Is Commercial Real Estate Really an Inflation Hedge?

With massive stimulus packages in 2020 and 2021 resulting in over 4 trillion dollars being pumped into the US money supply, the concern over inflation (and the debate over when that inflation will come) has become one of the most heavily debated topics in all of finance.

And while inflation directly affects the cost of goods and services, inflation also has a direct impact on real estate investors in all property types, affecting the cost to build new properties, own and operate real estate, and finance real estate deals.

So, with so much talk around inflation coming on the horizon, this article will break down what inflation might mean for real estate investors, and what investors can do right now to benefit from a hyperinflationary period in the future.

If video is more your thing, you can watch the video version of this article here.

What Is Inflation?

The technical definition of inflation according to Oxford Languages is, “A general increase in prices and fall in the purchasing value of money.”

This essentially means that, in the US, inflation reduces the value of the dollar in relation to what you can buy with that dollar.

And with trillions of dollars of stimulus funds being printed in 2020 and 2021, the increase in the money supply has introduced a very real threat of inflation numbers that we haven’t seen since the late 1970s and early 1980s here in the United States.

The M2 Money Supply

A helpful way to put all of this into perspective and to see the aggregate impact of this money being printed is to take a look at the year-over-year changes to something called the M2 money supply.

The M2 money supply is a figure tracked by economists that includes cash, checking deposits, savings deposits, and money market securities, essentially measuring how much money is in circulation at a given point.

And even though we’ve known about these stimulus packages as they were happening, what happened to the M2 money supply in 2020 and 2021 is shocking when you step back and take a look at the change.

In February of 2020, the M2 money supply in the US was $15.5 trillion and had been growing gradually at a fairly steady clip since the turn of the century.

But in over the next few months, the M2 money supply almost went vertical. And by February of 2021, the total M2 money supply figure had jumped all the way up to $19.7 trillion.

This means that the money supply increased by 27.1% in just a 12-month period.

To put this into context, this is the highest year-over-year increase in this metric on record since this figure began being tracked in 1959, with the next highest year-over-year increase at just 13.8% occurring back in 1976.

How The M2 Money Supply Affects Inflation

With money being printed at this velocity, coupled with spending volume already back at 2019 levels, inflation concerns are starting to get very real. This is because, as we’re starting to see already, the price of in-demand goods and services can now be bid up even higher with this increased money in the system.

And this bid-up in pricing has trickle down affects outside of just the price of food or gas or electricity, so if inflation does end up materializing over the next few years and we go back to the days of mid-single digit or even double digit yearly inflation, the question becomes, “What happens to real estate investors if that’s the case and how can real estate investors cover their downside if that does happen?”

Commercial Real Estate Rents Are Often Tied To The Consumer Price Index (CPI)

First, and probably the most impactful for real estate investors, real estate can often serve as an inflation hedge directly due to the nature of commercial lease structures (on both the income and expense sides of the equation).

From a revenue perspective for multifamily investors, leases turn every 12 to 18 months in most cases, meaning that landlords can quickly adapt to increasing costs by increasing renewal and new lease rents as inflation increases over time.

And for retail, office, and industrial properties on longer-term leases of anywhere from five to fifteen years or more, many of these agreements include annual base rent adjustments that are tied directly to changes to the Consumer Price Index, or CPI.

Even for leases that call for fixed percentage increases in base rent each year, these contracts often include “Fair Market Value” base rent adjustments either at certain points in the lease itself, or at the time the tenant has an option to renew. And again, this can allow investors to keep up with inflationary pressures during their ownership period.

Inflation Pressures Can Be Passed on to The Tenant

On the expense side of the equation for retail, office, and industrial properties, one of the biggest inflation hedges is that tenants at these properties are often required to reimburse the landlord for their pro rata share of operating expenses at the property.

This means that if the cost of labor rises significantly for things like janitorial contracts, maintenance staff, or on-site management teams, or material costs rise significantly (making it more costly to maintain and repair the property on a regular basis), these costs will often be passed on directly to the tenant and reimbursed to the landlord on a monthly or annual basis.

Inflation Can Lead To Demand Outpacing New Supply

Aside from the actual structure of the leases themselves, rising inflation also tips the scales in favor of real estate in another way, through an increased imbalance of supply and demand fundamentals.

Inflation leads to an increase in the cost of labor and materials, which is exactly what’s needed to develop new properties and ultimately increase supply in a market.

And when the prices of labor and materials increase, one of two things can happen.

