How (and When) To Negotiate a Real Estate Job Offer

So, I have good news and I have bad news.

The good news is that you’ve just received an offer for your dream job in commercial real estate that you’ve been pursuing for months, finally putting an end to the stress and uncertainty of the job search process.

The bad news is that this offer didn’t quite come back where you thought it would, and the salary, all-in compensation, and other benefits are definitely below what you believe you’re worth in the market.

So, what do you do?

The obvious answer is to negotiate, but is that always the right move?

And if you do decide to negotiate, how do you maximize your chances of getting the things you want without risking losing the offer you have in hand?

Negotiation is one of the trickiest parts of the job offer process, and in this article, we’ll cover whether or not you should negotiate your offer, and if you do decide to push back, four ways to improve your odds of getting the things you want at the end of that negotiation.

If video is more your thing, you can watch the video version of this article here.

When You Shouldn’t Negotiate a Real Estate Job Offer

Let’s address the elephant in the room here – does it always make sense to negotiate?

My blanket statement answer to this is yes – the vast majority of commercial real estate employers expect some sort of negotiation in the job offer process. However, it’s important to note that this blanket statement answer only applies if your intention is to accept the offer if you can come to an agreement with the company.

Some people will start the negotiation process just to be able to get two firms competing against each other to essentially bid on their salary, but in commercial real estate, you absolutely do not want to do this.

The CRE industry is a surprisingly small world.

Leading a company down a rabbit hole of negotiations, just to have you leverage that offer to get a raise at your current firm or to take that offer back to another company, is not only bad news for your overall reputation with the firm that you’re dealing with, but in the industry as a whole, as well.

When You Should Negotiate a Real Estate Job Offer

With that said and out of the way, if your intent is to take the job, I would highly recommend negotiating in almost all cases, even if you’re unemployed right now.

Most companies put out initial offers with the expectation that candidates will negotiate those offers, and salary and bonus figures tend to start on the low end of the company’s acceptable range because of this.

With that, not negotiating at all usually means you’re leaving money on the table.

And if you’re worried about rejection, or the company saying “nevermind” just because you negotiated your offer, don’t be. In almost all cases, assuming your requests are reasonable, some form of negotiation is expected and you’re not going to see a rejection just because you countered the initial offer given to you (if you do, that’s a red flag about the company in general).

So when you do negotiate, how can you maximize your chances of getting all (or most) of what you want during the process?

Make It Clear You Want The Job

First, above anything else, I’d recommend making it clear to the company from the start that you want to make this job offer work.

As much as possible, you want to show that you’re committed to the role and the company, and you just need to work out a few details of the offer to make it work from a personal standpoint.

The main reason why this is so important is because, to get you the things you’re asking for, your contact point at the firm is going to have to “go to bat” for you to higher-ups in the company to justify a higher salary, bonus, or any other requests you make.

And just like everyone else, that person is trying to save face and advance their own career.

With that, if they have reason to believe you might not take the offer even if the companies meets all of your requests, that person is going be much more reluctant to take the risk of showing poorly in front of their bosses by fighting for someone who ultimately wasn’t going to take the job in the first place.

Going down the route of a negotiation is also extremely time-consuming for hiring managers, especially in bigger companies with multiple layers of approval for new hires. By making sure you clearly communicate your desire to make this work after all the technical details are sorted out, you significantly improve your odds of getting what you want.

Back Up Salary, Bonus, or Other Compensation Requests With Data

Once you’ve made clear your intent to take the role, now you’re ready to get into the details of exactly what you’re looking for out of the offer.

And with that, my second tip here is to make sure that you’re backing up and justifying any salary, bonus, or other compensation requests that you’re making (using reliable data, if possible).

This means that if you’re negotiating an increase in your base salary and you think that (based on your position and experience level) you should be paid more, you need to do your research and actually gather data that supports the belief that you have.

In commercial real estate, the annual CEL & Associates report can be really helpful in gathering some empirical data around what the compensation ranges are in the market for certain positions. The report even breaks this down by position title, high, medium, and low ranges, and product type, so you can really get granular with how the data might apply to your specific market, experience level, and job function.

