Real Estate Market Timing – Is It Possible (and Should You Try)?

Ever since around 2014, I had been hearing that a real estate crash was right around the corner.

Baseball is often used in the industry to describe real estate cycles, and six years ago, everyone seemed to believe we were in the 7th or 8th inning of a 9 inning ballgame.

Fast forward to 2015, and I heard the same thing.

Fast forward to 2016, 2017, 2018, and 2019, and we were still in that same home stretch of the real estate cycle according most “experts” on panels at investment conferences and authoring major investment research.

Well, in 2020, the guys calling the crash in 2019 were finally right.

But the problem was that most of those people were also calling it for the 5 years before 2019, and they were wrong every time.

And being wrong in this case is a really bad thing, because believing that a crash is coming generally means waiting on the sidelines and missing investment opportunities, essentially hoarding cash for the next opportunity that always seems to be “right around the corner”.

If you want to make sure you’re not buying at the peak, but also want to make sure you’re not missing the wave of growth if a downturn doesn’t occur when you predicted, how do you do this, and is trying to time the market in real estate even something you should be considering? That’s what we’ll cover in this article (you can watch the video version here):

If have friends in the real estate industry or looking to make their first real estate investment, you probably have at least one friend that’s been waiting for the market to crash, and isn’t going to buy anything now because deals are “too overpriced in his market”.

For people like this, the motto is always “next year”, patiently waiting on the sidelines for some major event to occur that triggers opportunity.

Well, in 2020, that event actually happened.

And many of these people will fall by the wayside just because they’re not willing to “walk the walk” when it actually comes down to it, but even for those who do take a swing at trying to jump in to seize the opportunity that is now finally present in many major product types and markets, most of these people will still end up on the losing end of things.

And in my experience, there are three big reasons why this is likely going to be the case, and why trying to time the market is generally a loser’s game that does more harm than good for a real estate investor.

If You’re Wrong On Cycle Timing, You’re Missing Out [Big-Time]

The first, and one of the most important reasons is that if you’re wrong about a crash and you sit out an up cycle, you’re missing prime investing years (in a number of different ways).

The first (and most obvious) is that compounding is strongest when you’re young, meaning that every dollar you invest earlier on in your career is worth much more to your future self than dollars you invest in the future.

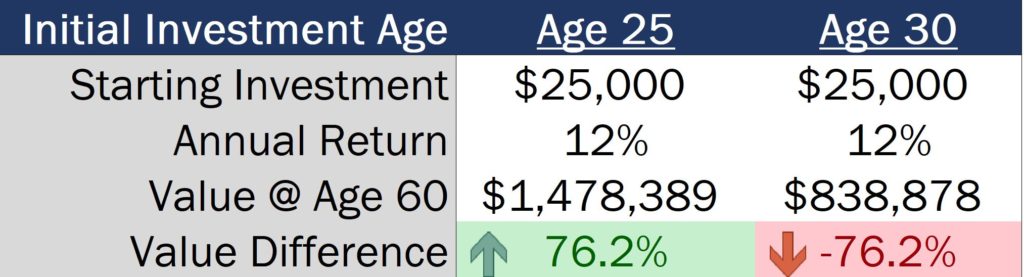

A simple example is investing $25,000 in your first deal at 25 years old vs. investing that $25,000 in your first deal at 30.

So to run the math on this, if we assume a 12% annual rate of return, which is very reasonable on a real estate deal with moderate levels of leverage, the difference is massive once you start looking at long-term results between the two scenarios.

If you start at 30, that $25,000 investment grew to $838,878 by the time you’re 60 years old, which is definitely a respectable number.

But if you make that same $25,000 investment just 5 years earlier, that same $25,000 investment grows to over $1,478,389, which is a whopping 76% higher than the scenario where you made your first investment in real estate at 30 years old.

And from a less quantitative psychological and life perspective, you also have the greatest ability to take chances on investments or even real estate career opportunities when you’re young.

One of the quickest rises I’ve ever seen by a real estate investment firm was a group of two guys in their late 20s that started buying properties and building their portfolio in 2016, when everyone was calling this the “end of the cycle”.

Well, it turns out that the end of the cycle was not in 2016, and since then, they’ve acquired over 3,000 units, successfully sold or recapitalized many of their deals, and have built an entire team in the process.

If they had waited until the bottom fell out of the multifamily market, they would still be waiting today, and their overall “life” overhead and responsibilities would probably be significantly higher in their early to mid-30s.

And with that, there’s also no guarantee they would have been able to take the leap whenever that opportunity would occur.

In Most Years, Commercial Real Estate Prices Go Up

Aside from the time value of money-related reasons for not trying to time the market, there are also other quantitative reasons at play. And one of the most straightforward reasons why waiting it out and trying to time the market doesn’t generally work in an investor’s favor is because in most years, commercial property prices actually go up.

Green Street is a very well-known real estate investment research firm that has been tracking commercial property prices since 1997, creating what they call the Green Street Commercial Property Price Index, or CPPI.

According to CPPI data, commercial property prices have only gone down in about 2 and a half of the 23 years tracked in the analysis, with those downturns occurring during the great recession between the summer of 2007 and spring of 2009, and during the most recent downturn in the economy between February and July of 2020, when lockdowns and closures were at their peak here in the US.

