How To Choose a Discount Rate in Real Estate Investment Analysis

The discounted cash flow analysis, or DCF, is one of the most widely used investment analysis and valuation tools in all of commercial real estate.

But in order to run a DCF analysis, one of the most essential components you’ll need is a discount rate, which will help determine what the valuation of the property you’re analyzing should be, based on your specific investment return targets on the deal.

One of the biggest points people tend to get tripped up on with this is choosing what that discount rate should be, and how this should change based on the deal that they’re analyzing.

So in this article, we’ll walk through exactly what a discount rate represents, how it’s used in real estate private equity, and how to choose the right discount rate for your next commercial real estate investment opportunity.

If video is more your thing, you can watch the video version of this article here.

What Is a Discounted Cash Flow Analysis in Real Estate?

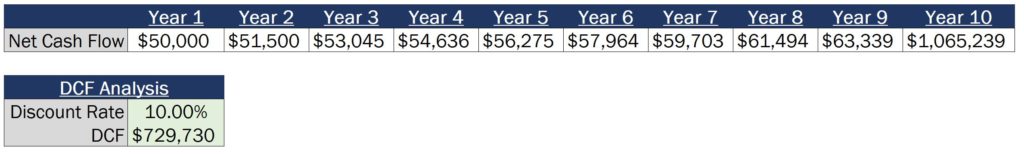

A discounted cash flow (DCF) analysis in real estate is a method used by investors to value commercial real estate investment opportunities based on the projected cash flows of the deal, and their time-weighted, annualized return targets on the project.

Essentially, this involves three parts:

- Making assumptions about the purchase, financing, operations, and sale of the deal.

- Creating cash flow projections into the future using those assumptions.

- Using a discount rate to analyze the projected cash flows on the project to determine investor’s valuation of the property based on their target returns

And while this can all seem relatively “plug-and-play” on the surface, one of the things within this analysis that people tend to have the most difficulty with is choosing what that discount rate should be, since this will have such a major impact on the valuation of the deal.

What Is a Discount Rate?

Let’s first quickly walk through what the discount rate represents, because this part is important.

For real estate investors, the discount rate used in a DCF analysis represents the target annualized, time-weighted return on equity invested in the deal.

For example, if a real estate investor is considering buying an office building and is seeking a 12% annualized return on their investment, the discount rate used in that investors DCF analysis would be 12%.

And generally, this is going to be the minimum rate of return acceptable for investors in the deal, factoring in the risk the investor is taking on by investing in the project in the first place.

What Should My Discount Rate Be?

If we know that the discount rate is the minimum rate of return acceptable for investors in the deal, the next logical question is, “How should I choose what the minimum acceptable rate of return should be?”

And the answer lies in what real estate investors refer to as “risk-adjusted” returns.

Real estate investors are inherently looking to maximize upside, and minimize risk of loss.

And with that, there will generally be a minimum threshold where an investor believes that, if the investment yielded a rate of return that was less than this figure, the potential risk would outweigh the potential reward of the investment.

And right where this crossover point lies is where the discount rate on the deal is generally going to fall.

This means that the higher the risk the investor takes on, the higher the required rate of return to make the investment worthwhile, and the lower the risk the investor takes on, the lower the required rate of return to make the investment worthwhile.

What Are Common Return Targets on Commercial Real Estate Investments?

In real estate, on a leveraged basis (or using debt), most of these expected time-weighted return targets fall somewhere between about 7% and 20% on an annualized basis, based on the risk profile of the deal.

And with that, if you’re considering investing in a brand new office building in downtown Manhattan with Google as your main tenant, the discount rate you use to value the deal will generally be closer to 7%, since the default risk of the tenant is low and the quality and location of the asset are both extremely strong. This leads to very little risk of major catastrophic loss on a deal like this, and investors are generally willing to accept lower returns as a result.

On the other hand, if you’re considering investing in a 20-year old, 60% occupied shopping center in Phoenix, Arizona, the discount rate you use to value the deal will generally be closer to 20%, since the occupancy of the property is extremely low, the success of re-leasing efforts is uncertain, the property is located in a secondary market, and there are unforeseen capital issues that could arise with a deal that’s 20 years old.

How Do I Choose a Discount Rate on My Own Deal?

For commercial real estate private equity firms, many of these investors will raise capital with return expectations made up front, and then seek to deploy (invest) that capital into deals that will produce those target returns.

For example, investors that want exposure to real estate and are willing to take on more risk might invest in a discretionary fund targeting deals with an 18% annualized, time-weighted return. And from there, that fund would value each potential acquisition at a level where they believe they could hit that 18% return target, and would use an 18% discount rate within their analysis to determine what that value should be.

At the end of the day, a target discount rate comes down to investor expectations.

And generally, real estate equity investor expectations for time-weighted, annualized returns tend to fall somewhere between 7% and 20%, with lower-risk deals falling in the lower end of that range, and higher-risk deals falling on the higher end of that range.

How To Put The Discount Rate Into Practice

If you want to learn more about the process of choosing a discount rate, as well as how to incorporate that discount rate into a complete real estate financial model (and how to build one from scratch), I’d highly recommend taking a look at our membership program, Break Into CRE Academy.

A membership to the Academy will give you instant access to all Break Into CRE courses on real estate financial modeling and analysis, access to our entire library of pre-built acquisition, development, and equity waterfall models for multifamily, office, retail, and industrial deals, and additional one-on-one, email-based career coaching support to help you get from where you are to where you want to be in the real estate industry as quickly (and painlessly) as possible.

Good luck with your next real estate investment analysis – I hope this helps!