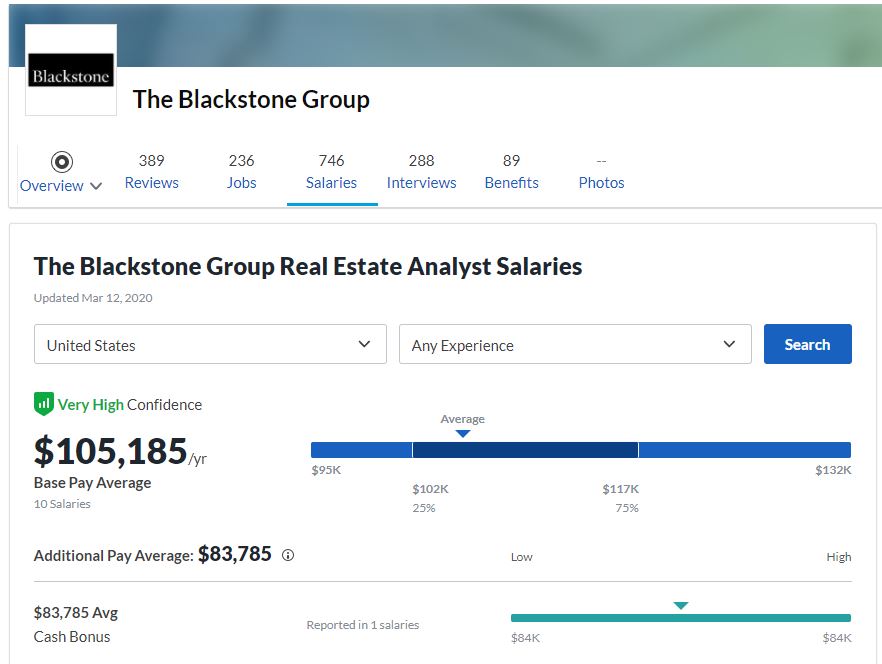

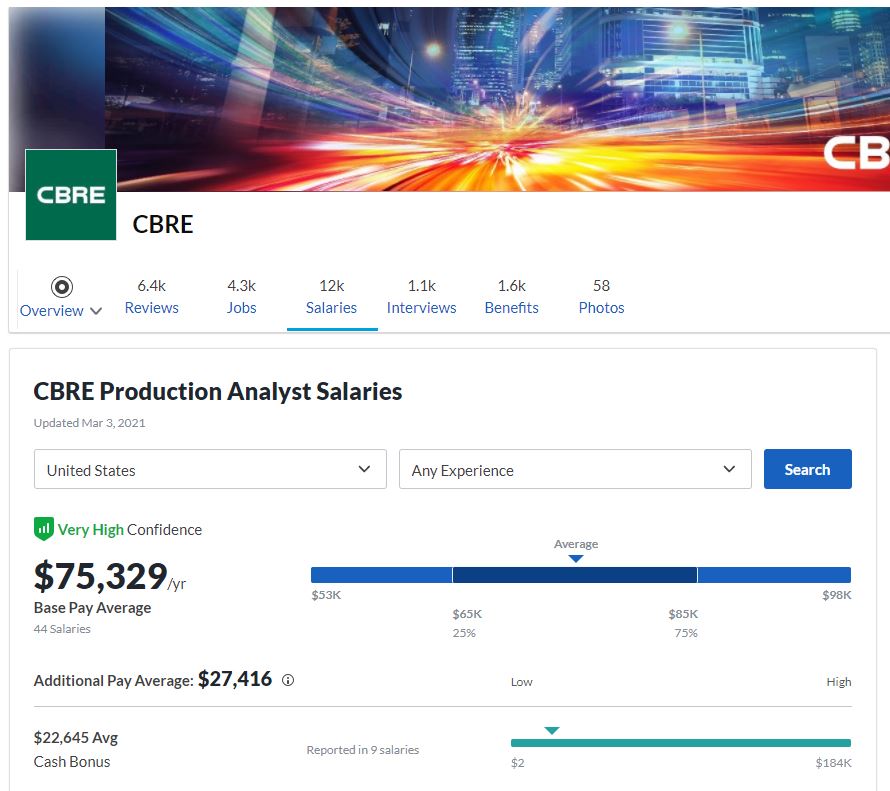

Sites like Glassdoor or LinkedIn can also be great ways for you to gather data on what other people in the industry are making in similar positions at similar companies, so these are also helpful resources when conducting your research.

If you’re not able to find accurate market data (or you want an additional layer of justification on top of the market data you’ve found), this could also involve:

- Sharing your current compensation package and letting the employer know they’d need to come in above that number to make the offer work

- Telling the employer about something like an end-of-year bonus that you’re giving up if you switch jobs in the middle of the year

- Mentioning a different offer you have in hand from another company that exceeds their offer (which you’d like to accept)

Again, speaking of the hiring manager going to bat for you, this also gives that person concrete evidence to be able to justify to higher-ups in the company why they should go ahead and pay you more money or give you other things you’re asking for.

