How To Learn Real Estate Financial Modeling [Faster]

When I was in school, picking up things quickly was never really my thing.

I’ve always worked hard, so I was always able to get through classes and ultimately get good grades, but fully grasping concepts always felt like it was taking me a lot longer than it should have, and definitely longer than other people in my peer group.

And it wasn’t really until I started working full-time that I learned, out of necessity, how to grasp concepts more quickly and how to be much, much more efficient with building a skill set and learning new things.

And if you’re reading this article, I’m assuming you’re trying to learn more about real estate investing, real estate financial modeling, or just real estate investment analysis in general, all of which can be pretty daunting subjects if you’re starting from scratch.

So to make this much less of a trial-and-error process for you, whether you’re in school, trying to make a career switch, or just trying “figure it out” in a new commercial real estate role, in this article, we’ll break down three things you can do to learn faster, and accelerate your learning curve if you’re trying to build your real estate financial modeling and analysis skill set today (you can also watch the video version here):

So when I say I learned how to learn faster by necessity, I mean it.

In the beginning of my career, I was very much in several sink or swim scenarios where I was responsible for doing a lot of different things (that I had no experience doing before).

And because of that, I had to work quickly to learn, to make sure I was getting things right, and also to make sure that I was being as efficient with my time as I could possibly be.

In some of these roles, learning a new skill could often mean the difference between going home at 7:00 pm versus going home at 10:00 pm, and so figuring things out quickly became a necessity in order to get everything done and still have some sort of a life outside of work.

And through this process, I developed a sort of a framework to learn new things quickly, which is the framework that I use in all of our Break Into CRE courses, and what I want to walk you through in this article.

So if you’re looking to learn real estate financial modeling and analysis, and looking to learn these things quickly and efficiently, these are the three things I’d recommend you do to make that happen.

Start Simple, Then Build From There

So first, the number one step in this process is to start simple and then build from there.

There’s a reason why algebra isn’t taught to first graders, and that reason is because they don’t have the foundational knowledge around the basic mathematical concepts they would need to know in order for algebra to even begin to make sense.

The same is true for learning real estate investment analysis and financial modeling.

If you don’t understand what an internal rate of return is or what it’s really telling you, learning how to partition the IRR between operations and sale proceeds or how to sensitize an IRR based on rent growth and exit cap rate isn’t going to make much sense to you, and is just going to make you frustrated and even more confused by trying to take those steps too early.

The key here is to start with the basics, and to not move on from those basics until you really, fundamentally, understand the concepts.

In real estate financial modeling, specifically, there are a few investment metrics and Excel functions that are used over and over again when you’re building models and analyzing deals, and so taking the time up-front to really drill in on these concepts and to understand how they work is going to set you up for success in everything else you work on in real estate financial modeling in general.

Focusing on things like the property cash flow statement and how it’s structured, the key real estate investment metrics that are commonly used in the industry to analyze deals, and the most commonly used real estate financial modeling functions and Excel shortcuts to build models more quickly will go a long way in making everything else much easier as your knowledge grows and you start to dive in to more advanced material.

A very clear pattern I’ve noticed among students in Break Into CRE courses and Break Into CRE Academy members who have a solid understanding of the foundational concepts that are taught in the program is that they went through the foundational coursework more than one time, until they fully understood the material.

The second time around takes a lot of the pressure off, you know what to look for if things get fuzzy, and you can draw your attention to things you might have initially missed to help you “fill in the gaps” that you may not have seen the first time around.

Just like if you were learning to play golf, you wouldn’t want to practice the wrong swing and drill that into your muscle memory without getting the basics of your swing correct first, and real estate financial modeling and analysis is no different.

Make sure you have the fundamentals down first, and only then move into more advanced modeling material once you have the basics covered.

Take The Training Wheels Off

Now aside from starting with the fundamentals, once you feel comfortable with the core concepts of real estate finance and financial modeling, the second step of this framework is to start practicing what you’re learning and start to progressively take off the training wheels over time.

In the education world, there’s a concept called scaffolding, which essentially refers to a teaching technique that involves moving students progressively through learning a concept by starting with the basics, supporting those students in learning those basics, and then (over time) reducing that support to let those students practice those skill sets on their own.

And in the Break Into CRE coursework, this is exactly what we do.

We’ll start by working through practice exercises or full model build-outs together, and then you have the opportunity to solve the same or similar problem sets or work through those modeling exercises on your own.

Building a model out with the answers in front of you is helpful when you’re first learning and being exposed to the information, but there’s another level of understanding that comes into play when you “take the training wheels off” and try to solve problems on your own.

