Multifamily Underwriting in 7 Steps

Multifamily is one of the most popular asset classes in commercial real estate.

Apartments are one of the easiest product types to understand, and without the complexities of long-term leases that can come with office, retail, and industrial properties, many investors are naturally drawn to the multifamily space.

Couple this with supply that just can’t seem to keep up with demand in the multifamily sector, and you have a recipe for valuations continuing to climb in the US over time.

But speaking of valuations, if you’re looking to buy a multifamily deal, what does the underwriting process look like, and how do you actually determine what a multifamily property is worth?

In this article, we’ll break down multifamily underwriting into seven steps, so you can understand what the process of multifamily underwriting actually looks like in practice, and how you can apply this process to deals you’re analyzing in the future.

If video is more your thing, you can watch the video version of this article here.

What Is Multifamily Underwriting?

In its simplest form, multifamily underwriting is the process of:

- Gathering data about a property

- Making assumptions about how the property is likely to perform in the future

- Creating projected cash flows on the investment

- Assigning a valuation to the property based on that information

Having spent several years working in acquisitions for one of the largest multifamily owners and operators in the US, I’ve underwritten thousands of multifamily investment opportunities across the country throughout my career.

And with that, after doing this so many times in so many different markets, I started to notice some patterns that showed up with each and every deal I analyzed, that I want to share here in case they’re helpful for someone wanting to put some structure around what can (admittedly) be a daunting process when first starting out.

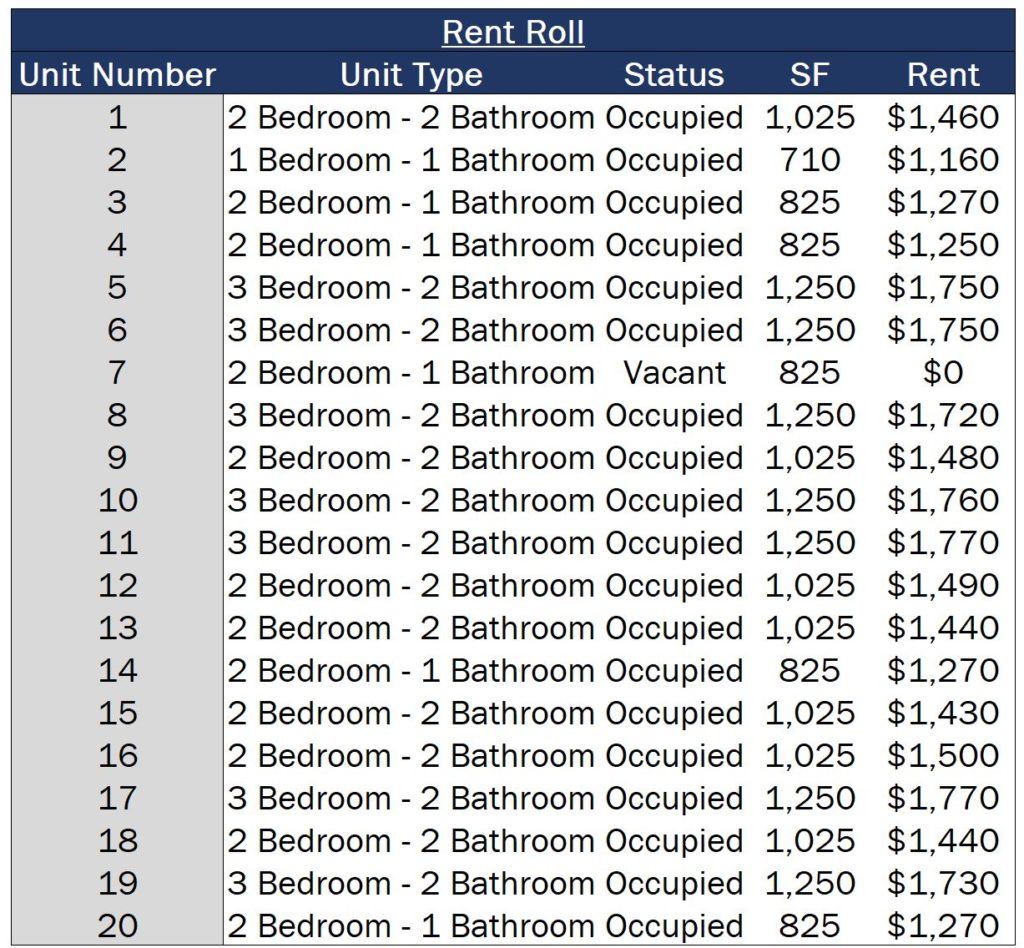

Step 1: Determine Your In-Place Revenue

Step number one in this process is to determine your in-place revenue, or the revenue the property is generating on a monthly basis with the current contractual leases in place, plus any other consistent ancillary income items that you expect to continue at the property.

