consuming to make sure you get this right.

Add Re-Leasing Information

Once you have this information added to your model, you’re ready to move on to step three of this process, which is adding re-leasing assumptions once those in-place leases expire.

One of the most important parts of this step is assigning a renewal probability to each tenant’s lease, or how likely you think it is that each tenant is going to renew at the end of their lease term. Ultimately, this is going to be used to create a weighted average in your model, which is going to drive your cash flows based on two sets of assumptions.

The first set of assumptions will be for a renewal scenario, where the existing tenant signs a lease extension to continue their term past their initial expiration date. The second set of assumptions will be for a new lease scenario, where the in-place tenant vacates and an unknown user backfills the space.

For both scenarios, you’ll need to add assumptions on things like the expected lease term, any sort of free rent period you expect to offer, the current rental rates in the market (and where you believe these will go in the future), and even what expense reimbursements are expected to be on each new lease going forward.

This is also where you’ll add assumptions about capital costs related to re-leasing a commercial suite, including tenant improvement allowances, any assumed TI allowance growth in the market over time, and any commissions you expect to owe to a leasing agent on the deal.

This information can be some of the toughest to pin down throughout the underwriting process and relies heavily on using market data, including sites like CoStar for market rents and projections, leasing broker relationships to get a real-time pulse on the market, and even looking at comparable listings on sites like LoopNet and Crexi to understand rental rates in the area and the concessions being offered.

Adding Expense Assumptions

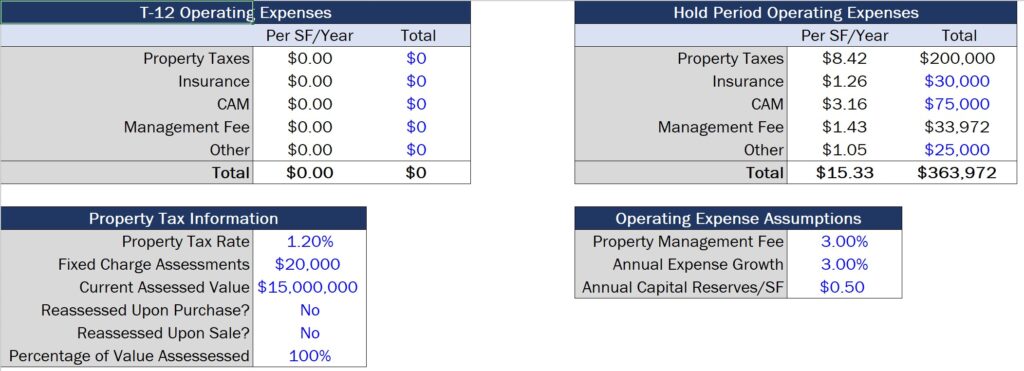

Once your in-place lease and re-leasing information is added to your model, step number four in this process is finishing out your net operating income calculations by adding your expense assumptions that you’re anticipating during your hold.

This process includes adding information on things like projected ongoing repair and maintenance costs, insurance premiums, property taxes, property management fees, and any other ordinary operating expenses you’re planning for as the new owner of the property.

Historical financials offered by the seller can be a great starting point to use for these assumptions, but some operating expense line items are going to require a little bit more research. These things include insurance premiums (which usually require going to a broker or your existing insurance carrier), property management fees (which usually require going directly to a property management company), and property tax assessments (which require direct research with the state, county, or city to know both when and how a property will be reassessed).

