Commercial Real Estate Appraisal Valuation Methods

Commercial real estate valuation can be a tricky subject.

While brokers and investors tend to arrive at a valuation based on target return metrics, when appraisers get in the game, the valuation techniques used can be a different story.

And for deals that will be acquired with debt (as most commercial real estate properties are), the lender is almost always going to require an appraisal of the property, which makes this an important piece of understanding what your loan proceeds might be on a deal.

So in this article, let’s walk through the three methods of commercial real estate valuation that appraisers use out in the field, and how your valuation might differ for each.

If video is more your thing, you can watch the video version of this article here.

The Cost Approach

The first method of commercial real estate appraisal that appraisers will use out in the field is referred to as the cost approach.

And for a new building, this method of valuation is pretty simple. For new construction deals, the cost approach will generally just involve determining the construction cost of the building improvements, and then adding the market value of the land.

However, for an existing property, there’s an additional step to this process.

The appraiser will still estimate the cost to replace the property improvements today, but they will then reduce that cost by any physical deterioration, functional or structural obsolescence, or external obsolescence from the surrounding area.

Physical Deterioration

Physical deterioration may include costs to upgrade the improvement or cure any deferred maintenance on a property. This will also factor in the useful economic life of the building, and the time that has elapsed since the property was placed into service.

Functional or Structural Obsolescence

Functional or structural obsolescence may include increased costs of operating an older building, including energy costs for less efficiently designed buildings. This increase in cost will also be factored into the analysis as to occur every year, and these cash flows will be discounted each year, as well.

External Obsolescence

The appraiser might also include external obsolescence in this calculation, which accounts for influences outside of the immediate property itself. This could include factors like traffic in the area, pollution, crime changes, or any other external factors that could materially affect the net operating income at the property.

With all of these considerations to take into account in the cost approach, it’s no surprise that this approach is most effective when the building structure is relatively new and the depreciation of the structure is minimal.

The Sales Comparison Approach

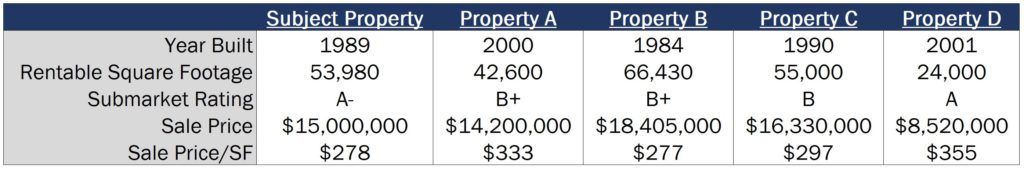

The second method of commercial real estate appraisal that appraisers will use out in the field is referred to as the sales comparison approach.

This approach uses data from recent comparable property sales of similar age, quality, and location to come up with a valuation for the deal.

However, as any real estate investor knows, no two properties are exactly alike. Even similar, comparable properties will differ in certain areas that need to be taken into consideration in this approach.

This could be a difference in things like the date the property was sold, the geographic location within the submarket, the age of the building structure, rentable square footage at the property, proximity to other landmarks, and other amenities or consumer draws that might exist at one property versus another.

To determine an appropriate valuation for the subject property, the sale price of the comparable property might be adjusted upward to reflect a superior location of the subject property, a newer structure, a superior submarket, or a better location within the submarket, or downwards to reflect an inferior location, older structure, inferior submarket, or inferior location within the submarket.

This approach works well when you’ve had a lot of transaction activity in your market in your specific product type, ideally within the last 12 months. However, the more unique the property becomes and the less sale volume of comparable properties your market has seen over the last several years, the more difficult the utilization of this approach becomes.

The Income Approach

The third and final method of commercial real estate appraisal that appraisers will use out in the field is referred to as the income approach.

And within the income approach, there are three main approaches used to determine the value of the property.