This means getting your hands on a current rent roll with a list of all current tenants at the property, their in-place base rent, any contractual ancillary fees they are paying in their lease (such as pet fees or storage fees), and any upcoming concessions that might reduce the rent you can expect to receive.

Additionally, you’ll also want to make sure you have access to trailing 12 months (T-12) financial statements which show operating income on a monthly basis over the past year, so you can get a sense of what other income items like late fees or forfeited security deposits might be on an ongoing basis.

Together, this information will help you determine what you believe the total revenue collected at the property will be on a monthly basis when you acquire the deal, which will be key in tightening up your valuation on the property.

Step 2: Determine Your In-Place Expenses

Next up, to round out your net operating income (NOI) calculations, you’ll need to determine your in-place expenses, or the ordinary, recurring operating expenses incurred at the property on a monthly or annual basis.

These will be made up of items like property taxes and insurance, repairs and maintenance, administrative fees, office expenses, payroll expenses, marketing costs, property management fees, and other cash outflows that are ordinary and necessary to operate the property on a month-to-month basis.

Again, a T-12 operating statement (and ideally the past two or three years of data) will give you detailed information on what operating expenses have been at the property in the past, if there were any irregularities in recently incurred expenses, and what operating expenses might be for you as the new owner when you acquire the property.

One thing to note here is that, unlike many retail, industrial, and some office properties with tenants under triple-net (NNN) lease agreements, multifamily investors generally can’t pass operating expenses back onto the tenant. And with that, one of the biggest expense line items that you’ll need to be aware of is your property tax, specifically whether or not your property value will be reassessed upon purchase, and how that might impact your operating expense load.

Many US states will reassess property values when real estate is sold (see Proposition 13 in California, for example), which can sometimes significantly increase the property tax burden of a new owner if the property value was previously underassessed.

This doesn’t happen in all markets, and you’ll have to do some digging in the specific state, county, and/or city the deal is in, but this is an easy one to whiff on that can be a big miss in underwriting if you’re not careful.