Adding Capital Expense Assumptions

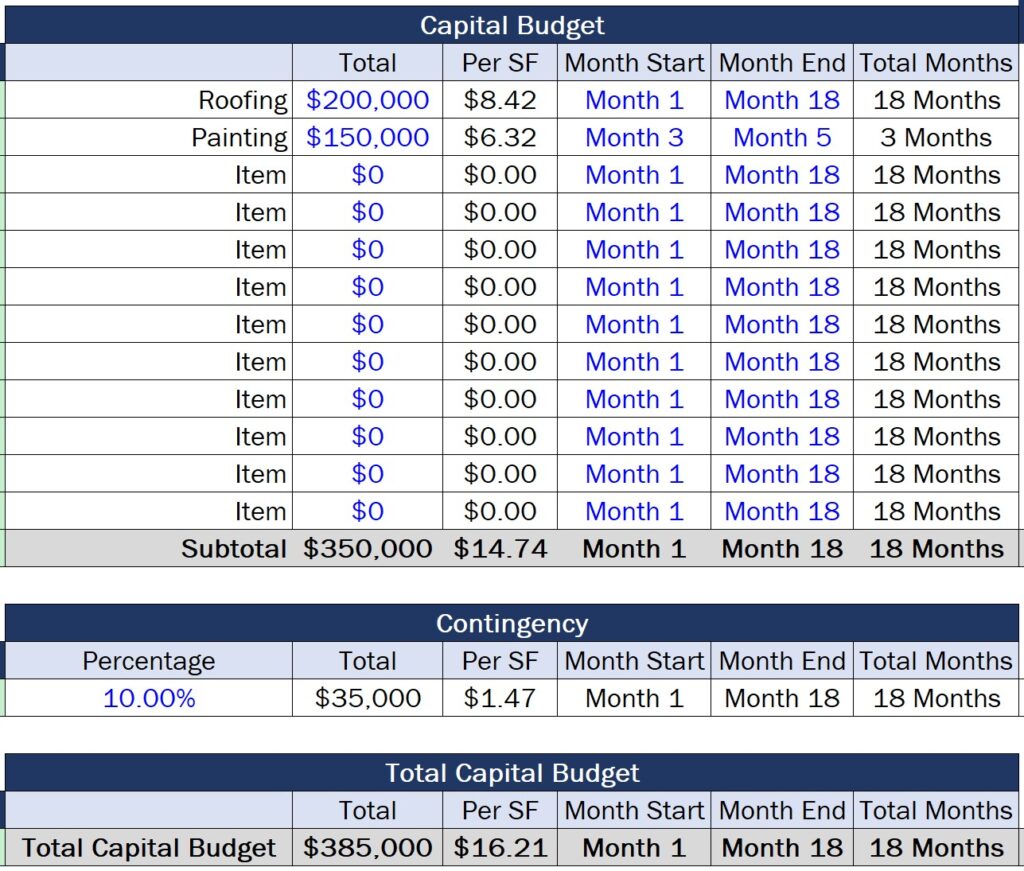

Once you have your operating expenses dialed in, your capital expense assumptions are next, with step number five in this process being to add construction cost assumptions on the deal you’re analyzing.

These are generally going to be relatively simple in an initial property underwriting, but these should include the amounts of each line item, the projected timing of each cost, and usually, a contingency on top of these projections (to protect against scenarios that come in over budget).

In most cases, you’ll also need to rely on a third party to come up with the information to add to your model here, usually in the form of working with a general contractor or another construction professional to get the most accurate figures possible based on your renovation plans.

Adding Debt Assumptions

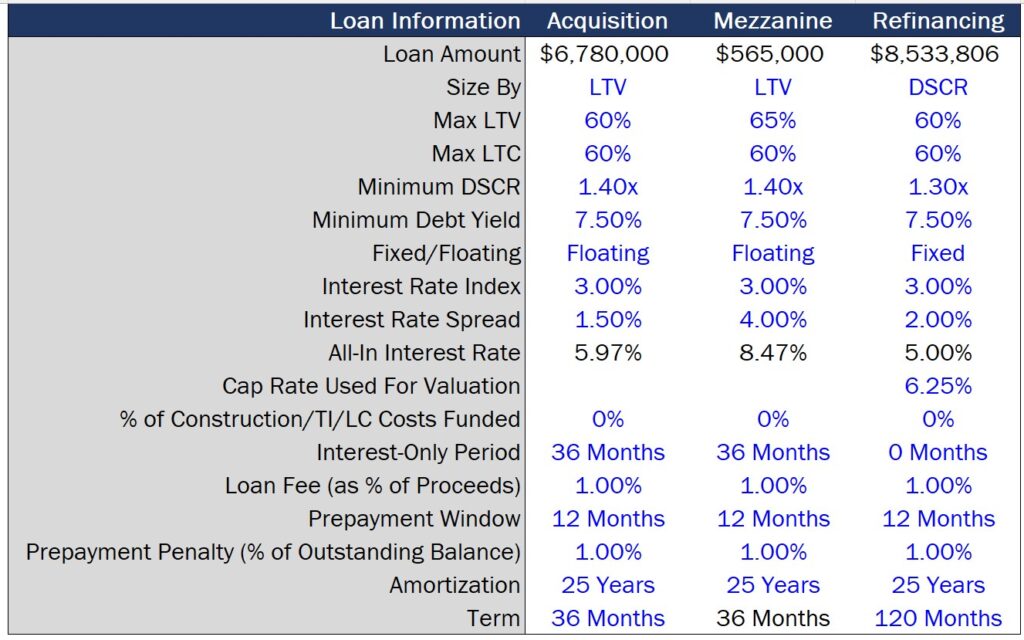

Once you’ve added your construction numbers into the pro forma, we’re starting to get into the home stretch of your underwriting, and step number six in this process is to add debt assumptions into your model.

