Commercial Real Estate Property Types (& Which One’s Right For You)

Commercial real estate can be an exciting industry, with a wide array of different career paths to choose from in the business.

But whether you’re looking to land a job at a commercial real estate investment or brokerage firm, or you’re looking to do deals on your own, one of the most important decisions you’ll make in you commercial real estate career is the specific property type you’ll focus on, and where you’ll devote your efforts to build your expertise.

There are so many different avenues you can go down, and since those avenues differ so widely depending on where you decide to go in the business, in this article, we’ll break down the four main “food groups” in commercial real estate, the pros and cons of each, and where you might fit in best in the CRE industry.

If video is more your thing, you can watch the video version of this article right here.

The Four Major Food Groups in Commercial Real Estate

There are four main property types in the real estate industry, commonly referred to as the four major “food groups” in CRE.

Additionally, commercial real estate professionals commonly refer to properties as product, so you might hear someone referring to new construction properties becoming available for lease as, “New product coming on-line.”

And with that, the different types of properties in commercial real estate are generally referred to as product types, and in this article, we’ll talk through the four most prevalent product types in CRE, the pros and cons of each, and if you’re just getting started in the industry, where you might fit in best in the mix.

Multifamily

The first major food group in commercial real estate is multifamily.

Multifamily properties are for-rent residential properties, and can be anything from a small 8-unit apartment complex to a 20-story high-rise building with 500 units or more.

Multifamily is one of the most popular product types in commercial real estate, because it tends to be the easiest asset class to intuitively understand for most people. And as the argument goes, everyone needs a place to live, which creates a sense of security among many aspiring real estate investors looking to venture into the space.

Multifamily Investing Pros

In a hot market, one of the biggest and most impactful benefits of being in the multifamily sector is the ability for apartment investors to take advantage of immediate-term, positive economic shifts.

Unlike other commercial real estate product types with tenants commonly on long-term, multi-year leases, multifamily leases only tend to be about 6 to 18 months in length. And because of this, multifamily investors can quickly adapt to changes in market rents, and raise rents on an annual basis for the majority of their tenant base in proportion to demand in the market.

This means that if you own an apartment building in a market where multifamily rents have grown by 6% year-over-year across the metro, you’ll likely be able to capture that increase within just 12 to 18 months, rather than having to wait for 5, 7, or 10-year leases to expire before adjusting rents to market rates.

Multifamily properties also tend to have the largest and most diversified tenant base of all commercial real estate properties, meaning that investors are generally protected from major sudden drops in occupancy that might be seen in single or dual-tenant buildings.

For example, if a single tenant vacates their unit at a 200-unit apartment building, this likely only represents less than 1% of an investor’s total revenue on the project, and it’s highly unlikely this will cause the investor to have to scramble in an attempt to pay operating expenses or cover debt service for the month on the deal.

Multifamily Investing Cons

You’ll hear many self-proclaimed gurus out there preaching the benefits of multifamily, but here’s something they don’t tell you – of all commercial real estate product types, multifamily is generally the most “hands-on” operationally, by far.

So while people trying to sell you something might espouse multifamily investing as “passive”, managing property management teams is not a passive activity whatsoever if you’re trying to drive the performance of your property.

And especially if you’re buying a multifamily property with a value-add business plan, as many investors will do, managing the renovation and re-leasing efforts is often an extremely intensive process that requires significant effort.

Additionally, when you’re creating residential spaces for tenants to occupy, you are responsible for the design, which can create additional overhead if you have to hire a third-party consultant or bring someone in-house to help meet the ever-changing needs and wants of residential tenants.

On the other hand, in commercial properties like office, retail, and industrial assets, the tenant is generally going to run the design process to build out exactly what they’re looking for, which tends to take the pressure off and relieves an investor of the headache and complexity of adding design to the mix.

Additionally, on the other side of the coin from what we mentioned in the pros section, as quickly as rents can rise in multifamily, they can fall equally as quickly.

This means that if rents in a market drop by 10% over a 12-month period, as we saw in many major metros in 2020, your existing tenant base is going to expect that 10% rate reduction when it’s time to renew their lease, or they’ll go somewhere else that will happily offer that.

The Bottom Line on Multifamily

Overall, multifamily can be a very easy product type to understand, especially if you’ve lived in apartments before and understand the renter/landlord dynamic.

And if you don’t mind the hands-on management and enjoy the prospect of creating attractive living spaces for residents, multifamily can be a great product type to sink your teeth into.

However, if you thrive on complexity and being able to figure something out that someone else can’t, or you’re looking for a more hands-off, less operationally-intensive investment, you may want to look towards one of the three product types we’ll dive into next.

Office

The second major food group in commercial real estate is office.

Office properties can be anything from single-tenant office buildings in the suburbs, to high-rise office buildings in major cities, to co-working spaces in creative, redeveloped buildings.

In my experience, office can be one of the most difficult product types for investors to wrap their heads around, and also tends to be one of the highest beta (i.e. riskiest) product types among all of commercial real estate.

