Buy and Hold Real Estate Investing – How To Run The Numbers

When you’re working for a private equity real estate firm that gets paid on the back-end through promoted interest (or potentially fees associated with selling the property), the deals you underwrite are going to be evaluated based on projected cash flows, usually over a 3-10 year period.

And within those projected cash flows, a sale is going to be assumed at the end of that hold period, where the profits will be captured and the deal will be be exited.

But what happens if you’re just buying a property on your own, or with a handful of friends and family investors, and you plan to hold the property indefinitely?

How do you analyze a deal when that’s the case, and when you’re not planning to sell a deal, do the metrics that are commonly used in the industry (like the IRR or equity multiple) even matter at all?

If you’re looking to buy real estate and looking to hold for the long-term, in this article, we’ll cover five things you should be looking for in “buy and hold forever” deals, the specific metrics you should be looking at in your analysis, and some things you might not be thinking of that are going to help your chances of long-term success in the real estate investing game.

If video is more your thing, you can watch the video version of this article here.

Money Is Made and Lost in Transactions

When it comes down to it, in the commercial real estate industry, money is made in transactions.

This is true for brokerage firms, private equity firms, lenders, appraisers, title companies, inspectors, and any other third-party companies associated with the buying or selling of commercial real estate.

But for commercial real estate investors, especially individual investors without third party equity, that money that is made in transactions is actually coming out of their pockets through things like brokerage commissions, legal fees, escrow fees, loan fees, prepayment penalties, and a host of other nickel-and-dime costs that significantly add up over an investing career.

And to avoid this, many real estate investors who are investing for cash flow and wealth accumulation over time will employ some sort of a “buy and hold forever” strategy to reduce their transaction costs, take advantage of long-term growth in real estate values, and ultimately own assets free and clear once debt is paid off over time.

So, if you don’t want to “churn and burn” through real estate deals quickly and you’re looking at a deal with an indefinite hold period, how do you actually analyze a deal like this?

And without a projected sale date or value, what return metrics should you be looking at to value a deal you’re thinking of acquiring and holding for the long-term?

Expand Your Analysis Period

In an indefinite buy and hold scenario, the first thing that I would recommend doing to make your analysis mean something at the end of the day is to expand your analysis period.

Most real estate financial models will project out cash flows for 5-10 years, but if you’re thinking this might be a generational deal that is held for many decades to come, extending that timeframe out to more like 25 or 30 years is likely a good move.

And obviously it’s hard to know exactly what might happen 30 years down the road, but especially in later years, growth of things like operating income or overall property value can start to compound significantly.

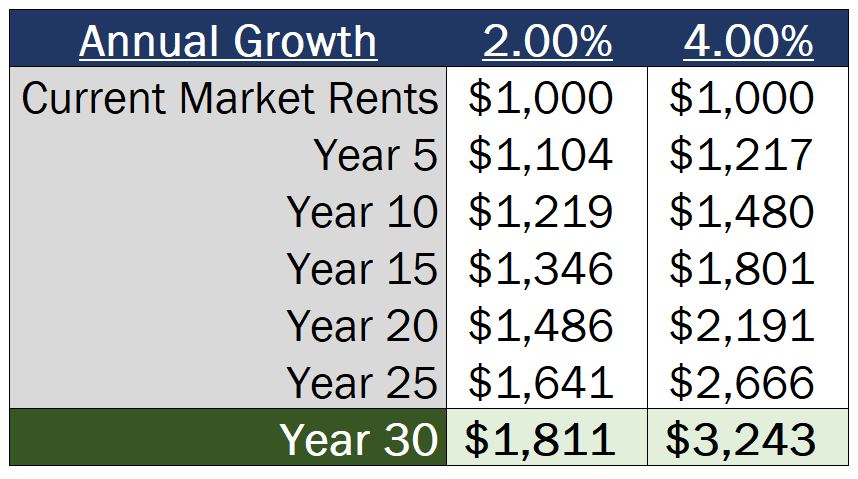

This means that a 2% annual assumption for rent growth in a market vs. a 4% annual rent growth assumption in a market is going to have a massive impact on your cash flows 30 years from now, and you’ll definitely want to see that if you plan to hold the deal for an indefinite period of time.

