Commercial Real Estate Interview Questions YOU Should Be Asking on Interview Day

Interviews can be stressful.

And for job candidates, the focus of interview prep is usually (understandably) on how they should answer the questions that might come their way on the big day.

However, what most people tend to gloss over is the fact that, while the company is interviewing you, you are also interviewing the company, to make sure this is the right fit on both sides at the end of the day.

And with that, before going into any commercial real estate interview, I always recommend having several questions of your own lined up for the interviewer(s) you’ll be meeting with, so you can get a better idea of the company itself and the role you’ll play within it.

In this article, we’ll cover 6 key questions I generally recommend asking in commercial real estate interviews, and why each of these are important.

If video is more your thing, you can watch the video version of this article here.

How Is the Company Capitalized?

First on this list, I’d highly recommend getting a clear idea of how the company you’re interviewing with is capitalized, and what their main sources of funding and/or revenue are.

The goal here is to try to understand two main things:

- Job stability

- Ability to do transactions (“Dry Powder”)

On the job stability front, you’re looking for reliable sources of capital and/or revenue. This could be consistent revenue earned through asset management fees or an in-house property management company, long-term advisory deals with multi-year contracts, or any other predictable way that the firm earns money on a monthly or quarterly basis.

Sometimes companies that are primarily reliant on transaction-related revenue, such as acquisition fees, disposition fees, or even promoted interest, can end up having a tough time keeping their staff in tact when tough times hit. And this means that the more stability in cash flows the company has, the more likely they’ll be able to keep you around for as long as you want to be there.

Additionally, it’s important to understand how the company (and their investment strategy) is funded to understand the firm’s access to capital, and how many deals you’ll likely be doing on an annual basis at the firm.

For firms that raise capital from high net worth individuals and small family offices on individual deals, the process can be arduous and time-consuming, and smaller private equity firms often cap out at about 3-6 deals per year when using this process.

However, if the firm just raised $1 billion of equity in a discretionary fund and needs to deploy that capital in the next three years, you’re likely going to see significantly more deal volume than in the one-off syndication scenario.

Not to say that either scenario is bad, since doing small syndication projects will give you invaluable experience in putting deals together and raising equity, but you’ll want to be aware of how many deals you’re likely going to be doing on an annual basis and how secure your job might be.

Does The Company Subsidize Memberships To Industry Organizations?

When you’re just starting out in your career, memberships to groups like ULI for developers, NAIOP for office and industrial professionals, ICSC for retail professionals, and NMHC for multifamily professionals are going to be huge in building your professional network quickly.

Most of these organizations also have “Young Leaders” subgroups for real estate professionals under the age of 30 or 35, which make these excellent places to meet your peers and build relationships that you’ll have throughout the rest of your career.

With that said, you also want to make sure that the company you’ll be working for encourages their analysts or associates to be involved with these types of groups, allows for time to participate in networking events or industry functions, and ideally, they either partially or fully subsidize memberships to these groups for their employees.

Company funding definitely isn’t a requirement (and can be the exception rather than the norm), but just by asking this question, you can get a great sense as to how committed the company is to the growth and development of their employees. And in addition, in my experience, this is often an good indicator of potential for growth within the firm, as well.

How Did The Company Fare During Previous Recessions?

This one can be a touchy subject at some firms, but if a company has been around long enough, it likely has a few real estate cycles under its belt.

And even if these are just anecdotal stories from the people you’re interviewing with, this is still helpful information to know to assess job security in the position you’re applying for.