Office Investing Pros

Right off the bat, let’s get one thing on the table – you can make a lot of money investing in office properties in a very short period of time.

In fact, I’ve worked on deals where buildings were sold for double what they were acquired for in less than a 12-month period.

And this isn’t magic or (usually) just the result of timing the market correctly. The reason why investors are able to create value so quickly in office deals is through commercial leasing, specifically signing a lease with a large tenant that can take up all (or the majority) of the vacant space at a struggling office property.

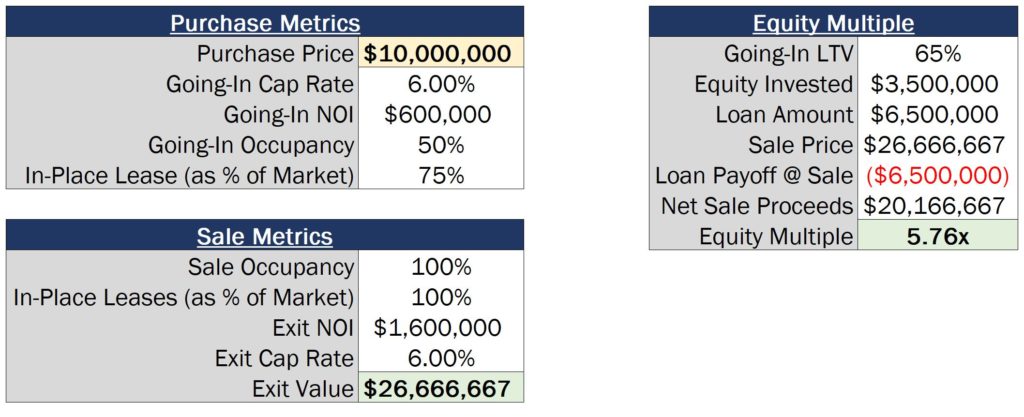

For example, let’s say an office investor buys an office building for $10MM at a 6.0% cap rate, but the property is 50% occupied and the single existing tenant has a lease that is 25% below market rates.

From there, let’s say that one year later the existing tenant has vacated, and you find one single user for the entire property at current market rents, and then you’re able to sell that property at the time, again at that 6.0% cap rate.

With a going-forward $1.6MM NOI and one fresh lease term with a new, credit-worthy tenant, you’ve increased your property value to $26.67MM in less than 18 months. And if we assume a standard 65% LTV ratio on the acquisition, an investor would be able to almost 6x their initial investment (5.76x) during this time.

Additionally, if you’re able to sign leases with strong-credit tenants, office properties can also provide almost bond-like payment guarantees, with companies like Apple, Google, Facebook, and other Fortune 500 companies generally having very low default risk on their office space.

Office Investing Cons

Even with the significant upside the office product type offers, office property investing can be extremely volatile, especially when you own a property with just a small handful of leases that make up the majority of the revenue on the deal.

For example, if you acquire a property with just four tenants in a 40,000 square foot office building which each occupy 10,000 square feet of rentable space, every time a tenant’s lease expires, your property’s occupancy immediately drops by 25%. And this, unfortunately, can often be at (or near) the break-even cash flow point for investors using debt to acquire their properties.

Additionally, for office deals, the cash flows the property will generate tend to be extremely irregular over a span of a three to ten-year hold period.

This is because office tends to be one of the most capital-intensive product types in all of commercial real estate, so when an in-place user vacates and a new user is looking to lease space, generally that prospective tenant is going to expect some sort of significant tenant improvement (TI) allowance to help build out their space.

Additionally, every time a lease turns over, you’ll have to pay leasing commissions to a broker to help you find a new tenant to occupy the property, which can really add up if you have a dozen leases (or more) reaching expiration during your hold period.

The Bottom Line on Office

Office properties can be excellent investments if you know the market well and you’re looking to be opportunistic in your investment strategy, or if you’re looking for bond-like cash flows from buildings occupied by strong-credit tenants.

However, if you’re looking for steady cash flow over time and want to have a diversified tenant base at the same time, office might not be the right fit for you based on the investment goals you have.

Retail

The third major food group in commercial real estate is retail.

Retail properties could be anything from stand-alone drugstores and restaurants, to shopping centers, to major regional malls. And today, retail is undergoing a massive shift with the rise of e-commerce, and the way retail was done 10 years ago is not the way retail is done today.

With that said, however, change tends to bring about opportunity, which makes retail one of the most exciting property types in all of commercial real estate today.

Retail Investing Pros

Innovation in any industry brings opportunity.

And especially when looking at properties like dying regional malls all across the US, most of these assets are well-located deals with excellent real estate fundamentals, that just need to find a better use.

Even though consumers can now readily buy products online, they still need a place to go get their hair cut, go out to dinner, or see the latest movie release on the big screen.

So today, one of the biggest opportunities in the retail space is buying well-located deals that just need to mix up the tenant base a little bit to create a more experience-based shopping experience, and/or what is referred to as “adaptive reuse,” or changing the use of functionally obsolescent retail space into other product type uses like industrial, multifamily, or office.