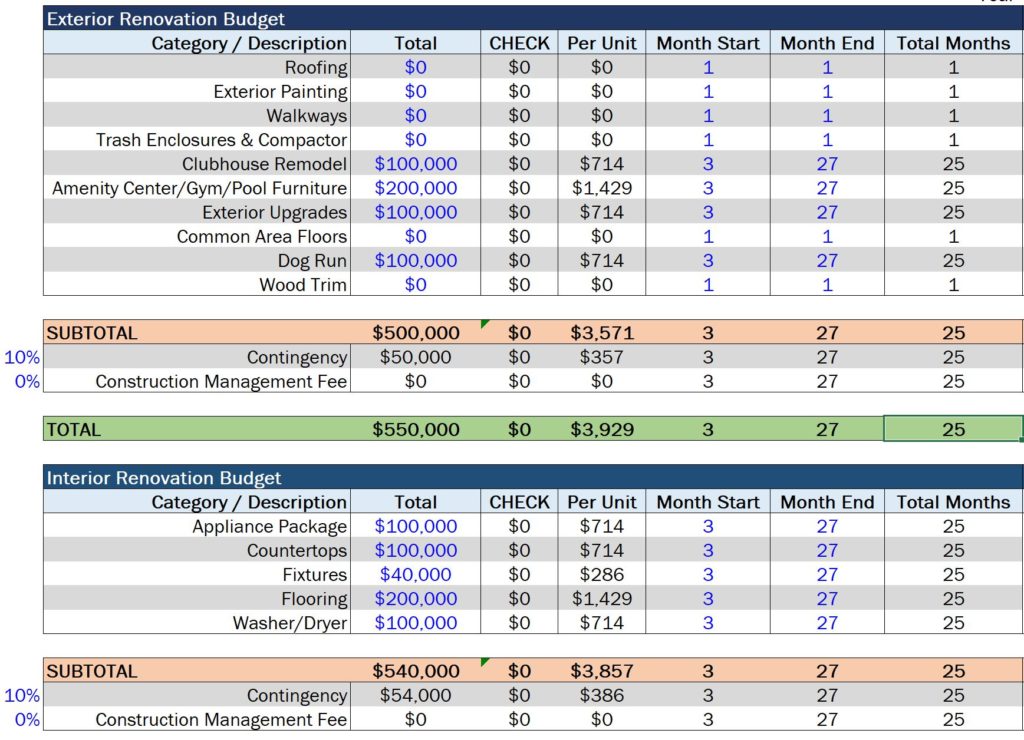

Step 3: Build Your Construction Budget

Many multifamily investors will go into a deal with the goal to create value through a renovation.

And whether that’s through renovating common areas, improving an on-site fitness center, adding a dog park, or renovating unit interiors, these can be significant costs that will have an equally significant impact on the overall performance of the deal.

With that, getting your projected construction costs dialed in before you acquire the property (and come up with a valuation) is extremely important, and you’ll often want to enlist the help of a dedicated construction professional, especially if you’re not an expert in construction yourself.

Within your real estate financial model, you’ll generally want to have a breakdown of all renovation costs, including hard costs such as labor and materials, soft costs such as architectural and engineering fees, contingencies as a buffer for any unplanned expenses, and also the projected timing of the construction, and when you think those costs might be incurred.

This last part is especially important, because when you complete each renovation will have a direct impact on the timing of the rent premiums you can charge to new tenants, which will have a significant impact on your cash flows and valuation of the deal.

Step 4: Make Growth & Vacancy Assumptions

This step will create a bigger impact than you might think, as market rent growth values directly drive NOI, which also drives what your projected sale price will be, and ultimately drives your valuation of the deal.

With that, making educated assumptions around what you believe rent growth will be for this type of property in the market in the years to come is essential to creating accurate projections on your deal.

Most investors will use a database like Yardi Matrix to gather data on historical rent growth values in the market and to reference growth projections for the next 3-4 years, but if you don’t have access to a paid database, Zillow Research Data and Zumper Research both tend to be great free resources to get a general idea of rents in a market.

Expense growth is also a big one here, and you’ll need to make assumptions around how much you believe general operating expenses will increase on an annual basis.

Many investors will use changes in the Consumer Price Index (CPI) as a proxy for how they believe many operating expenses will increase in the future, but again, property taxes can be a tricky one here. Make sure to get clear on the reassessment schedule in the specific market of the property you’re analyzing and how that will affect your property taxes. Ideally, with a separate growth rate than other operating expense growth assumptions that are guided by CPI changes.

Step 5: Make Projections About Rent Premiums

If you’re planning to renovate the property, what does that mean for rents?

For many multifamily investors, the goal is to make upgrades to the common areas and/or unit interiors, and as a result of that, be able to charge higher rents to tenants once those are complete.

And again, getting these right is critical to making sure your cash flow projections are as accurate as possible, since your rents directly affect your NOI, which affects your projected sale value, which affects your valuation.