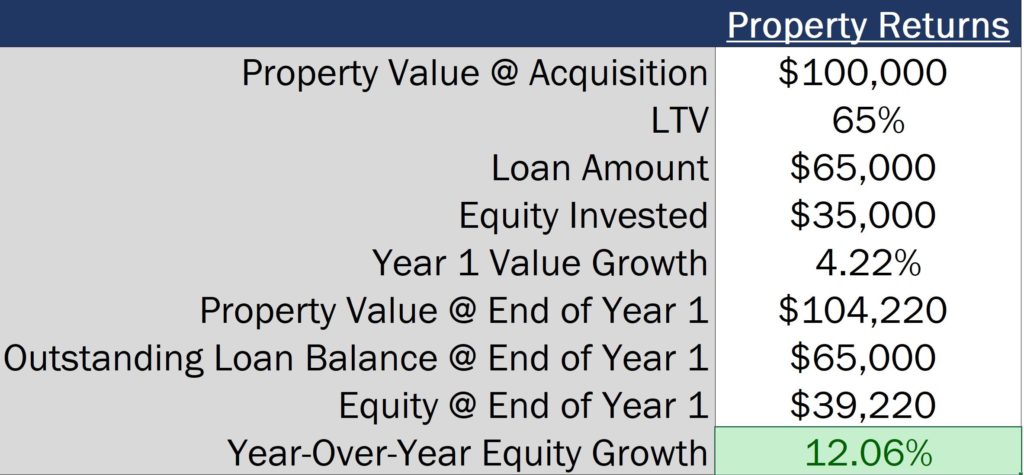

During all other periods, the general trend of pricing has been up and to the right, and since they began tracking the index in December of 1997, commercial property prices have increased at a compound annual growth rate of 4.22% up through August of 2020.

And this growth includes those massive value decreases during the Great Recession, with the CPPI dropping almost 37% between 2007 and 2009.

However, what’s really interesting to note is that these property value increases represent unlevered data.

Most commercial properties are acquired with debt, meaning that a 4.22% annual increase in property values likely meant significantly higher equity increases for investors who also added leverage to their deals.

For example, using a conservative 65% LTV ratio on a $100,000 property, roughly $35,000 of equity would be required to be invested into the deal.

And with a 4.22% property value increase, that would bring the property up to $104,220 in value after one year of ownership, meaning that even if the loan balance wasn’t paid down at all and stayed the same at $65,000 at the end of the year, the new equity balance would represent $39,220.

This represents a year-over-year equity growth for the investor of 12.06%, rather that just the 4.22% value increase seen at the property level.

The bottom line is, if you’re sitting on the sidelines, chances are you’re just saving up your money to buy more expensive real estate later on in the future.

Not good.

Capitalizing on Real Estate Investment Opportunities Requires Experience

If neither of those first two points convinced you, the final reason why timing the market generally doesn’t work is because gaining investment experience is the only way to actually know what you’re doing when opportunity like this does end up striking.

By investing consistently over time, you gain experience.

And with that experience, you learn the markets you like and don’t like, the property types you like and don’t like, and if you’re investing as a passive capital partner, the sponsors you like and don’t like.

In the process, you’ll also build relationships so that deals will be sent to you when that distress starts to occur, rather than having to seek them out on your own starting from scratch.

If you’re an active investor, this means that brokers and lenders will be calling you, knowing you have a track record and can close on deals when new opportunities arise.

And if you’re a passive investor, you’ll already have a network of groups that will be sending you opportunities, and you’ll know the groups you like and trust before investing a huge chunk of capital in a new investment opportunity.

Investing gradually each year, especially during “up” years, can also help you grow your capital much more quickly than you would be able to otherwise.

This gives you even more investment capital to work with than if you just sat on the sidelines before a major correction.

And this has been true in my own portfolio, as well.

Over the past 5 years, I’ve benefitted from several major capital events, including refinances that returned all or most of my invested capital, several major sales that were either distributed as cash or rolled into a new, bigger investment as a 1031 exchange, and even regular cash flow distributions that have allowed me to make bigger and more frequent investments than I would have otherwise been able to make if I only had that money in a savings account.

How To Get In The Real Estate Investment Game (Even Without Significant Capital To Get Started)

For these reasons, a form of “dollar cost averaging” through making consistent real estate investments over time generally makes more sense than hoarding cash for a correction (that you may be waiting years to get into).

And if the big price tags of commercial properties make this feel impossible, one thing to keep in mind is that you don’t always have to start with a massive capital investment.

Most investors can access things like REIT shares for as little as a few thousand dollars, and investments from around $10,000 to $50,000 can get investors into single family rental houses in some markets, passive syndication opportunities, or even bigger commercial properties as a GP investment if third party equity is raised to cover the remaining equity needed.

However you do it, you don’t want to be the person waiting on the sidelines for the right moment, only to be sitting in quiet desperation until that time finally comes, and you might not even be ready when it does.

And if you want to go deeper into any of this and want to learn more about how to analyze deals and find the right opportunities (regardless of the market cycle we’re in), make sure to check out Break Into CRE Academy, which will give you instant access to our library of courses on real estate financial modeling and analysis, access to our library of real estate financial models and Excel training files, and some additional one-on-one email-based career support to help you navigate whatever challenge is next for you in your real estate career.

Thanks for reading!