When this happens, you’re forced to apply both the concepts and skill sets you’ve learned in coursework, but you’re also forced to use critical thinking skills to creatively solve the problem ahead of you for the unique scenario you’re analyzing.

There’s a saying that “necessity is the mother of invention”, but I would also say that necessity is the driver of true learning.

It’s easy to sit back and watch someone else do something and take notes, but not nearly as easy to use critical thinking skills to solve problems and apply textbook concepts to real life scenarios.

Apply Your Learning

And speaking of real life scenarios, once you have the basics down and you’re progressively building your skill set and practicing what you’ve learned, the final step of this process is to apply what you’re learning in real-life scenarios.

So if you’re in college right now, this could mean landing an internship or job shadowing, where you’re actually able to put in context the things that you’re learning in school or in a program like Break Into CRE Academy.

And if you’re working in the industry right now and trying to make a switch to another part of the business within your organization or within another firm, this could mean working through your company’s acquisition or asset management models to really understand how they function and how they’re put together to analyze and track investment performance.

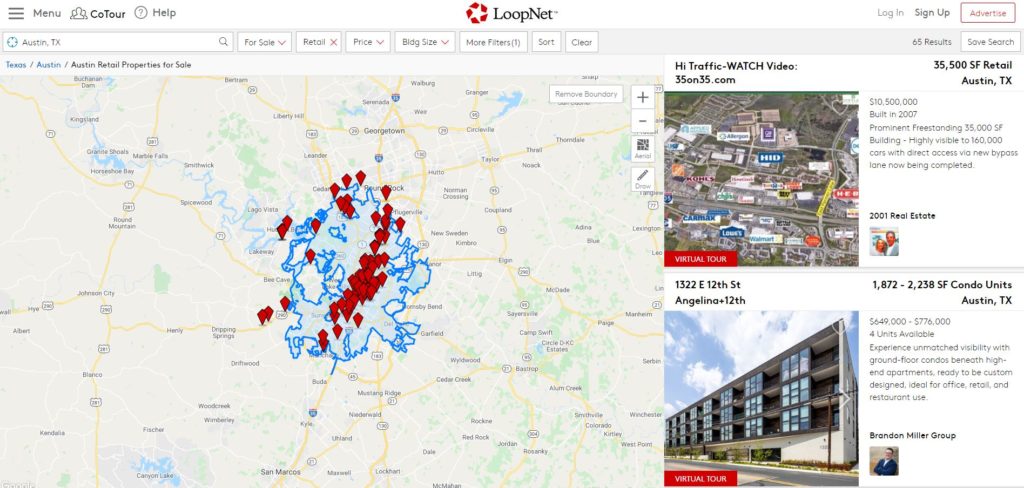

And if you’re not in college or not working in real estate right now, this could just mean starting to underwrite live property listings online and running your own analyses to actually apply what you’re learning to something tangible that takes your analysis out of just Excel (and brings it into real life).

When I was first breaking into the industry, every experienced real estate professional I met with told me that I needed “reps”.

And what they meant by that is that I needed experience, or repetitions, underwriting and analyzing deals to actually get the hang of what I was doing.

This is a big reason why often I advocate for high-transaction volume roles when you first break into the industry, because “reps” are built into these positions where you’re analyzing multiple deals at once and “drinking from a fire hose” from an experience perspective.

The more you can put what you’re learning into real life scenarios and context, the more quickly things will “click” and sink in, and faster the analysis process will start to become second-nature as you work on more deals.

The Three-Step Process For Learning Faster

Overall, if you’re trying to learn real estate financial modeling and analysis and looking to make your learning process faster and more efficient, the general framework I’ve found most helpful for myself and Break Into CRE students is to:

- Start simple and master the basics first.

- Take the training wheels off (gradually) as you continue to practice and hone your skill set.

- Apply what you’ve learned to real-life scenarios to bring these concepts to life.

If you can do these three things, you’re going to give yourself the best shot of learning real estate financial modeling and analysis quickly and efficiently, and you’re going to reduce a lot of the headache that I went through during this process.

And as I mentioned throughout this article, I created Break Into CRE courses and Break Into CRE Academy with this framework in mind.

Our goal is (and has always been) to make the learning process as easy, simple, and efficient as possible, so if you’re looking to learn the building blocks of real estate financial modeling, you need some additional reps to take your skill set to the next level, or you want to learn how to analyze live deals with everything you already know about the industry, make sure to check out our full library of individual courses.

And if you want instant access to all courses, all models, and some additional one-on-one, email-based career coaching support, check out the full Break Into CRE Academy program.

Thanks so much for reading! I hope you found this helpful in building your real estate financial modeling skill set, and good luck!