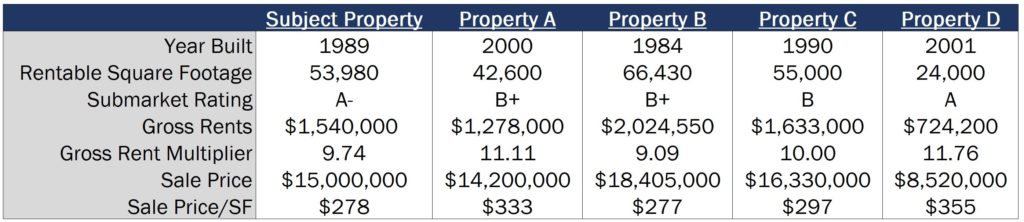

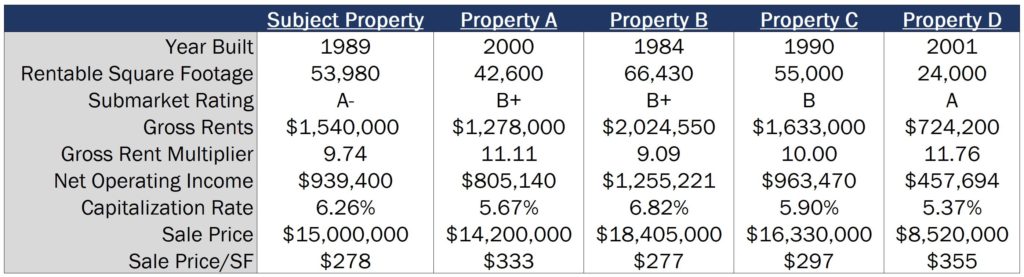

Gross Rent Multiplier

The first method used within the income approach is the gross rent multiplier approach.

This involves dividing the sale prices of comparable properties by each property’s gross income, and then applying that figure (adjusted for the differences in quality/age/location mentioned above) to the subject property.

Direct Capitalization

The second income approach method used in commercial real estate appraisal is the direct capitalization method.

Using this method, instead of just taking gross income into account, the property’s net operating income (or revenue less expenses) is used to determine the value of the property.

This, again, involves using operating data from recently sold comparable properties and calculating the cap rate (the net operating income divided by the sale price) on each of those comparable deals.

From there, the valuation of the subject property is determined using the cap rates of those comparable properties, and dividing the subject property’s net operating income by that adjusted expected cap rate on the deal.

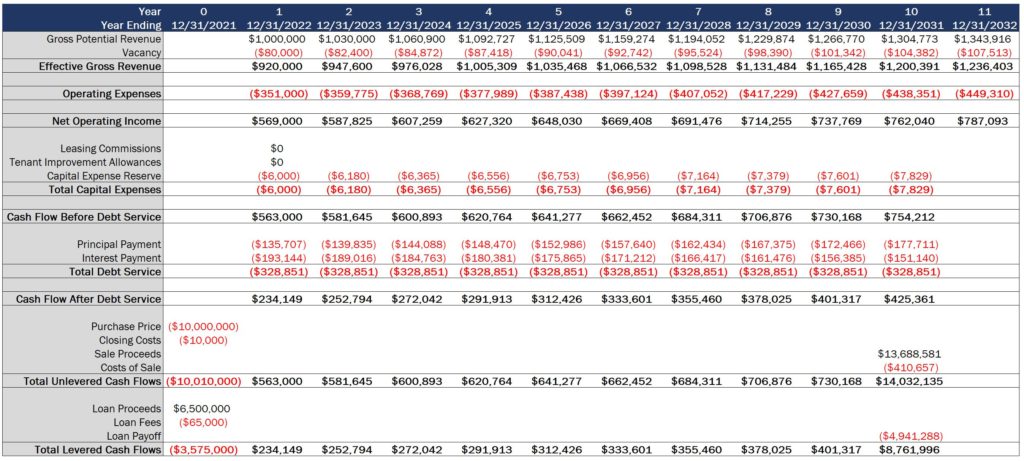

The Discounted Cash Flow Method

Finally, the third income approach method used in commercial real estate appraisal is the discounted cash flow method, which is the method that is most commonly used by commercial real estate investors and brokers to value deals (and the same foundational valuation method we use in our Break Into CRE coursework).

This method involves forecasting net cash flows over an extended period of time, and also requires the appraiser to make an assumption about what the property’s sale price might be in the future.

From there, this method applies a discount rate (or required annualized, time-weighted return) to those cash flows to determine an appropriate valuation of the property.

For appraisal purposes, this discount rate is generally going to be the risk-free rate of return (in the US, the US Treasury yield), plus a risk premium to compensate the investor for investing in real estate. The process of choosing that risk premium can get a little tricky, so if you want to learn more about how this risk premium is determined by commercial real estate investors, you may want to check out this video here.

The Bottom Line

If you’re about to have your property appraised and want to know the “secret sauce” being used by those appraisers to come up with a valuation for your deal, these are the three approaches to property valuation used by commercial real estate appraisers out in the field.

And if you want to learn more about the discounted cash flow analysis used by commercial real estate investors and brokers to value commercial properties, make sure to check out Break Into CRE Academy.

A membership to the Academy will give you instant access to our entire library of courses on real estate financial modeling and analysis, valuation case studies for multifamily, office, industrial, and retail property acquisitions, and additional one-on-one career support if you’re looking to break into the industry and need some extra guidance along the way.

I hope you found this helpful. If you’re about to head into an appraisal, good luck!