The 30 year hold period projection could also show you personal milestones that you might be investing for in the first place, like how much cash flow the property will generate when you hit a projected retirement age, cash flow the property will generate when you have a child that’s ready to head off to college, or any other major financial goal that the property investment could be helping out with.

Track Your Property & Equity Value on an Annual Basis

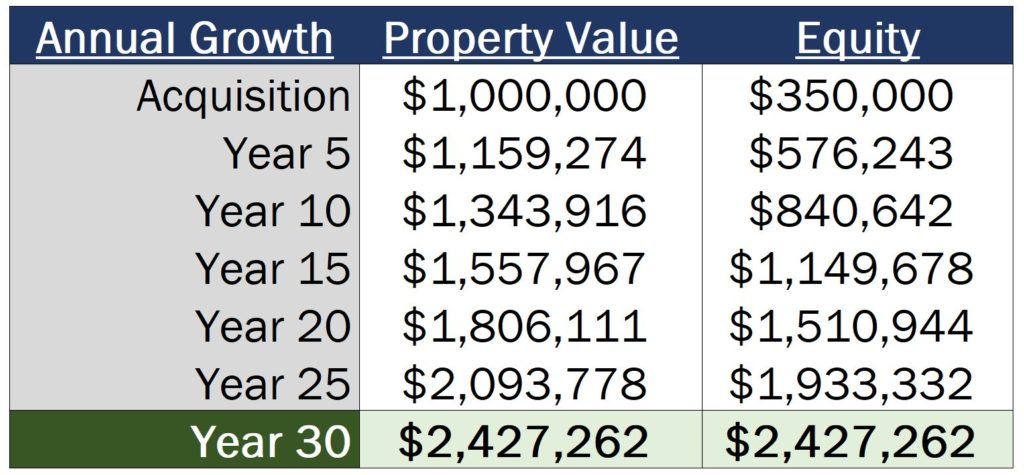

Speaking of long-term compounded growth, the second change I would recommend making on a long-term hold deal is to track your property value and equity value on an annual basis in your model.

In a short-term, 3-10 year analysis, it’s usually sufficient to only look at what returns look like for about 1-3 different potential hold periods. But for a longer-term view, a year-by-year value and equity comparison can be a really helpful metric to have readily available in your analysis.

And if you don’t plan to sell the deal, this is going to give you a good idea of how your equity is growing over time, and also the outstanding loan balance at different times of your analysis if you’re planning to finance the acquisition.

How Debt Magnifies Returns Long-Term

Speaking of debt, this can also clearly show the effects of leverage, and how that can magnify your equity returns.

At a high level, you probably already know that big value increases of your property will mean bigger equity value increases as debt levels rise, and big value decreases of your property will mean bigger equity value decreases with as debt levels rise. However, it’s another thing to actually see this in action within your analysis.

Track When a Return of Capital Is Complete

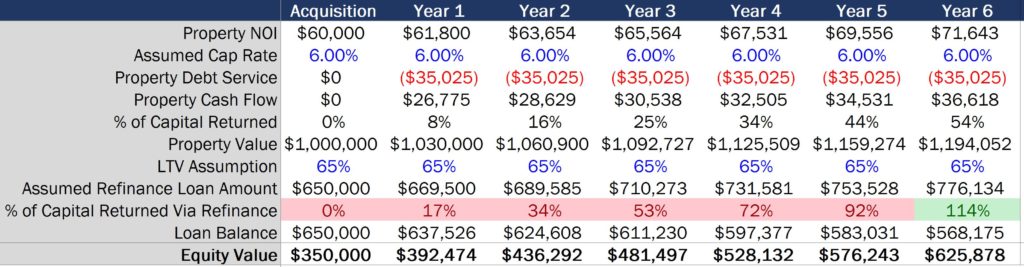

Speaking of equity, the third thing I’d recommend in an indefinite hold scenario is to track your timeframe in which all equity invested is returned, either through operating cash flow or a refinance.

