The Three Most Common Commercial Real Estate Interview Questions (& How To Answer Each)

If you have a commercial real estate interview coming up, the process can be stressful and overwhelming (I know, I’ve been there).

It’s not uncommon to have a commercial real estate interview last several hours with half a dozen people meeting you at various different times, all with their own questions to help vet you for the team.

So, to help you know what to look for within the wild card of questions that might be thrown your way on interview day, this article will break down three of the most commonly asked questions in commercial real estate interviews today, and how to answer each to put yourself ahead of the pack.

Whether you’re interviewing for a real estate analyst or real estate associate role at a private equity, development, brokerage, or lending firm, this article is for you.

And if video is more your thing, you can check out the video version of this article here.

Tell Me About Yourself

This can be a tricky one, and I have an entire article dedicated to this question itself, but essentially, this is where the interviewer will get to know you as a professional, and your career path that’s taken you to this point.

And with that, an effective way to answer this is to break down how you got interested in the commercial real estate industry, how you were involved in real estate in college or graduate school, any internships or full-time job opportunities you’ve had in the industry, and why that path has drawn you to the role (and company) you’re currently interviewing for.

The goal here is to paint the picture that, based on your previous experiences, this job is a perfect fit for you and you can step in and leverage those experiences to add value immediately in the job.

Your answer to this question (and all other questions thrown your way) should always tie back to what your employer stands to gain by hiring you.

We’re all inherently selfish, and your potential employer is included in that mix. They are looking for the person who can best solve the problem they’re currently facing, and their first priority is that, rather than making your career dreams come true.

By answering this question in a way that showcases yourself as the clear missing “puzzle-piece” for the role they’re looking to fill, this will put you head and shoulders above the competition answers this question with a “me first” attitude.

What Is Your Current Skill Level in Excel?

This one is huge, especially at the analyst level.

For people first starting out in the industry with very few contacts, little or no access to capital, and a lack of transaction experience, the biggest, most immediate way to add value is to come into a position with a strong background in Excel and real estate finance.

If you’re just graduating from college or graduate school, or transitioning from another industry, it’s completely understandable that your Rolodex isn’t full just quite yet, or you don’t have the war stories of deals that have gone south, but there is no excuse for not having the fundamentals down.

Unlike a professional network and transaction volume under your belt, a knowledge of Excel does not require multiple years of experience in the industry, and is relatively easy to learn on your own without a decade of on-the-job training in the business.

Understanding Excel and real estate finance is an absolute must for people looking to break into analyst or associate roles at real estate private equity, brokerage, or lending firms, and your answer to this question needs to reflect that understanding.

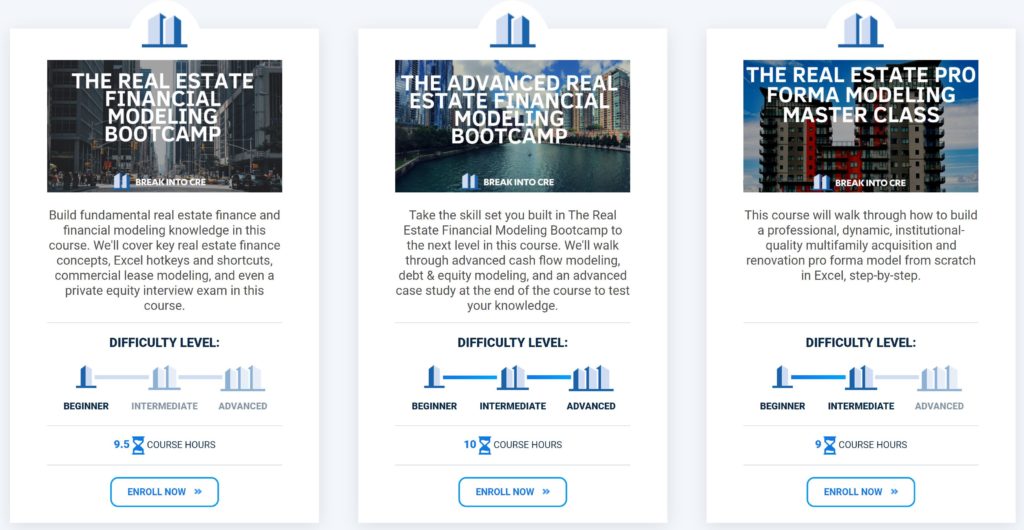

This means that being able to point to coursework you’ve taken directly related to real estate financial modeling in Excel (like those on our Courses page), projects or case competitions you completed in school that required an application of Excel knowledge, or internship or full-time job experiences that involved a significant project in Excel are all helpful things to highlight here.

The goal is to do more “showing” rather than “telling”. And the more you can demonstrate what you’ve done in Excel and how you’ve mastered the software, rather than just explaining that you do, in fact, know Excel, the better off you’ll be when answering this question.

Where Do You See Yourself in 5 Years?

Questions about long-term goals can feel scary or almost trapping in the moment, but they don’t have to be.

This question is primarily aimed to make sure that employers know that you’re in the real estate game for the long-haul, and you’re committed to the industry (and ideally the company) long-term.

Hiring and training is one of the most expensive and time consuming activities real estate firms take on, so if you show up as a “flight risk” on interview day where it’s unclear whether or not you’ll even be in the real estate industry five years from now, that’s an immediate red flag during the interview process.

This also goes for entrepreneurial endeavors, as well.

If your goal is to learn everything the company does in 2 years so that you can go out and start your own (competing) firm in the future, now is not the time to lay out your entrepreneurial vision.

Employers are looking for two things here – that you’re committed to this specific part of the industry long-term, and that you have the desire to grow within the firm in the future.

This means that if you’re interviewing for an acquisitions analyst position at a company that invests in office buildings on the west coast, they’re looking for answers that show you want to grow in an acquisitions capacity, you’re committed to the office space, you admire (and want to be a part of) the culture that the company operates within, and don’t have plans to move to Miami any time soon.

Fortunately, this is relatively easy to do if you’re interviewing for the right positions at the right firms.

And if you feel like this type of answer is forced, this can also be a good sign to you that this role might not be the right fit.

The Bottom Line

Ultimately, real estate firms ask questions to figure out why you’re the best-suited candidate to solve their problem (which is why they’re hiring someone in the first place).

And the more you can frame your answers to position yourself as that perfect fit, the higher your chances will be of landing the role you’re interviewing for.

And if you’re going through the interview process right now, or just want to make sure you’re prepared for interview day when the time comes, make sure to check out Break Into CRE Academy. A membership to the Academy will give you access to coursework that will help you master real estate financial modeling so you can answer the dreaded Excel question with confidence, as well as one-on-one, email-based career coaching to help you navigate the job search process, wherever you are in that journey.

I hope this helps with your own interview process – good luck on the big day!