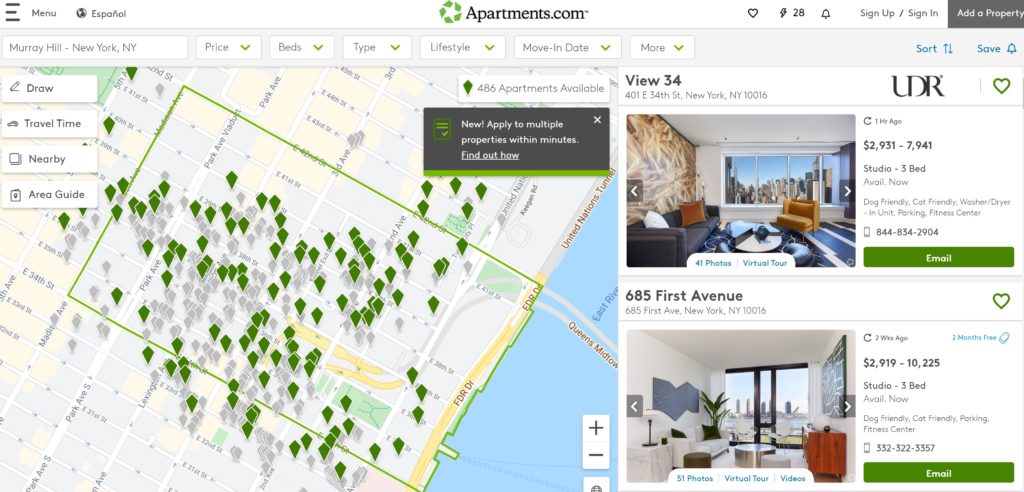

Fortunately, these are relatively easy to determine (using free information), simply by looking at comparable properties in the submarket which reflect the “finished product” of what you’re planning to create.

For example, if you’re acquiring a property built in 1962 in the Murray Hill submarket in Manhattan and plan to renovate the unit interiors, you can search for other units for lease that were built in the 1960s in that same submarket which have already undergone the same renovation as you plan to undergo, and get a sense of what rents they’re commanding post-renovation.

Listing sites like Apartments.com make this process relatively easy, and if you can pull together three to five comparable properties, you’ll start to see patterns that emerge.

Step 6: Make Debt Assumptions

For underwriting purposes, debt assumptions on a property can make a significant difference in returns and property valuations, as well.

On your loan, you’ll want to make sure you’ve made accurate assumptions around your total loan amount, what your interest rate will likely be, if that rate will be fixed or floating throughout the loan term, what the amortization period and term will be, and if there will be any interest-only period or future funding offered.

Lender relationships will come in handy here, and a quick turnaround on a term sheet will be extremely helpful in getting a clearer idea of what your loan terms are likely to be, and how those will affect your projected cash flows on an acquisition.

I’ve seen debt make and break deals in either direction, and if you’re way off on debt assumptions, you’ll also likely be way off on your valuation. Getting at least rough terms from a lender (or two) before you submit an offer can make sure you feel confident in your assumptions, and can line up the appropriate amount of equity required to close on the asset.

Step 7: Solve For a Valuation

Once you have all of the information above and your projected cash flows are built out in your model, it’s time to put everything together and come up with a valuation for the property.

For most multifamily investors, the way a property is valued is going to be based on the specific goals of the investment, generally using target return values for three key metrics:

- Internal Rate of Return (IRR)

- Equity Multiple

- Cash-on-Cash

Most multifamily investors go into a deal with target figures for one, two, or all of these metrics, either based on the returns they’ve promised equity investors when raising capital for a fund, or based on the risk profile of the individual deal and what investor return expectations are likely to be.

And to back-solve for a target IRR, equity multiple, or cash-on-cash return, multifamily investors will adjust the purchase price in their real estate financial model until the deal, based on all assumptions made, will achieve (or exceed) targeted investor returns on the property.

How To Put This Into Practice

The steps we outlined above can admittedly feel overwhelming, but these points will each give you a framework to use to help you feel more confident when underwriting multifamily deals.

And if you’re looking for more in-depth, additional training on multifamily investment analysis, as well as access to a pre-built multifamily acquisition model to analyze deals, I’d highly recommend checking out our course, The Complete Guide To Multifamily Real Estate Investing, available on our Courses page.

That course will walk through the multifamily underwriting and analysis process in detail, with video training and Excel practice files to help solidify the concepts as you work through the material. The class also includes a practice acquisition case study at the end of the course, so you can test your knowledge and apply the skills you’ve learned to a sample deal immediately.

And if you’re looking for additional training on real estate financial modeling and analysis and want access to all Break Into CRE courses, all Break Into CRE models and training files, and an additional level of one-on-one support, make sure to check out our premium training platform, Break Into CRE Academy.

The Academy includes in-depth course videos on real estate financial modeling and analysis for multifamily, retail, office, and industrial properties, you’ll get instant access to pre-built acquisition and development models so you can practice what you learn in the coursework to analyze returns on new acquisition and development opportunities, and you’ll even have access to private, one-on-one, email-based career coaching support to get your questions answered on your own unique situation, if you’re navigating the job search process and need some extra help along the way.

Good luck on your next multifamily deal – I hope this helps!