Many real estate investors refer to this as “recycling capital”, meaning they’re getting back their initial equity investment, and then they’re able to turn around and reinvest that capital into another investment vehicle (or potentially another real estate deal).

The sooner capital is returned, the more “dry powder” investors have to invest in more deals. And with that, the shorter the payback period, the more real estate an investor can acquire in a shorter period of time.

Additionally, with the annual value tracking we talked about in the previous point, you can also test when a refinance would return all capital invested, based on an assumed property value each year and an assumed LTV (loan-to-value) ratio.

This can also give you a good sense of when you might be able to recycle your invested capital fully, ideally to buy another deal without having to dip into your own pocket for investment funds.

Especially when you’re trying to build a portfolio over a long period of time, the more you can use lender capital to do this (rather than just relying on your savings for every new deal), the more quickly you’re likely to achieve your real estate investment goals.

Scrutinize Long-Term Market Trends (In Detail)

The fourth thing I’d recommend doing in your analysis for an indefinite hold scenario is to take a much deeper, more holistic view into long-term demographic changes in the market that you’re analyzing.

While things can change a lot in 3 to 5 years, things can change significantly more in 25 to 30 years. And with that, making bets on things like migration patterns and job growth become much more important as your projected hold period increases.

Ask yourself questions like:

- “Will technology make people more or less likely to move to this market?”

- “Is there natural disaster risk that will significantly impact the market over the next 30 years?”

- “What are taxes like in the market, and where might they go in the future?”

Each of these questions will give you direct insight into where rent and value growth might go in a particular market long-term, so having some forward thinking on these things is extremely important in making sure you’re investing in a market you’ll actually want be in several decades from now.

Shift Your Focus From IRR & Equity Multiple To Cash Flow & Equity Value

Finally, the fifth adjustment I’d recommend making for an indefinite hold analysis is to shift your focus from IRR and equity multiple targets to cash flow and equity value targets over time.

While many private equity investors look primarily to the IRR to make investment decisions, a positive IRR requires a return of capital and a final cash flow date, meaning that this is really only a relevant metric if you plan to sell the property.

And if you don’t plan to sell the deal, looking at a cash flow metric like the cash-on-cash return when you first acquire the property to see the percentage of equity invested that you’ll be distributing to investors (or yourself) each year, or even a pure cash flow dollar amount that is going to be distributed each year later on in the hold period, is going to be a much more relevant metric to use for valuation purposes based on your own investment goals.

This also gives you a much more tangible metric to lean on, since knowing a property is going to produce $45,600 per year in cash flow 10 years from now will help you plan for the future much more than knowing that your IRR is 0.4% in year 10 of your analysis.

Use The Metrics YOU Care About

No matter what, a long-term hold analysis for a deal you’re acquiring on your own should reflect what you care about.

Whether that’s your cash-on-cash return when you buy the deal, the cash flow the property will produce when your kid goes to college, or the income the property will generate for you in retirement, making sure you’re modifying your analysis to your own personal goals is key in valuing the property accurately, based on your unique situation.

How To Run Your Own Analysis

If you’re looking to learn more about how real estate financial models like this work, and how to build your own models to analyze real estate deals, make sure to check out Break Into CRE Academy.

A membership to the Academy will give you instant access to our entire library of courses on real estate financial modeling and analysis, pre-built, downloadable acquisition and development models for multifamily, office, retail, and industrial properties, and even courses and models on investing in single family rental properties if you’re looking to start small and build from there.

Thanks so much for reading – I hope you found this helpful in analyzing your long-term hold deals!