Be Open To Being Flexible About How You’re Paid

Sometimes, companies truly won’t be able to “get there” with everything you’re looking for in an offer.

But if you really want to take the job and everything checks out with the exception of compensation, what can you do?

If you really want to take the role and the pay just isn’t where it needs to be, my third piece of advice is to be open to flexibility with exactly how you’re being compensated.

Especially within a commercial real estate firm, there are a lot of different ways to get paid, and many of these more unconventional ways end up being much more lucrative long-term than something like an up-front 5% increase in salary or bonus.

In practice, this might look like:

- The company offering you the opportunity to invest in deals the company acquires with a smaller than normal minimum investment of something like $5,000 or $10,000

- The company offering you $10,000 per year of “deal credit” that can be used to invest in projects the company acquires

- The firm allowing you to participate in a portion of the promoted interest when the property is sold

Other opportunities presented to you could involve taking a piece of acquisition or disposition fees on new deals you work on, taking a percentage of commissions if you’re working at a brokerage shop, or even taking a percentage of something like leasing override fees if you’re working in an asset management capacity.

These items also tend to be very low-risk to the company up-front, which can be highly preferable to some employers, especially in times of uncertainty.

Salary commitments are due to employees regardless of how the company or the greater economy performs, but deal and/or fee participation makes sure that the employee is paid only when the company gets paid, giving the firm more breathing room with their overhead, and the employee more incentive to do their job well on a daily basis.

Be Open To Revisiting Compensation at a Later (Predetermined) Date

Finally, if none of the above points are an option for your employer, or the company still can’t get you where you want to go using all of those different compensation methods, my final tip here is to be open to revisiting compensation at a later (pre-determined) date.

This could mean a review six months into the job where your pay is revisited, or even a predetermined raise assuming you hit certain objectives.

This not only gives you a clear goal of something you’re working towards, but it also gives you time to prove to the company why you’re worth what you’re asking.

It’s one thing to say during a performance review that market rate is $X and you’re making $Y, but it’s a much more powerful statement to point to all of the revenue-generating activities you’ve done in the first 6 months of your time on the job, and how you’ve directly benefited the company financially.

Especially during tough economic times, or for young companies only a few years into operation, giving your employer this window of time gives them more breathing room to ramp up production, while also allowing you to prove your worth to the company and quantify how you’re adding value to the team.

Consider Learning Opportunities

Aside from all of these negotiation tactics, one thing I would recommend (especially when you’re first breaking into the industry at the analyst level) is to keep in mind that your total compensation package for your first role generally shouldn’t be the most important determining factor regarding whether or not you take the job.

In the grand scheme of things, the opportunity you’ll have to grow within the position and the industry (rather than the exact paycheck you’ll get every two weeks in your first year of employment) is going to be far more meaningful in determining your long-term success in the commercial real estate industry.

How This Works in Practice

To put this into context, this is shown really well in brokerage roles.

It’s not uncommon for analysts at major brokerage firms to have base salaries that range anywhere from about 20%-40% less than their peers on the principal side with those same entry-level analyst roles, which can be really discouraging for people just starting their careers on the brokerage side.

However, 3-5 years into that analyst’s career in brokerage, assuming they’ve stuck with the role and worked hard, it’s not uncommon for these analysts to now be making anywhere from 50% to 100% more than their principal side counterparts with that same level of experience, and possibly even more if they’ve moved into production.

How Should You Negotiate?

The bottom line is that, if you have the opportunity to invest in deals, participate in promoted interest, or even just learn from smart people who know how to make money in entrepreneurial environment, these can all be very good reasons to accept a job offer on their own, even if your salary isn’t quite where you’d hoped it would be.

Keep in the back of your mind that the experience you get in certain positions can often be worth worth far more than a $5,000-$10,000 salary bump, so if the job really is your dream role and the only thing that’s stopping you from moving forward is the base salary, there are many other ways to make that up.

And if you’re going through the commercial real estate job application or commercial real estate interview process and want to make sure you’re prepared when your dream job arises, make sure to check out our premium training platform, Break Into CRE Academy.

A membership to the Academy includes private, members-only, email-based career coaching, so you can ask questions and get feedback on your own unique situation, and you’ll also get instant access to our complete library of video courses on real estate financial modeling and analysis, so you can build the technical skill sets you’ll need to land a job at a top real estate private equity, brokerage, or lending firm.

If you’re heading into the negotiation process, I hope this was helpful. Good luck!