This is where you’ll need to add things like your total assumed loan proceeds, any fees associated with the loan, the amortization period, the interest rate that’s going to be used to calculate monthly payments, and any interest-only period before amortization begins.

Again, in most cases, you’ll need to consult with a third party to get the most accurate information to add to your model, but most mortgage brokers and lenders can give you a rough idea of these figures before actually putting together a concrete term sheet.

Adding Sale Assumptions

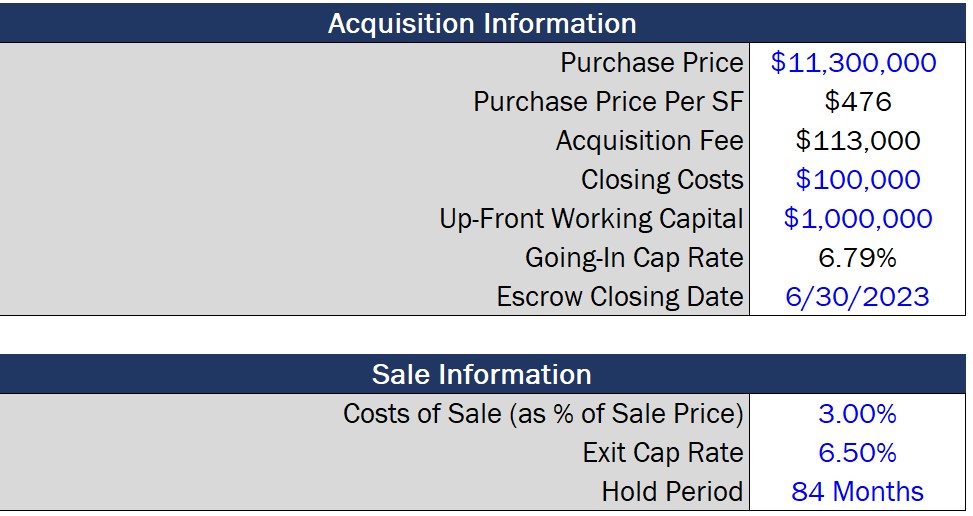

Once you have all of this information within your pro forma, step number seven to put everything together is adding your sale assumptions to your model to finalize your cash flows.

This part of the process involves adding a projected sale date, any assumed costs of sale related to brokerage commissions, transfer taxes, or any other closing fees, and also selecting an assumed exit cap rate in your model that you believe the next buyer of the property is going to assign to the deal.

This is one of the most difficult parts of commercial real estate underwriting, since an exit cap rate assumption can have such big impacts on your projected sale price and ultimately your overall returns.

This video goes into more detail on this process, but ultimately, to finish up your model, you need to have conviction around a sale price and the costs that are going to be associated with that sale.

Valuing The Property

Finally, once you have your sale assumptions in place, you now have everything that you need to calculate project-level cash flows and come up with a valuation or an offer price on the deal.

Most commercial real estate investors use a target IRR, equity multiple, cash-on-cash, or a mixture of all three of these things to come up with a valuation of a property, and these targets are going to be based on the unique goals and objectives of each individual investor and also the risk profile of the deal itself.

If all assumptions have been added correctly up to this point, this is just a simple process of adjusting the purchase price in your model to find an amount that, based on your assumptions, would generate the returns that you’re looking for. And once you find that number, your underwriting is complete.

The Big Picture

When I was first starting out in the industry, I really just wanted to understand the overall picture before digging into the weeds, and I hope this is helpful to get a sense of what you might be doing when underwriting commercial properties, and what you might be responsible for in a commercial real estate analyst role.

And if you do want to dig into the details and learn more about the real estate underwriting process, or you want access to pre-built pro forma templates like the one you saw throughout this post, make sure to check out our all-in-one membership training platform, Break Into CRE Academy.

A membership to the Academy will give you instant access to over 120 hours of video training on real estate financial modeling and analysis, you’ll get access to hundreds of practice Excel interview exam questions, sample acquisition case studies, and you’ll also get access to the Break Into CRE Analyst Certification Exam. This exam covers topics like real estate pro forma and development modeling, commercial real estate lease modeling, equity waterfall modeling, and many other real estate financial analysis concepts that will help you prove to employers that you have what it takes to tackle the responsibilities of an analyst or associate at a top real estate firm.

As always, thanks so much for reading, and make sure to check out the Break Into CRE YouTube channel for more content that can help you take the next step in your real estate career.