The Biggest Drivers of Real Estate Investment Returns [With Examples]

A real estate financial model can be a really helpful tool to analyze deals, but it’s also very easy to make a pro forma tell you what you want to hear by adjusting inputs and assumptions that directly impact returns.

In a real estate financial model, some assumptions have bigger impacts than others, and these are the ones that tend to get manipulated most when real estate investment and development firms are trying to get a project to pencil (and trying to sell a deal to potential equity partners).

If you want to become a better real estate analyst, or just be able to analyze your own real estate investments more critically, this article covers three of the biggest return drivers in a real estate financial model.

If video is more your thing, you can watch the video version of this article here:

Annual Rent Growth & Timing

The first set of return drivers are assumptions that drive not only the income a property can generate, but also the projected sale value at the end of the hold period, and these are the annual rent growth and the timing of rent changes.

Revenue increases during the hold period can drastically impact cash flow from operations, especially on levered deals with fixed-rate loans.

And since revenue increases will also impact the NOI for the next buyer of the property, these assumptions also have a significant impact directly on sale proceeds.

Rent growth tends to have the biggest impacts on returns in the earliest years of the hold period, since rent increases compound over time, meaning that the more quickly rents increase on a deal, the larger those increases are going to be in the future.

An Example

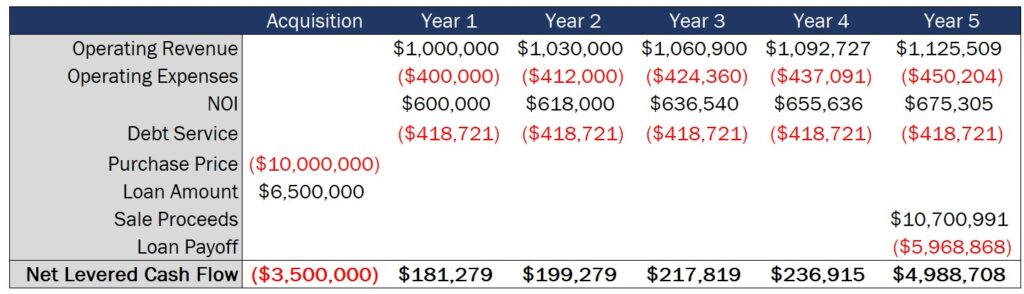

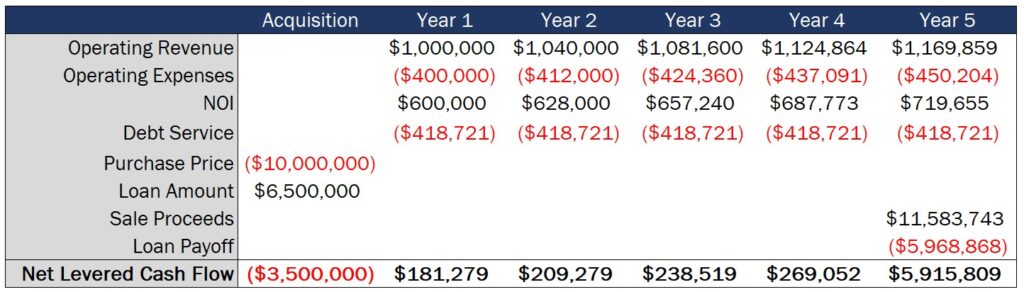

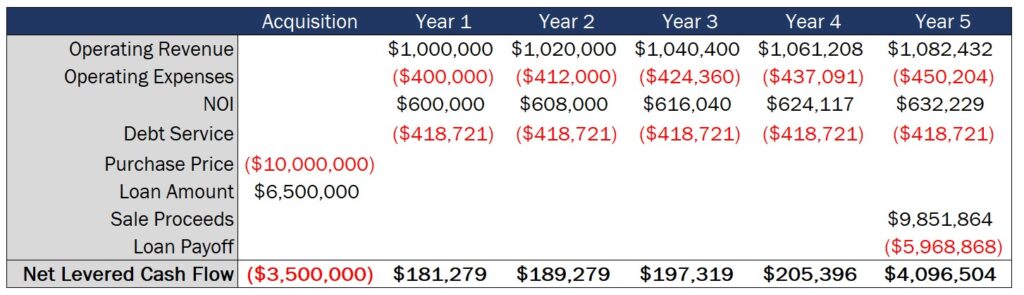

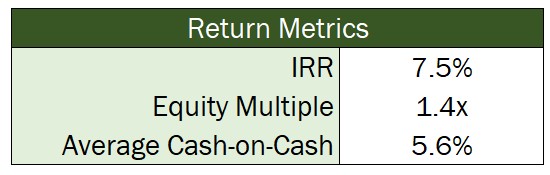

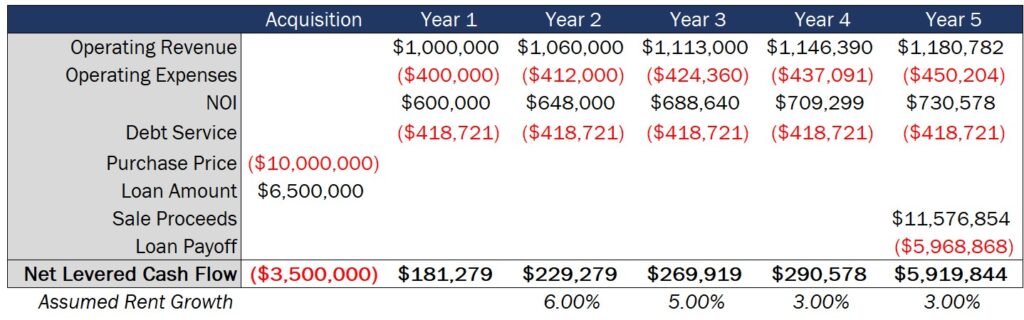

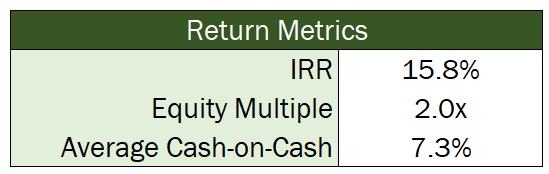

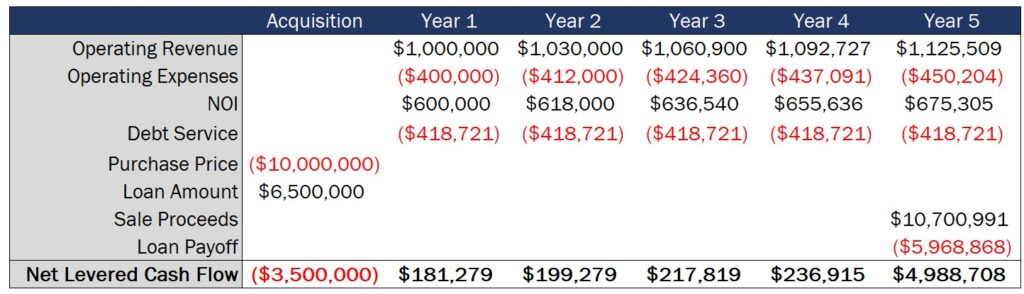

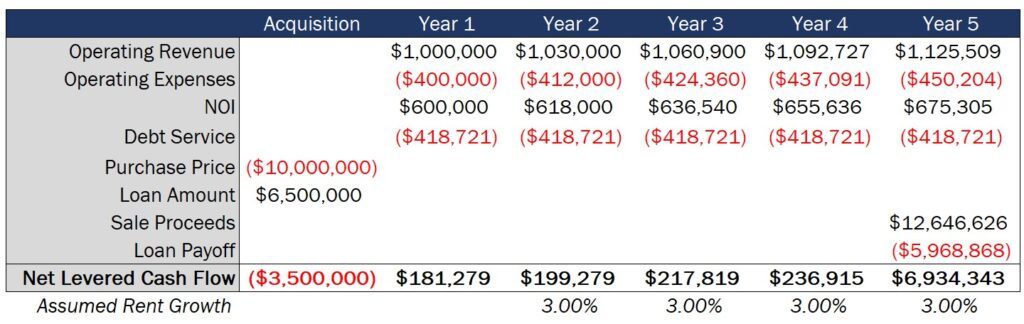

To illustrate this with an example, let’s take a look at returns on a deal acquired for $10,000,000 at a 6% going-in cap rate, with annual operating expense growth assumed to be 3% per year. We’ll also assume the property is financed with a 65% LTV loan at a 5% interest rate amortizing over 30 years, and we plan to sell the property at the end of 5 years at a 6.5% exit cap rate.

In this scenario, if we were to assume 3% annual rent growth throughout the entire 5-year hold period, this would produce an 11.7% IRR, a 1.7x equity multiple, and a 6.2% average cash-on-cash return.