Additionally, another pro of retail real estate investing (that we alluded to earlier on in this article) is that, often times, the tenant base of a retail property will reimburse a portion, or all, of the operating expenses associated with their pro rata share of the leasable area of the asset.

Lease structures in which tenants reimburse their pro rata share of the property’s operating expenses are referred to as triple-net (NNN) leases, which essentially means that the property owner is able to pass down the operating expense burden to tenants, often including property tax, insurance, and general repairs and maintenance of the property.

Retail real estate also generally tends to be far less operationally-intensive than a product type like multifamily, as many of these tenants will run their operations like a well-oiled machine, and generally only reach out if something at the property is preventing them from making sales.

Retail Investing Cons

A major downside of retail real estate investing is the other side of the coin regarding what a point we mentioned earlier, and that is that retail is changing very, very quickly.

And even with longer-term leases in place, if a company goes out of business, it’s often very difficult and costly for a landlord to fight a legal battle to recoup any guaranteed rent they’re owed.

Even worse, many retail leases at larger shopping centers and malls have something called a “co-tenancy” clause within them, which essentially says that if a major tenant in the center stops operating or the center’s occupancy as a whole drops below a certain level, that tenant can reduce (or even completely eliminate) their rental payments for a certain period of time, or may even be able to vacate the center completely with no penalty.

Retail leases can also be extremely complex, so you’ll want to make sure you have a solid understanding of the different terms to look out for in retail leases and run your due diligence thoroughly before you buy a retail deal. Reading and auditing leases is a critical part of retail real estate investing, so if you don’t enjoy getting into the legal language and don’t want to pay an attorney to do it all for you, retail might not be the best bet for you.

The Bottom Line on Retail

Right now is one of the most interesting times in history for retail real estate, and with the landscape changing so quickly, there is a tremendous opportunity for investors right now to acquire struggling assets ready for a turnaround, and/or to repurpose retail assets into other property types that are more heavily in-demand within the market.

If you find consumer behavior and retail interesting overall, and you’re looking to dive into a “Wild West” product type without much of an instruction manual on how to succeed in the new economy, retail could be a great fit for you.

Industrial

The fourth major food group in commercial real estate is industrial.

Industrial properties consist primarily of warehouses and manufacturing facilities that help companies create and store goods.

Industrial Investing Pros

Today, one of the biggest pros of industrial real estate investing is that e-commerce has made the demand for industrial product extremely high in the market, which has caused industrial rents to rise substantially over the past several years, and cap rates for industrial product have decreased at the same time.

Industrial properties are also generally regarded as the least management-intensive of the four major food groups on this list, and in many cases, this product type can also be the least capital intensive of the CRE asset classes, as well.

There’s also a huge opportunity in the industrial space for developers who can create “build-to-suit” product, where commercial real estate investors can work with a tenant to find a site, build a custom building, and go into a project with a pre-signed lease and a tenant in tow.

Industrial Investing Cons

One of the biggest downsides of the industrial product type is the single-tenant nature of many of these properties, meaning that, if a vacancy occurs at an industrial project, that property can go from 100% occupied to 0% occupied very, very quickly.

Additionally, when the economy slows and consumers aren’t purchasing as many retail goods, the demand for creation and storage of those goods decreases, which can decrease the demand for industrial space in the market.

Not that this is a bad thing for everyone, but industrial also tends to be the least “sexy” type of commercial real estate out there, and while high-rise office buildings in major metros and high-profile shopping centers with national retail tenants can be exciting to work on, industrial warehouses in the outskirts of secondary and tertiary markets can be a lot less exciting when you’re in the weeds day-to-day.

The Bottom Line on Industrial

Overall, if you want low management intensity, you can find a property with a long-term lease with a credit tenant in-place, and you don’t mind side-stepping the high-profile travel and tours that may accompany some other product types, industrial is on fire right now and presents a huge opportunity for investors looking to enter the space.

A Deeper Dive

If you want to take a deeper dive into any of the four major food groups mentioned and the analysis behind each, make sure to check out The Complete Guide To Multifamily Real Estate Investing, The Complete Guide To Retail Real Estate Investing, and/or The Complete Guide To Office & Industrial Real Estate Investing courses available on our Courses page, which include detailed walkthroughs on the underwriting process for each of these product types, and acquisition analysis case studies at the end of each course to practice what you’ve learned in a full pro forma model.

And, as always, if you want access to all Break Into CRE courses, all Break Into CRE models, and additional one-on-one support, make sure to check out Break Into CRE Academy.

The Academy includes in-depth course videos and training on real estate financial modeling and analysis, you’ll get instant access to pre-built acquisition and development models so you can practice what you learn in the coursework to analyze acquisition and development opportunities, and you’ll even have access to private, one-on-one, email-based career coaching support to get your questions answered if you’re navigating the job search process and need some extra help along the way.

I hope this helps give you an overview of the CRE business and where you might want to go next – good luck!