How To Invest in Commercial Real Estate [With Less Than $10,000]

Investing in commercial real estate can be a pretty daunting process, especially with the sky-high price tags that often come along with these deals.

This can tend to scare a lot of people away from building a real estate portfolio altogether, but there are several ways to get exposure to this asset class without cutting a huge check.

If you have limited access to funds or you’re just starting out in your career, this article covers three ways to get in the game with less than $10,000, and how you can start building your real estate portfolio today (with a lot less money than you might think you need).

If video is more your thing, you can watch the video version of this article here:

Invest With Your Company

The first strategy here is the method that I used to make my first commercial real estate investment, and this involves working in the industry and investing alongside the company you work for.

Real estate deals put together by many smaller, entrepreneurial investment and development firms are often capitalized primarily with equity from friends and family, sometimes with 30-50 investors (or more) funding a single a deal.

And because of this, adding a handful of employees to the investor list often ends up not only being allowed, but actually encouraged by the company, as a strategy to both raise additional capital and keep employees engaged in their work.

And to make sure that everyone within the company has access to these deals, firms will often reduce the minimum investment required from $25,000, $50,000, or even $100,000 in many cases to something like $10,000, $5,000, or sometimes even less.

By investing with the company you work for, you’re not only getting exposure to commercial real estate as a passive investor, but you’re also training yourself to make investment decisions with your own capital on the line. At the same time, you’re also working on these deals directly and learning how to manage a portfolio, add value, and sell deals at a profit.

This also makes going to work every day a lot more fun, and gives you the ability to work directly on finding and managing your own investments (without the stress that comes along with striking out on your own).

If you can’t find a job on the principal side where you’re able to co-invest with your company, working in brokerage can also open up opportunities to invest in deals you work on, since many small to mid-sized firms will allow their brokers to roll their commissions into a deal.

In some cases, this can end up being an even better situation than investing with your own firm, since this will give you even more exposure to different sponsors, product types, and even geographic markets, helping you reduce your risk and diversify your portfolio.

Raise Third-Party Equity

If you don’t want to be a passive, limited partner and you’re not able to invest with the company you work for, another way to invest in commercial real estate with very limited capital is to raise third-party equity as a sponsor on a deal.

This is the traditional real estate private equity model, where an investment firm (or individual) will do the work necessary to identify a property to acquire, put the property under contract, and manage the deal on behalf of passive equity investors.

In exchange for that work, those passive equity investors will put up the majority of the equity required and pay the sponsor fees for the work they’re putting in, which can significantly reduce the up-front equity commitment required from the sponsor.

Limited partner equity contributions often make up 90%-95% of the overall equity requirement in a real estate partnership, and even if you’re working on bigger transactions where the remaining 5%-10% equity requirement is substantial, acquisition fees can often make up the majority (or even all) of the remaining equity requirement.

An Example

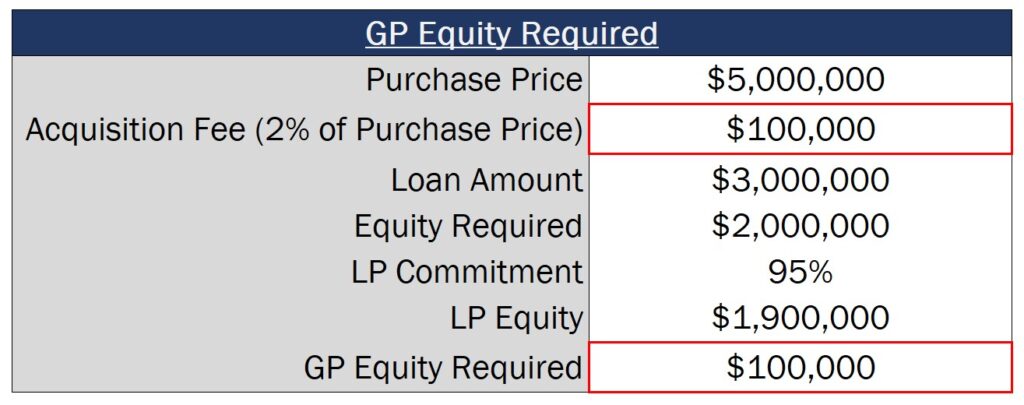

For example, if a sponsor were to identify a $5,000,000 property, work with a lender to secure a $3,000,000 loan, and raise equity for the remaining $2,000,000 required to close the deal, if the limited partners put up 95% of the equity, this would make the sponsor’s equity requirement just $100,000.

And even though $100,000 isn’t a small amount of money, if the sponsor charges a market-rate acquisition fee of 2% of the purchase price for a deal of this size, that fee alone comes out to exactly $100,000.

Many joint venture structures will also allow a GP to roll this fee into the deal as their equity commitment, allowing a sponsor to control a $5,000,000 asset with essentially $0 in funding coming out of their own pocket.

Now, in practice, there will be closing costs, deposit requirements, dead deal costs, and other operating costs associated with striking out on your own. However, if you have very limited funds and you’ve built up a strong network and a skill set to be able to identify, acquire, and manage commercial real estate, when you start to do the math, the out-of-pocket requirements to raise capital and do deals are often significantly less than they might appear at first glance.

Investing in Publicly-Traded REITs

If you’re not up for investing with the company that you work for or raising capital to do your own deals, the last option here is available to almost anyone, and this is to invest in publicly-traded REITs.

I’m not a huge fan of this strategy if you’re working in the industry already and you know how to analyze individual deals, since a lot of the tax benefits that you’ll get from investing directly in commercial real estate tend to go away by going this route.

However, if you don’t have any other options and you want to get in the game with very limited capital, buying REIT stock can be a great way to do it.

The National Association of REITs (NAREIT) website is a great online resource to research the options out there, and because these are publicly-traded companies, there is a lot of information available online to help narrow down your search.

And aside from the benefit of transparency, another major benefit of investing in REITs is the level of diversification these types of investments will typically give you, which is very difficult to match when investing in deals directly.

Publicly-traded REITs are generally extremely large companies with extremely large portfolios, and by buying REIT stock, you can immediately get exposure to different real estate product types, as well as real estate assets across the entire country (or even the entire world).

Because you’re buying a piece of an entire company, distributions also tend to be slightly less volatile than what you might see when investing in individual properties. And while stock prices can fluctuate pretty wildly on a day-to-day basis, if you’re a long-term, buy-and-hold investor that believes in a certain asset class or a certain geographic market, buying and holding REIT stock over the long-term can be a great way to get exposure to real estate, while also keeping your capital liquid and diversified in the process.

How To Learn More About Real Estate Investment Analysis

Early in my career, one of the things I heard most often from people who had been in the industry for a while was that these people wished they had bought more real estate sooner. And if limited access to funds is stopping you from getting in the game, these are three ways to start building your real estate portfolio as early as possible.

And if you want to learn more about real estate investment analysis, or you want to make sure you have the skills you’ll need to be able to land a job at a top real estate investment or development firm, make sure to check out our all-in-one membership training platform, Break Into CRE Academy.

A membership to the Academy will give you instant access to over 120 hours of video training on real estate financial modeling and analysis, you’ll get access to hundreds of practice Excel interview exam questions, sample acquisition case studies, and you’ll also get access to the Break Into CRE Analyst Certification Exam. This exam covers topics like real estate pro forma and development modeling, commercial real estate lease modeling, equity waterfall modeling, and many other real estate financial analysis concepts that will help you prove to employers that you have what it takes to tackle the responsibilities of an analyst or associate at a top real estate firm.

As always, thanks so much for reading, and make sure to check out the Break Into CRE YouTube channel for more content that can help you take the next step in your real estate career.