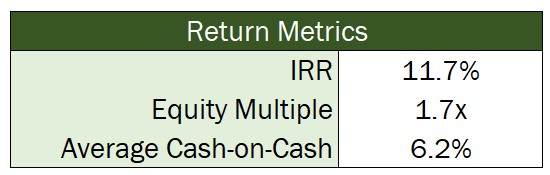

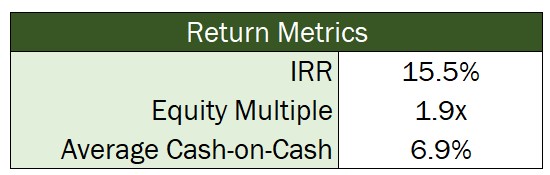

However, if we were to increase that assumed rent growth by just 100 basis points to 4% per year, the IRR, equity multiple, and average cash-on-cash would jump to 15.5%, 1.9x, and 6.9%, respectively.

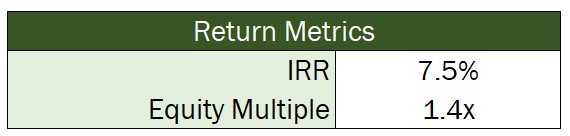

If we were to decrease that assumed rent growth from 3% down to 2% per year, those returns would drop to just 7.5%, 1.4x, and 5.6%, respectively.

While this isn’t all that surprising, where this really starts to matter is when rent growth in the early years of an analysis is underwritten to be significantly higher than rent growth during the rest of the hold period, making the performance of the deal heavily reliant on that strong initial rent growth.

To illustrate this, let’s say we go into this same deal, but now we assume that rents will jump by 6% in year two, 5% in year three, and 3% every year thereafter, resulting in a 15.8% IRR, a 2.0x equity multiple, and a 7.3% average cash-on-cash return.

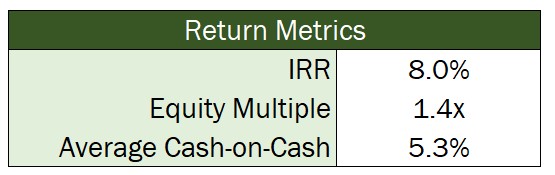

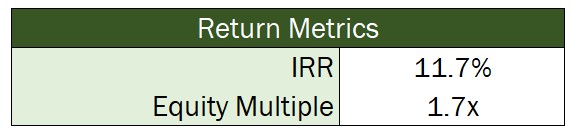

However, if this scenario doesn’t end up playing out and rents actually soften in the early years of the investment, if year two rent growth ends up being flat, year three rent growth is dialed back to just 2%, and then that same 3% increase is assumed every year thereafter, the IRR on the deal would drop to just 8.0%, the equity multiple would drop to just 1.4x, and the average cash-on-cash return would drop to just 5.3%.

Rent growth directly affects net operating income, which ultimately affects a property’s future sale value, and this is often where a significant portion of returns are generated on a real estate deal (especially on short-term holds).

This is why it’s always so important to look closely at rent growth assumptions within a pro forma, especially in the early years of the hold period. Rent growth projections that are overly aggressive can expose you to a significant amount of risk down the line, while conservative rent growth assumptions can make sure your downside is protected if rents don’t end up increasing at the pace you had hoped.

Exit Cap Rate

The second key assumption in a real estate pro forma that’s going to have a significant impact on returns is directly related to the sale of the property, and this is the exit cap rate assumption at the time the property is sold.

Real estate investment firms calculate projected sale value on a deal by taking the next buyer’s first year of projected net operating income and dividing that by an assumed exit cap rate at the time the property is sold.

And because the exit cap rate is used as the denominator within the sale proceeds calculation, even small changes in this value can significantly impact returns, even if nothing else changes on the deal as a whole.

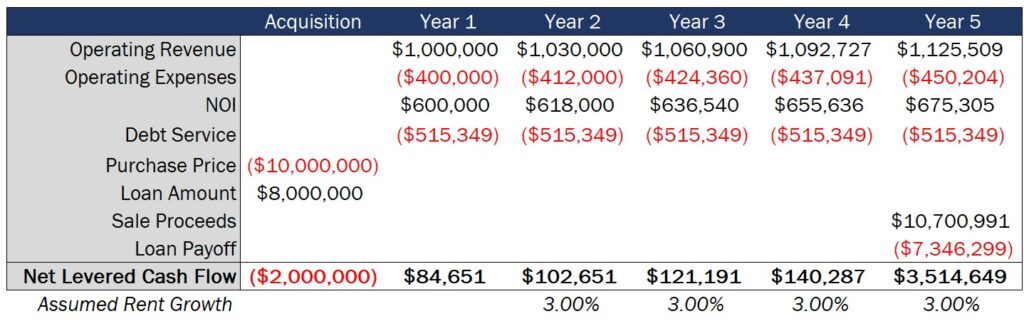

To use that same example we just used to illustrate the importance of rent growth, if we assume rent growth stays constant at 3% per year throughout the entire hold period, at a 6.5% exit cap rate, to zoom in on just the return metrics that factor in sale proceeds, our IRR on the deal would be 11.7% and our equity multiple would be 1.7x.