The first scenario is that the development pipeline will slow, leading to demand outpacing supply in many product types, increasing rents for existing properties in the process.

The second scenario is that builders decide to continue ahead with expensive construction costs, and try to justify those costs with top-of-the-market rents or sale prices.

We’re already seeing scenario two play out today, with lumber prices jumping by an insane 67.2% between April of 2020 and February of 2021. The average sales price for new homes in the US has also jumped from $360,300 in April of 2020 up to $416,000 in February of 2021, a 16% increase for new product during that 10-month period.

We already had a supply shortage in many markets across the US of both rental and for-sale housing which caused tremendous upward pressure on home values even prior to 2020, and rents that had grown to such unaffordable levels that governments have actually stepped in to enact rent control measures in many US cities and states.

And with a drag on new supply in the market, this lends itself to continued sky-high increases in rents and home values for the foreseeable future.

Inflation Rewards Investors With Long-Term, Fixed Rate Debt

Aside from rents and values increasing in an inflationary environment, a second (and almost equally important) impact for many real estate investors is that the weakening of the purchasing power of the dollar allows investors using fixed-rate debt to benefit from disproportionate cash flow increases on their properties over time.

The vast majority of real estate transactions are financed with debt. And many of these loans have an interest rate that is fixed, meaning that it won’t change throughout the entire loan term (usually somewhere between about five to ten years for commercial properties).

This means that, even if inflation hits and rents increase due to the factors mentioned above, fixed-rate loan payments can stay the same for sometimes a decade or more.

And this means that an investor’s monthly debt service payment will be the same ten years from now as it is today, while operating income at the property is likely to have increased substantially during that same 10-year period.

How This Works in Practice

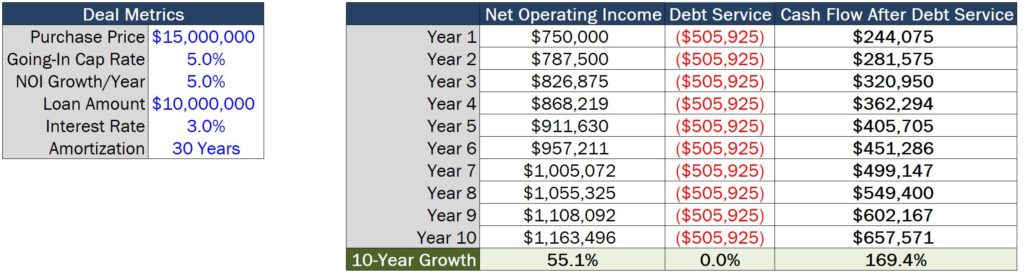

To use an example, let’s take a look at a sample $15 million acquisition of a property acquired at a 5% cap rate. We’ll assume that the property is acquired with a $10 million loan at a 3% interest rate which amortizes over 30 years.

Then, let’s assume we plan to hold the property for 10 years, and we’ll also assume that inflation goes crazy and our net operating income (NOI) increases by an average of 5% per year over the next 10 years.

In this scenario, the NOI will have grown by a total 55.1% over that 10-year hold period, which is already a huge win for a property owner from a cash flow and value growth perspective.

However, where this gets even more interesting is after taking those loan payments into account.

Once debt is paid and we look at the total cash flow after debt service, this figure increases by almost 170% during that same time 10-year time frame from just $244,075 in the first year of ownership to $657,571 in year 10 of the hold period.

This isn’t to say that there aren’t potential downsides to leverage (there are), but if reasonable leverage is used on profitable deals, real estate investors can significantly magnify returns by using debt on their properties.

The Bottom Line

With the money supply increasing by over 25% in 2020 and 2021 and the available supply of in-demand goods and services not rising at that same pace, it’s hard to believe that we won’t see some form of increased inflation in the very near future.

But for investors who have already locked in long-term, fixed rate debt and own properties with either short-term lease structures or long-term contractual rent increases that are tied directly to the Consumer Price Index, I actually see an inflationary environment as an opportunity for real estate investors, rather than a disadvantage.

And if you’re looking to get into the real estate game and want to learn how to run analyses like these on your own deals, make sure to check out Break Into CRE Academy, which includes courses on building acquisition and development models from scratch in Excel, courses on analyzing and valuing multifamily and commercial real estate properties, and a library of pre-built acquisition and development models so you can practice what you learn in the coursework in real-time.

And if you’re just dipping your toes in the water of this whole real estate thing, go ahead and enroll in our free Break Into CRE Real Estate Financial Modeling Crash Course linked below.

Thanks for reading!