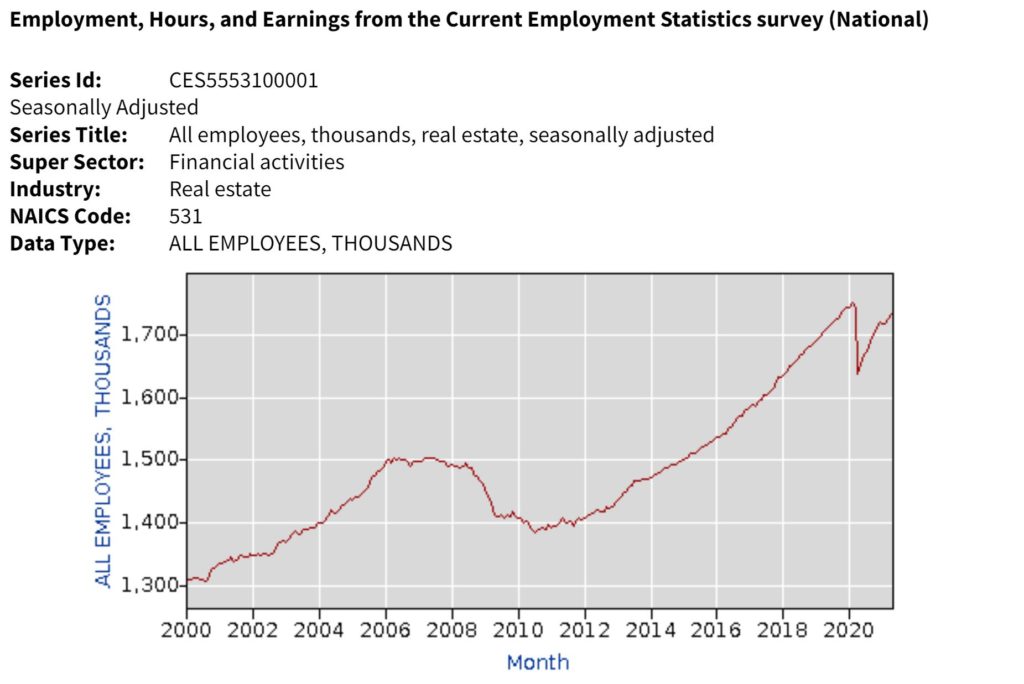

Analysts and associates were some of the first to go in the depths of the Great Financial Crisis between 2008 and 2010, and many people with these same titles (especially in the retail and hospitality sectors) were also let go quickly during the depths of COVID-19-related shutdowns in 2020.

However, not all commercial real estate firms are created equal, and while many firms did have to make staffing cuts and lay off workers, other firms were able to hang on to all or the majority of their employee base, and it’s helpful to know how the company you’re interviewing with has weathered the past few economic storms.

Similar to point number two on this list, this can give you some great insight into how the company takes care of its employees, and what you might expect if things go south in the economy during your tenure.

What Have People Who Have Held This Role Before Me Gone On To Do?

I love this question, and in a way, this often gives the interviewer a subtle “pat on the back” for fostering growth of their employees (assuming they’ve been around the company long enough).

When considering taking a role, it’s important to know where that role could take you and the trajectory you might be on (by default) when taking the position.

Ideally, you want the person you’re interviewing with to be able to point to people who are currently experiencing the same kinds of professional success you are setting out to achieve in your own career, and how the position helped them achieve that success.

For most people entering the industry, an analyst position isn’t the final destination, but rather an entryway into the business. And with that, if your goal is to become a VP of Acquisitions at a national multifamily investment firm and you’re interviewing for an Acquisitions Analyst role, hearing a hiring manager talk through how people who have sat in the same chair as you have gone on to do what you want to do is extremely insightful information.

On top of that, this type of question also shows drive and long-term vision, which is something all employers are looking for in their organizations.

Can I Invest In Deals The Company Invests In?

Most people who enter the commercial real estate industry get into the business with the end goal to own real estate themselves. And if you’re able to get started with this process on the job, this can be an ideal scenario.

Many smaller, more entrepreneurial firms will allow their analysts and associates to make small equity investments in deals they work on (generally much lower than the common $25,000 or $50,000 investment minimums for most deals), creating a scenario where you’re essentially getting paid to work on your own real estate investment opportunities.

However, the details of how this co-investment comes together are extremely important here, and you’ll want to know exactly how you’ll be allowed to invest in these deals.

I’ve heard of (and experienced) all kinds of different structures, from the ability to invest in deals in the LP position (but being subject to the firm’s general fee structure), to the ability to invest in deals in the GP position (and earning promoted interest), to the company providing a loan or salary deferral which acts as your equity investment (that only vests after you’ve stayed at the firm for a certain period of time).

The important thing with this question is to make sure you are extremely clear with exactly how this is set up, and the timeframe of employment that these investments might be contingent upon.

Can I Talk With Another Current or Former Analyst/Associate?

Hiring managers will often try to sell the position and the company as a whole (especially if they want you), which can tend to paint an unrealistically rosy picture of the position, or at least gloss over some not-so-nice details.

And with that, one of the most helpful things to do during the interview process is to speak with someone who has the same role as you (that you’ll be working with on a day-to-day basis), or someone who has held the same role in the past and has since moved on.

The goal here is to get a true picture of what it’s like to work in this position day-to-day, and ideally, to get the inside scoop on some downsides that might not be so appealing, that were conveniently left out of your conversations with a hiring manager.

These tend to be more relaxed, honest conversations about what the role entails, expectations of work hours, difficulties of the position, and opportunities for growth, and if you can talk to someone who has moved on from the position (and has nothing to lose by telling you the truth), this is ideal.

Why Asking Questions Is So Important

At the end of the day, you want to make sure you’re taking a position that’s the right fit for you – one that you’re ideally going to learn and grow within for years to come.

And while companies will often try to sell themselves to you as a prospective job candidate, it’s important to get your questions answered during the interview process, as well.

Employment is a two-way street, and if you choose incorrectly, you could be wasting years of your career in a dead-end job, or heading down a career path you don’t actually want to be in long-term.

Asking these types of questions up-front will maximize your chances of landing in a role that’s right for you, and reflects who you are and where you want to be in the future.

How To Prepare For Your Next Commercial Real Estate Interview

If you’re going through the commercial real estate application and/or interview process right now, and you know you’ll have to tackle a technical Excel modeling exam or just want to strengthen your resume to be more attractive to employers, make sure to check out Break Into CRE Academy.

A membership to the Academy will give you instant access to all Break Into CRE courses on real estate financial modeling and analysis, access to our entire library of pre-built acquisition, development, and equity waterfall models for multifamily, office, retail, and industrial deals, and additional one-on-one, email-based career coaching support to help you get from where you are to where you want to be in the real estate industry as quickly (and painlessly) as possible.

I hope this helps as you’re preparing for interview day. Good luck!