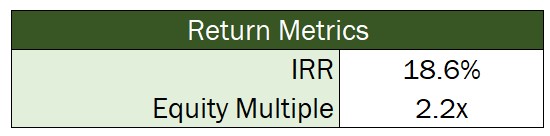

However, if we were to decrease this exit cap rate assumption by just 100 basis points to 5.5%, this deal starts to look a lot more attractive, with the IRR jumping to 18.6% and the equity multiple jumping to 2.2x.

The shorter the hold period is, the higher these swings in returns tend to be, with fewer years to generate cash flow from operations, and sale proceeds making up a significantly higher portion of the total cash flows generated by the deal.

Within a real estate pro forma, it’s extremely important to understand how sale proceeds are being calculated, how realistic the exit cap rate assumption is going to be at the time the property is sold, and whether you’re willing to tolerate the risk associated with relying on a speculative sale value to generate the majority of your returns on a deal.

The LTV Ratio

The third major driver of returns in a real estate financial model isn’t associated with operations or sale value, and this is the amount of debt used to finance a deal.

Many real estate investment firms will look at returns on both an unlevered and levered basis, analyzing a property’s cash flows both with and without debt, since leverage levels can have a significant impact on projected performance and the risk associated with a deal.

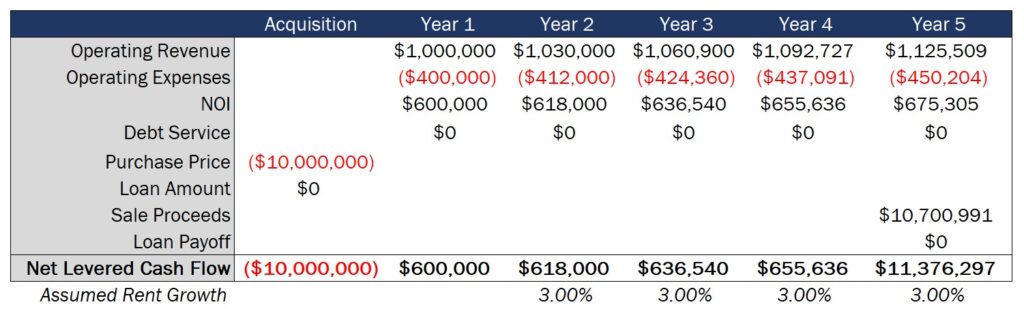

And to go back to that same example we’ve been using throughout this article, at a 65% LTV ratio, assuming 3% annual rent growth, the IRR on the deal would be 11.7% and the equity multiple would be 1.7x.

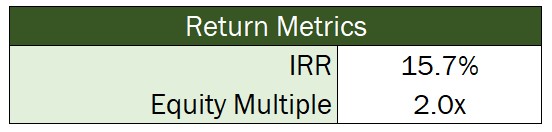

However, if we were to increase that LTV ratio to 80% instead of 65%, the IRR would jump by 400 basis points to 15.7%, and the equity multiple would jump to 2.0x, assuming no changes in operations.

On the other end of the spectrum, when we reduce leverage levels, this also has a significant impact on returns. If we were to analyze this deal on an unlevered basis (without a loan in place at all), the IRR would drop to just 7.5% and the equity multiple would drop to just 1.4x.

Leverage magnifies returns on commercial real estate deals, making profitable investments even more profitable in most cases, but also increasing losses when rents or values decrease in a market and increasing default risk when times get tough.

How To Learn More About Real Estate Investment Analysis

Real estate investment firms can do a lot to make a pro forma say what they want it to say, but if you’re analyzing a deal that might go into your own portfolio, looking at a potential acquisition at work, or considering investing passively as a limited partner in a deal, these are three of the biggest levers that investors tend to use within a real estate pro forma to make a deal pencil.

And if you want to learn more about real estate investment analysis, how to put these concepts into practice, and how to build your own real estate financial models from scratch in Excel, make sure to check out our all-in-one membership training platform, Break Into CRE Academy.

A membership to the Academy will give you instant access to over 120 hours of video training on real estate financial modeling and analysis, you’ll get access to hundreds of practice Excel interview exam questions, sample acquisition case studies, and you’ll also get access to the Break Into CRE Analyst Certification Exam. This exam covers topics like real estate pro forma and development modeling, commercial real estate lease modeling, equity waterfall modeling, and many other real estate financial analysis concepts that will help you prove to employers that you have what it takes to tackle the responsibilities of an analyst or associate at a top real estate firm.

As always, thanks so much for reading, and make sure to check out the Break Into CRE YouTube channel for more content that can help you take the next step in your real estate career.